Active ETFs look set to storm Europe’s mutual fund bastions

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Fund providers in Europe that until recently saw little threat to their business model of selling actively managed mutual funds appear to be changing their tune.

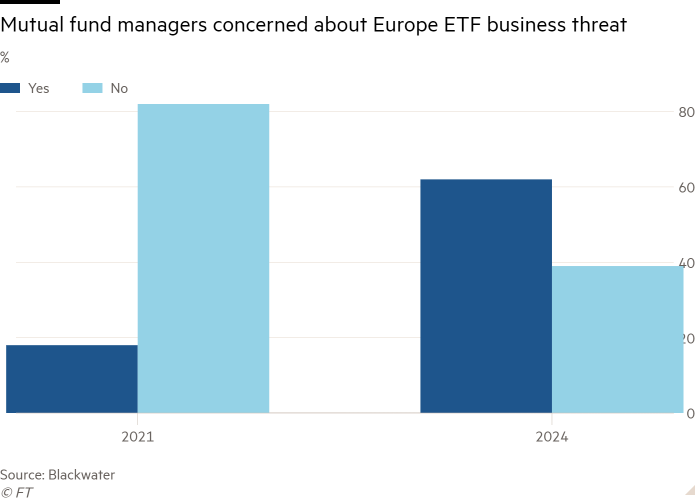

Two surveys released over the past few days reveal the marked change in sentiment. The first, performed by Blackwater, an exchange traded fund consultancy, found that 62 per cent of European fund managers are now concerned by the growth of ETFs, up from 18 per cent in 2021, when it last conducted the survey.

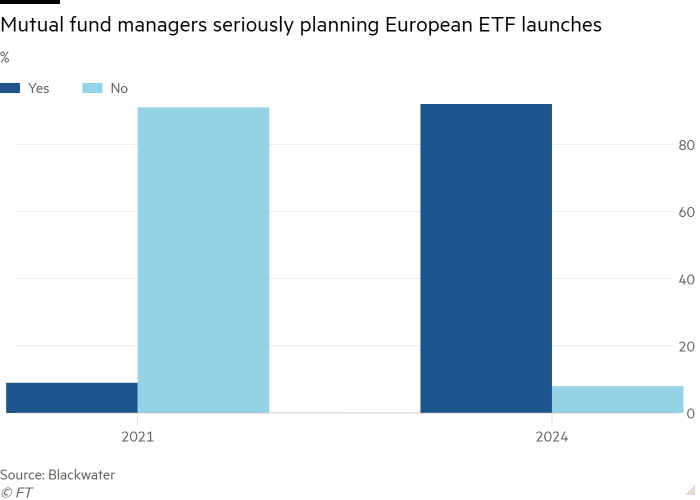

Even more striking were the numbers making serious moves to launch an ETF, with 92 per cent of European mutual fund managers saying they planned to either launch ETFs or to undertake due diligence of the space within the next two years, up from 9 per cent in 2021.

“The tide has turned in Europe,” said Michael O’Riordan, founding partner of Blackwater.

Both Blackwater and PwC said one reason for mutual fund managers’ change of heart was the rapid rise of actively managed ETFs in the US.

Interest in active ETFs in the US has hit record levels, accounting for 48.2 per cent of all ETF buying in January, according to Morningstar.

“US trends translate to Europe,” said Marie Coady, global ETF leader at PwC Ireland. “The level of interest we are seeing from active managers is at an all-time high.”

The newly released PwC annual ETF survey found that nearly half of respondents in Europe expected significant demand for active ETFs over the next two to three years while less than a tenth saw little to no demand.

“I expect that a number of US firms that have launched active ETFs will be coming here [to Europe],” said Deborah Fuhr, co-founder of ETFGI, another consultancy. She said many would be targeting investors in Asia and Latin America where the European Ucits fund designation is often seen as better wrapper than its US equivalents.

In addition, she pointed to the rise of new distribution channels such as online brokerages and neobrokers that are disrupting the dominant bank and insurance company distribution systems in Europe.

This theme was also spotted by PwC across the world, with 85 per cent of global survey respondents believing that developing distribution channels is the most important factor in the success of their business.

“Failure to develop effective mobile and other digital channels could also make it harder for managers to connect with younger investors into the future,” the report noted.

Despite the huge jump in interest in entering the European market that PwC had observed, Coady said the adoption of US trends in Europe tended to be slower than asset managers expected due to the complexity of, and fragmentation in, the European market.

O’Riordan agreed: “Talk is cheap. Saying something and doing it can mean two different things,” he said, adding that in reality managers took a long time to come to market in Europe.

Comments