ETFs viewed as large opportunity by 74% of US asset managers, poll says

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Exchange traded funds, already thrashing mutual funds in the battle for new investor dollars, are beginning to challenge another bastion of the asset management industry, a survey of US asset managers suggests.

For the first time ETFs have edged out separately managed accounts for institutional clients as representing the largest opportunity among investment vehicles in the monthly survey of product trends by specialist consultancy Cerulli Associates.

The research revealed that 74 per cent of US asset managers viewed ETFs as a large opportunity compared with 70 per cent for institutional SMAs used by entities such as foundations, endowments and insurance general accounts.

The proportion that felt the future was bright for ETFs was down five percentage points from 79 per cent when this survey was performed last year, but the sentiment has cooled far more significantly for institutional SMAs for which 83 per cent of asset managers expressed the highest level of enthusiasm last year.

The research follows reports of a growing number of conversions of SMAs into ETFs.

The Cerulli researchers found that mutual funds experienced an even greater drop in support: only 50 per cent of managers viewed them as a large opportunity compared with 68 per cent last year.

All three products package up securities for investors. SMAs are tailored solutions run by professional investment firms. Fees are typically negotiable. Providers can offer custom tax solutions and generally require higher minimum investments. Mutual funds and ETFs have set fees that are published in fund prospectuses, but advantages offered by ETFs, including intraday liquidity, preferential tax treatment in the US and generally lower fees, have helped them to gain momentum over mutual funds.

In addition, ETFs are beginning to transform the investment landscape in the US due to their recent forays into the actively managed investment space. There were 1,160 US-listed active ETFs in September, data from Morningstar shows, with a collective $447bn of the $7.5tn held in US ETFs.

“ETFs are one of the most efficient distribution models that asset managers have at their disposal,” said Ben Johnson, Morningstar’s head of client solutions. “It’s no surprise that when you look at the pecking order . . . that ETFs feature prominently.”

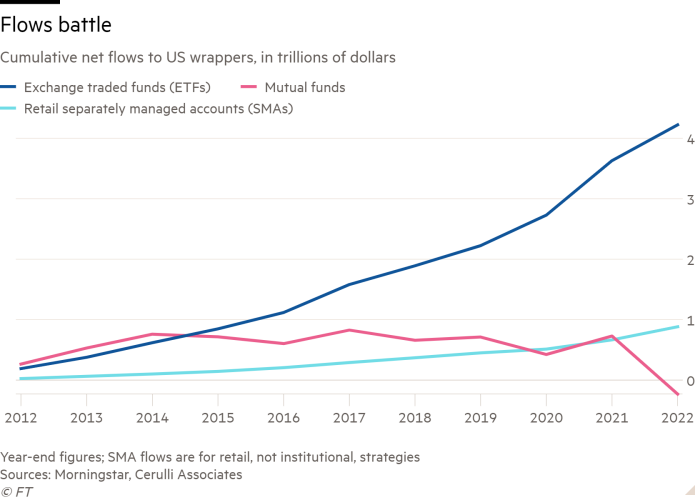

ETFs’ long-running rivalry with mutual funds has been well documented. US mutual funds suffered net outflows of about $960bn in 2022 and leached $243bn in the eight months to the end of August, according to Morningstar Direct, while ETFs reeled in about $592bn last year and had garnered about $289bn by the end of August, marking the continuation of a long-term trend towards ETFs and away from the mutual fund wrapper.

Cerulli could not immediately provide data for flows into institutional SMAs but said that total US assets in the vehicle rose from $14.3tn at the end of 2021 to $15.1tn at the end of 2022.

However, the consultancy was able to provide a decade’s worth of flows for US retail SMA products, which are used by wealthy individuals and families. These model-driven SMAs, which are more commonly used by retail clients, were seen as a “large opportunity” by only 52 per cent of the asset managers that offered them.

Retail SMAs, like ETFs, but in contrast to mutual funds, have been enjoying net inflows over the past decade albeit on a smaller scale than their ETF rivals. Their total inflows of $883bn in the US over the past 10 years includes a haul of $152bn in 2021 and $218bn in 2022, according to Cerulli.

While mutual funds remain the largest of the three types of vehicles with a combined $22.1tn in US assets under management at the end of 2022, that represents a rise of only 70 per cent from 2012, according to data from the Investment Company Institute. In contrast, ETFs collectively held about $7.4tn at the end of 2022, but that represented a jump of 400 per cent from a decade earlier, ICI data shows.

Retail separately managed account asset growth rates in the US have been more than double that experienced for mutual funds, but are dwarfed by the sharp rise in popularity of ETFs. Data from Cerulli show AUM in retail SMAs has risen from $633bn in 2012 to about $1.7tn at the end of 2022, an increase of around 170 per cent.

Latest news on ETFs

Visit the ETF Hub to find out more and to explore our in-depth data and comparison tools helping you to understand everything from performance to ESG ratings

While both strategies offer tax advantages: “At worst, the tax burden of an SMA and an ETF with the same strategy over the same holding period is the same, while at best, the tax burden of the SMA is lesser because of the ability to choose which individual securities to sell,” said Matt Apkarian, associate director of product development at Cerulli.

SMAs remained relevant because of their customisation and ability to tap in to active management, and “for many, both index-based ETFs and SMAs can work together within a portfolio”, said Todd Rosenbluth, head of research at VettaFi. “I don’t think this is erosion.”

The personalisation offered by SMAs is an advantage for investors who would prefer to, say, exclude a certain company from their holdings, said Morningstar’s Johnson, though he added that ETFs retained a distribution edge over SMAs.

“I would say a larger spectrum of mass affluent and emerging investors are better served by ETFs than they would be by an SMA,” Johnson said.

Comments