Investment grade ETFs suffer second-highest outflows on record

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

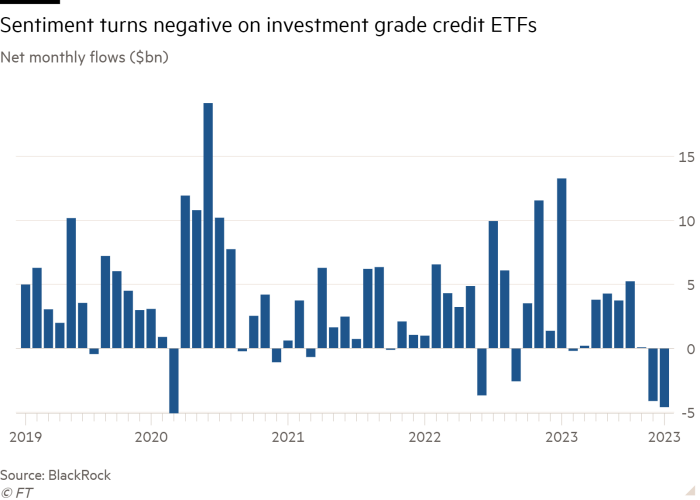

Investment grade corporate bond exchange traded funds suffered their second-highest monthly outflows on record in September, even as investors poured money into the large companies that issued the debt.

Analysis from BlackRock shows net outflows of $4.1bn from investment grade credit ETFs — selling that was concentrated in US-listed vehicles although their Europe-listed counterparts also suffered outflows of $0.6bn.

That number has only been exceeded once since BlackRock’s records began, in March 2020 when outflows from investment grade ETFs hit $5.1bn.

However, investors poured $35.1bn into US equity ETFs, more than three times the $11bn tally registered in August. With $30.7bn directed into US large-cap exposures, they were essentially injecting money into many of the same companies that were issuers of the investment grade credit they were selling.

Karim Chedid, head of investment strategy for BlackRock’s iShares arm in the Emea region, pointed out that it was hard to know if these flows into equities and out of investment grade credit were coming from the same investors.

“We can’t say for certain that it’s the same institutional money doing both these things,” Chedid said.

Instead, he emphasised the separate drivers affecting different parts of the ETF market.

He pointed out that while corporate credit ETFs had suffered outflows, government bond ETFs, also referred to as “rates” ETFs, had attracted $16.9bn in inflows.

“Investors are expressing optimism in US equities based on sector and fundamental drivers, for example AI, and capturing the yield opportunities in short-dated US Treasuries, without taking on additional credit risk. Both motivations could be consistent with a view that interest rates will stay higher for longer,” Chedid said.

He noted that fixed income ETF investment behaviour was increasingly granular and showed evidence of differing expectations in different markets.

For example, there were marked differences in the buying of US and European-listed government bonds. “For US investors we’ve seen the focus on the front end [short-term rates exposures] while in Europe we’ve seen more duration [longer-term] risk-taking,” Chedid said.

“This speaks to the point that we’ve been saying about greater use of fixed income ETFs for more targeted view expression,” he added.

Todd Rosenbluth, head of research at VettaFi, agreed. He said there had been a flight to safety in September on concerns over the possibility of a US government shutdown with investors turning to short-term Treasury ETFs such as the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL), which attracted inflows of $1.5bn, and the iShares 0-3 Month Treasury Bond ETF (SGOV), which sucked in $1.2bn.

In contrast the “higher risk” iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) had $1.2bn of net outflows.

“Investors chose to hunker down and protect capital rather than taking on additional income opportunities,” he said. He noted, for example, that investors could have moved out of US equities, but instead they turned towards higher quality large-cap US stocks.

Latest news on ETFs

Visit the ETF Hub to find out more and to explore our in-depth data and comparison tools helping you to understand everything from performance to ESG ratings

MJ Lytle, chief executive of Tabula Investment Management, a bond ETF specialist, referred to the differing use cases for fixed income ETFs, pointing out that in creating bond ETFs providers had created instruments allowing investors to trade in and out of the market. As such, “investment grade bond ETFs, could be used to express a view”, he said.

High-yield and emerging market debt ETFs also experienced outflows of $1.8bn and $1.5bn respectively, according to the BlackRock data.

Despite the large amounts of money washing in and out of fixed income ETFs in September, however, Rosenbluth said take-up of the products was continuing to widen.

“Fixed income ETFs in the US represent more than 40 per cent of the year-to-date net inflows, despite managing 20 per cent of the assets,” he said. “The future is very bright.”

Comments