Miami Grand Prix solidifies F1’s push into America

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Formula One could not have asked for a louder endorsement of its charge into the US than the presence of sporting legends Michael Jordan, Tom Brady and David Beckham at the inaugural Miami Grand Prix on May 8.

Brady, the American football quarterback who plays for the Tampa Bay Buccaneers, gained almost 600,000 likes on Instagram after sharing a photograph of the trio posing with Lewis Hamilton, the seven-times F1 world champion who drives for Mercedes.

The celebrity line-up, however, is “more of a symbol, a manifestation of the popularity of the sport and what the sport is doing in the United States than . . . [a] driver of [what’s] making it popular”, says Jefferson Slack, an American sports marketer who is the commercial managing director of the Aston Martin racing team.

Like his compatriot Zak Brown, the chief executive of McLaren Racing, Slack draws a parallel with the Super Bowl, the American football spectacle that is known for its half-time shows and lucrative advertising opportunities.

Nearly six years after Liberty Media acquired F1 in an $8bn deal, the sport is finally building momentum in its new owner’s home market. Signing a 10-year deal last year to add Miami to the calendar was a landmark moment for Liberty Media. Previously, the only F1 event in the US was the Texas Grand Prix.

Tickets to Miami sold rapidly and attendance topped 240,000 over the three-day weekend, with 85,000 fans there on race day. An average of 2.6mn fans watched on US television as cars raced on a circuit around the home of the Miami Dolphins American football team.

And, earlier, in March, F1 confirmed that Las Vegas would join the calendar from November 2023, with Liberty Media spending $240mn to acquire 39 acres of land east of the famous strip for the pit, paddock and hospitality.

Austin, Miami and Vegas, plus Montreal and Mexico City, mean that North America will host about a fifth of a hectic schedule that could yet expand to the 24-race limit. While F1 still has a way to go to catch up with US sports such as basketball and American football, its negotiating power has strengthened ahead of the renewal of its US broadcasting contract.

“I don’t see any reason why we can’t be seen as one of the major sports in America,” says Brown. “I think we’ve got a lot of room for growth.”

The 2021 season was the most watched on record in the US, averaging 949,000 viewers a race, up by more than half on 2020. The previous high of 748,000 was set in 1995.

The sport has built on that momentum in 2022. An average of 1.4mn US viewers tuned in for the opening five grands prix of the year, up by 53 per cent on the year.

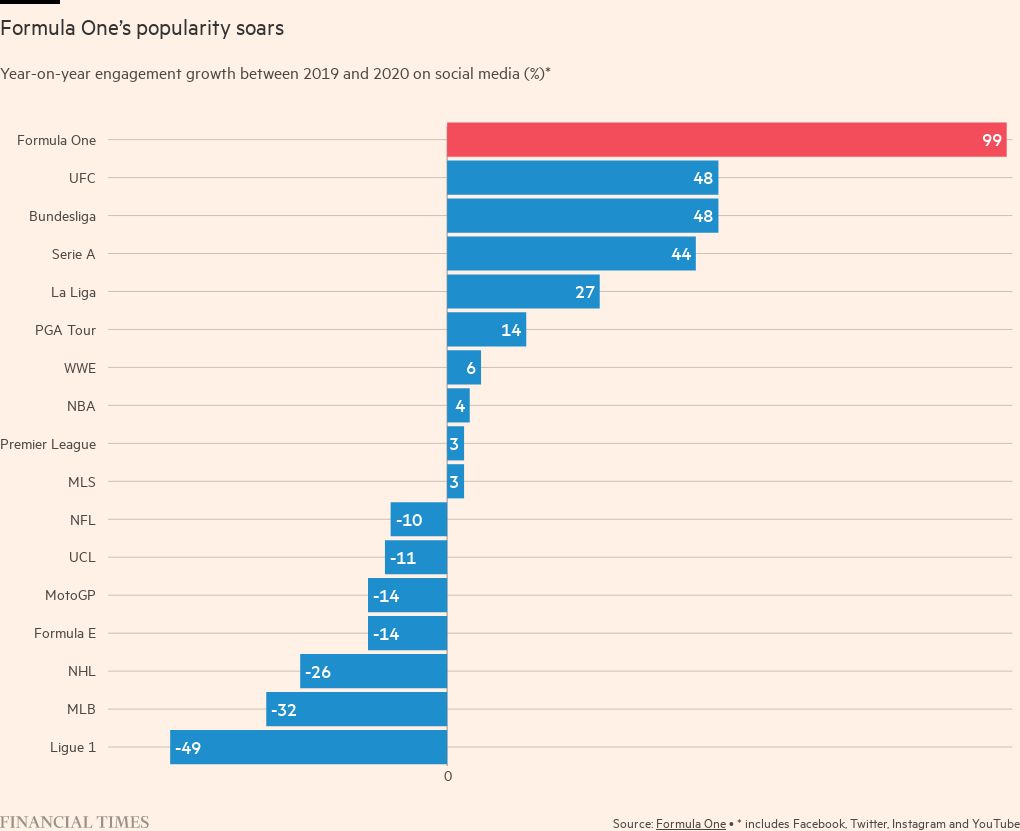

F1 has used social media and video streaming services to attract new fans. It also rewrote its racing rules to make them more attractive to a global audience and played the long game to add Miami and Las Vegas to its schedule.

More from this report

F1 begins to purr as changes revolutionise motor racing

Cost cap ushers in return to profitability in Formula 1

Right place, wrong time? Drive to Survive star George Russell arrives at Mercedes

Hope of a 100% green fuel leads Formula One’s efforts to tackle climate change

Benedetto Vigna will keep Ferrari’s technology in pole position

Hamilton inspires industry to accelerate F1 diversity initiatives

Optimistic Michael Andretti knocks on F1’s door . . . but will the other teams let him in?

Times have changed since Red Bull Racing boss Christian Horner had, as he recalls, to “leave the circuit through the back door” at the 2005 US Grand Prix in Indianapolis, when only six of 20 cars participated because of tyre problems. Unimpressed, the crowd booed.

After the removal of Indianapolis from the calendar in 2008, F1 did not return to the US until 2012. “Austin came along and it has always been a hugely popular event,” Horner says, “but then, really, the phenomenon that has come through is Netflix’s Drive to Survive [documentary series] . . . explaining the sport, the characters and some of the challenges — it has engaged America.”

Agreeing to give Netflix access to the paddock was a masterstroke by Liberty, which saw digital content as a marketing tool largely ignored by Bernie Ecclestone, the former F1 chief executive who ruled the sport for decades.

Drive to Survive became a global hit, attracting younger fans and women to a sport that is traditionally associated with wealthy older men. The second and third series of the documentary were aired during the Covid-19 pandemic, giving fans the inside track on the politics of the sport and introducing them to the team principals and drivers.

“In the US, Drive to Survive tapped into new audiences,” says Toto Wolff, team principal and a shareholder in the Mercedes F1 team. “Netflix has created . . . a very loyal, hugely informed audience for the races.”

Netflix confirmed over the Miami weekend that Drive to Survive will return for a fifth and sixth season.

Laurent Rossi, chief executive of Renault’s Alpine racing team, says deeper changes made by Liberty have also increased the sport’s appeal after years of domination by Mercedes, which won eight consecutive constructors’ championships.

Liberty Media and the Fédération Internationale de l’Automobile, the motorsport’s governing body, persuaded teams to agree to a cost cap to help level the playing field. The idea is to crown champions based on how well teams use their money rather than on the amount they spend.

In addition, F1 has introduced cars designed to make it easier for drivers to race closer together — a move to encourage overtaking. The old cars created turbulence known as “dirty air” that made this harder for drivers.

Executives say the outcomes this year are good, although the early frontrunners — Charles Leclerc of Ferrari and defending champion Max Verstappen of Red Bull — both drive for teams that have previously won trophies and historically outspent rivals.

“[The changes] professionalised the sport, for sure, and it’s good,” says Rossi. “At the end of the day, you want 10 teams vying almost equally for the win, that’s what makes the sport interesting.”

FT Scoreboard

Sign up to the FT’s weekly newsletter covering the multi-billion-dollar global sports industry. www.ft.com/scoreboard

The next question for F1 is how to build on the sport’s success in the US. Some executives hope that its newfound popularity will attract American drivers or teams.

“Would those things help? Of course. But this race here in Miami totally sold out in every shape and form,” Brown says. “Formula One has proven it can be very successful in America regardless of the nationalities in the sport.”

He cautions, however, against adding more US destinations to the schedule, despite calls by some team principals to consider California, New York or Chicago. “I don’t think we need more races in America,” he says.

“I think we can always grow the fan base and bring on more partners . . . America is very excited about F1 and I think we’ve only seen the tip of the iceberg.”

Comments