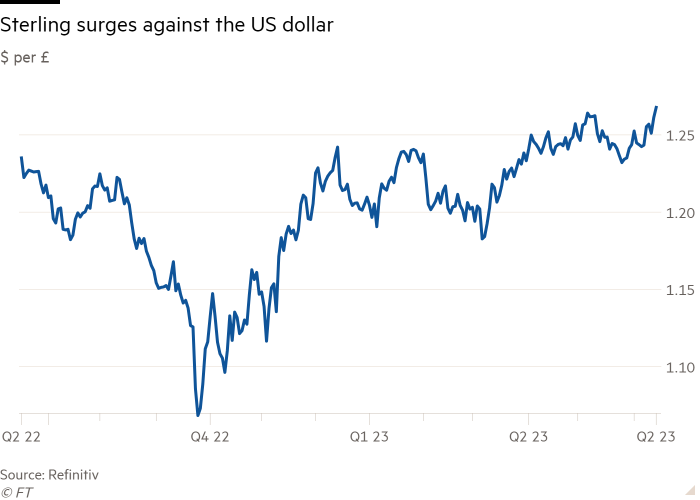

Sterling hits 14-month high against dollar as market bets on higher UK rates

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Sterling has risen to its highest level against the dollar since April 2022, boosted by strong economic data that has added pressure on the Bank of England to keep raising interest rates.

The pound climbed as much as 0.8 per cent on Wednesday to $1.2698, helped by a broad retreat for the dollar as markets expected the US Federal Reserve to pause its tightening.

The UK currency also rose 0.16 per cent against the euro to €1.1705, its highest level since August last year, before retreating to €1.1693.

The surge in sterling comes as markets are having a major rethink about the outlook for UK interest rates. They are now pricing in a peak of 5.71 per cent by the end of the year, up from 5.35 per cent earlier this month, and a current level of 4.5 per cent.

Official figures this week showed that the UK economy expanded in the first three months of this year, despite previous predictions of a recession. Meanwhile, average private-sector wages, excluding bonuses, were 7.6 per cent higher than a year earlier in the three months to April, the fastest pace of growth on record outside the coronavirus period

“The market has a tendency to overreact, but it is very obvious that the UK economy has an inflationary problem which is far stickier than its peers,” said Jane Foley, senior foreign exchange strategist at Rabobank.

“We have revised our GBP forecast modestly higher on the back of the step up in gilt yields, as expectations of tighter UK monetary policy takes hold,” she said.

Andrew Bailey, the BoE governor, said on Tuesday that inflation was taking “a lot longer than we expected” to be brought under control.

A sell-off in UK government debt on Tuesday pushed yields up to levels not seen since former chancellor Kwasi Kwarteng’s “mini” Budget last autumn, which included £45bn of unfunded tax cuts.

The yield on 2-year UK debt was trading at 4.8 per cent, compared with a peak of 4.64 per cent last autumn. Yields on gilts with longer maturities have not exceeded last autumn’s levels.

The pound has also been boosted by a broader weakness in the dollar as the Federal Reserve is expected to pause its aggressive rate rising campaign on Wednesday, prompting investors to pare back expectations of a further rise in July.

“I have a blockage on that — if you think monetary policy works with long and variable lags of multiple months — how does stopping for one month enable the Fed to take stock and see where we are?” said Kit Juckes, a currency strategist at Société Générale. “It doesn’t really make sense.”

Juckes expects sterling will climb against the dollar to a peak of $1.28.

However, he added that the pound had probably peaked against the euro. “To get sterling to outperform the euro from here you have to genuinely believe that we are going to see policy rates 1 per cent higher than this before Christmas,” he said.

“We have a lot of people with mortgages that need to be refixed at levels that people won’t be able to cope with before then.”

FT survey: Calling all consultants - what is working life like for you?

Have you lost your job recently or have you been working longer and harder than ever before? Or perhaps work has been slow and you’re wondering what is next for your career? We want to hear from you. Tell us via a short survey.

Comments