Huge inflows to China ETFs prompt speculation about state buying

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Huge inflows over the past two weeks to just four exchange traded funds tracking China’s blue-chip CSI 300 index have prompted speculation that Beijing’s “national team” is at work trying to support the economy.

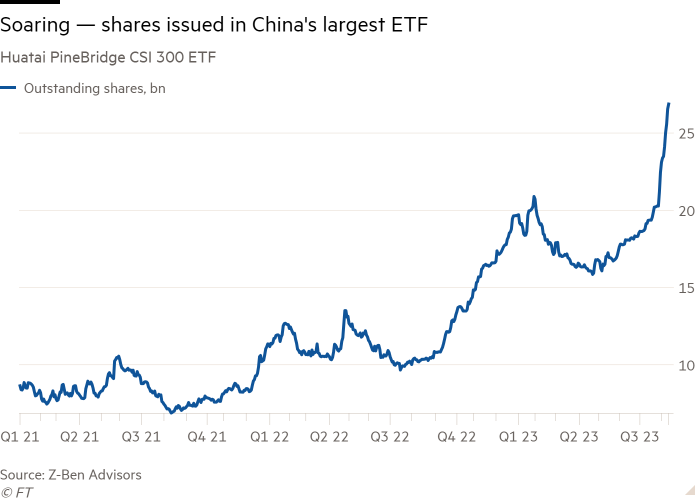

Z-Ben, a Shanghai-based consultancy, noted that in just eight trading days the four ETFs had attracted $4.4bn in inflows, bringing their combined assets to more than $25bn and potentially suggesting involvement by the national team — a term coined in 2015 to describe large state-affiliated institutions that intervened to prop up the stock market.

The speculation that a new team might be beginning to act has been fuelled by the readout from China’s latest politburo meeting on July 24 when China’s leaders vowed to boost the economy and “expand consumption by increasing residents’ income”.

The largest of the four funds, the Huatai-PineBridge CSI 300 ETF, has surpassed Rmb100bn ($13.8bn) in AUM, becoming the first ETF, excluding money market fund vehicles, to reach this scale, Z-Ben noted. The other three ETFs are provided by the joint venture between ChinaAMC and Mackenzie, Harvest’s joint venture with DWS, and E Fund, the only one of the four ETF providers that has 100 per cent domestic ownership.

Ivan Shi, head of research at Z-Ben, said it was hard to know whether or not the national team was at work.

“My view is that the flows in the past two weeks are different from the flows over the past three years,” Shi said. “Whether it’s the national team or not, I don’t know. But I suspect there might be some national team element in there.”

The CSI 300 rose 5.7 per cent in the two weeks following the politburo meeting, but had given up much of these gains to sit 2.1 per cent higher on August 11. Despite this muted rally, it remained 33 per cent below its peak in February 2021.

However, Phillip Wool, managing director and head of research at Rayliant Global Advisors, which provides a US-listed actively managed ETF that invests in onshore Chinese companies, said while he would not be surprised if state-owned allocators were putting some money to work in ETFs the recent trend had been towards a lighter touch by the national team.

“Some domestic investors have actually been frustrated at the apparent lack of state support for local stocks,” he said.

He did not, therefore, expect to see the sorts of levels of support that were evident in 2015.

“In some ways, the national team functions like a contrarian investor with a deep value bias: they’re putting money to work when sentiment is at its absolute worst,” Wool said.

But he also argued that it would be a departure for these state-affiliated institutions to concentrate on the whole market because in recent years they had been selective, for example showing a bias towards financial stocks within the CSI 300.

He noted that while he thought it unlikely, if China has decided to move towards using broad market ETFs as a means of intervening in the economy it would be following a precedent established by Japan.

The Bank of Japan started buying equity ETFs tracking the domestic Topix and Nikkei indices in 2010 as part of a monetary easing programme. It held $266bn in the ETFs at the end of March 2023.

Thomas Gatley, senior analyst at Gavekal, the China-focused research and consultancy group, said “the National Team diagnosis is pretty plausible, but . . . I don’t think that these kinds of sums can move the needle.”

He noted that the ETFs’ inflows were a “drop in the ocean” of the average combined daily turnover of Shanghai and Shenzhen’s stock market which had ranged between Rmb600bn and Rmb1.2tn this year.

But he also added that national team activity in ETFs would make it harder to detect.

“If in the future we’re talking about ETFs holding many trillions of renminbi of stock exposure, it’s going to be much harder to gauge whether the national team is involved or not,” he said.

Additional reporting by Steve Johnson

Comments