Women’s lack of confidence widens gender investment gap, study finds

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

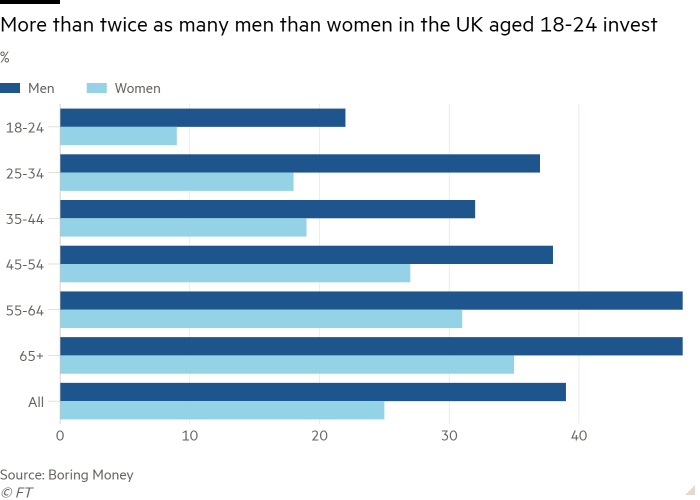

The UK’s gender investment gap has widened as more young men choose to invest while women hold on to cash due to risk aversion and a lack of confidence, according to a survey.

Investment research house Boring Money found the gender investment gap rose by £54bn to £567bn between January 2023 and January 2024. Men have £1.01tn invested versus £450bn for women. The figures include personal investments but exclude workplace pensions.

The difference has grown due to more men between the ages of 25 and 44 putting their money to work for the first time compared with women in the same age bracket, according to the study, which questioned 6,486 adults across the UK. Young women also tend to be more risk-averse and less confident about investing than their male counterparts.

“The gender investment gap remains stubbornly and frustratingly high and has got worse in 2024,” said Holly Mackay, Boring Money’s chief executive. “Shockingly, it’s higher than the gross domestic product of Poland or Argentina.”

Just 19 per cent of women aged 25 to 44 were investors in January 2024, up 1 percentage point from the previous year. Meanwhile, the proportion of British men of the same age who had invested rose from 28 per cent to 34 per cent.

The gap is even more pronounced for 18 to 24-year-olds, where 9 per cent of women invest compared with 22 per cent of men.

In Scotland and Wales, men under 44 are three times more likely to invest than women.

The average amount held by male investors is £102,000, compared with £66,000 for women. If invested amounts by gender were spread across all men in the UK, men would have on average £40,000, while women would have £16,000.

The survey also highlighted disparate attitudes to risk, with women of all ages — even those who invest — less tolerant of it than men. Only 18 per cent of women would choose a higher-risk pension in comparison with 33 per cent of men.

Men’s preference to invest in cryptocurrencies may also contribute to the gap. According to HM Revenue & Customs, 13 per cent of men own the asset compared with 6 per cent of women.

Sort Your Financial Life Out with Claer Barrett

Learn how to make smarter money decisions and supercharge your personal finances in this six-part newsletter series with the FT’s Claer Barrett. From saving and investing to property and pay rises, she’ll inspire you to get more confident with your money.

This lower appetite for risk, as well as lower average wages, drives women to keep more of their assets in cash. Female investors keep 29 per cent of their assets in cash, compared with 25 per cent for male investors.

“This gender gap comes into play at an early age, even before the typical culprits of childcare and pay gaps appear,” McKay said.

“Our research has found that with this younger group, this is all about confidence, brand awareness and social norms and expectations of what an investor looks like.”

Although the interest rates that savers can earn on cash have increased since the Bank of England began to raise interest rates in December 2021, investing in shares has offered a greater return in the long term. Vanguard data shows that the average inflation-adjusted returns for shares over 120 years is above 5 per cent, compared to cash returns of 1 per cent.

Women are also more likely to get financial advice from their mothers than fathers, according to data from Hargreaves Lansdown published on Tuesday. A quarter of women say their parents have had the most influence on their attitude to money and, of those, 35 per cent said their mother had the most influence.

Only one in three said their relatives educated them about investment when they were growing up, compared with two in three who said their family taught them about personal finance, such as budgeting.

Comments