Fund managers snap up gilts as yields soar

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Big asset managers are buying up UK government debt again, tempted by the higher yields on offer after a much faster sell-off than in other large bond markets.

Two-year gilts suffered a sharp sell-off on Tuesday, with yields surging more than 0.25 percentage points to 4.89 per cent, the highest level since 2008. However, they edged down on Wednesday in early trading to 4.85 per cent. The moves follow official figures that showed wages had risen at their fastest pace on record outside the coronavirus period, adding to concerns about stubbornly high inflation and further interest rate rises.

Yields on longer-dated 10-year bonds, which are less sensitive to interest rate expectations, had a more muted response but still rose 0.09 percentage points to 4.43 per cent.

The price moves extend a dismal year for gilts compared with US and European counterparts, with benchmark 10-year yields rising as much as 0.76 percentage points from the start of the year, reflecting a fall in prices. In contrast, benchmark German and US yields currently trade lower than at the start of the year, at around 2.43 per cent and 3.80 per cent, respectively.

Some big investors believe the yawning gap between UK bonds and their German and US counterparts presents a buying opportunity.

“For years we were underweight [gilts] and then we got the repricing and now we are at a level where 10-year yields look quite attractive versus the US,” said Andrew Balls, chief investment officer for global fixed income at Pimco, the world’s largest active bond fund manager.

Balls said Pimco did not have a strong house view on gilts, but that some global portfolios were overweight as a “relative value” trade compared with US bonds. He added that his firm did not think the UK had more of a structural inflation issue than the US or Europe, as core inflation was “broadly in the same ballpark”.

Core inflation, which strips out volatile food and energy prices, rose by 5.5 per cent in the US in the year to April, compared with 5.6 per cent in the euro area and 6.8 per cent in the UK. Official figures from the US on Tuesday showed that US core consumer price inflation rose by 0.4 per cent in May, matching April’s increase.

Legal & General Investment Management, the UK’s largest asset manager, changed its tactical outlook on gilts from neutral to positive at the start of June, a trade that has so far performed poorly. But Chris Jeffery, the group’s head of inflation rates and strategy, said he expected the moves to be “partially self-correcting” as mortgage market conditions tighten, which would ultimately lead to lower consumption growth putting downward pressure on rates.

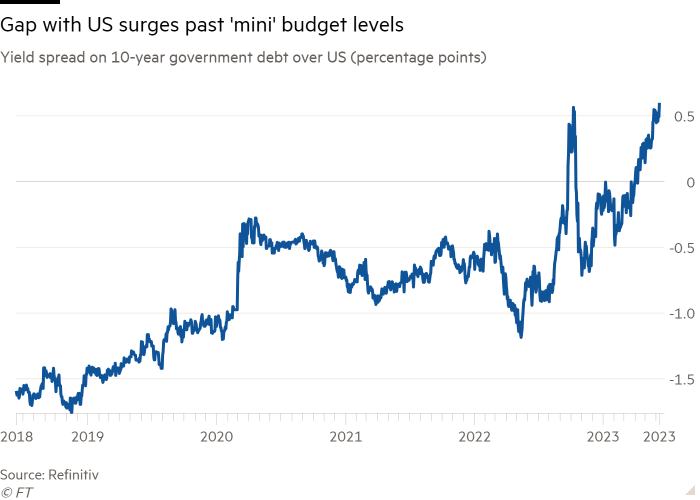

For most of the past decade, US Treasury yields have exceeded their UK counterparts, reflecting higher central bank policy rates. But that has reversed and the extra yield on benchmark gilts above 10-year Treasuries is now at its highest level since 2009.

BlackRock is also looking more favourably on gilts, with an underweight position on long-dated US Treasuries and euro area government bonds while neutral on UK debt.

“We find gilt yields attractive as they have risen back near levels reached during 2022’s Budget turmoil,” the group said in its weekly market commentary on Monday. 10-year gilt yields peaked at 4.5 per cent last autumn in the wake of the crisis, while two-year gilts surpassed “mini” Budget levels on Tuesday.

Craig Inches, head of rates and cash at Royal London Asset Management, which manages £150bn in assets, added that “gilts are now starting to look good fundamental value, specifically at longer maturities”.

“In the last few weeks we have been increasing our duration stance and moving overweight UK,” he said. He added that while there was “a risk” that base rates could go to 6 per cent, in that scenario it would be “very unlikely” that longer-dated yields would rise above 5 per cent owing to the recession that rates at that level would induce.

Traders have dramatically increased their outlook for UK interest rates in recent months, now betting that they will rise by more than one percentage point to 5.72 per cent by the end of the year.

However, some analysts warned of more trouble ahead for gilts. “Other economies offer yield and safety. The UK is offering a lot of inflation,” said George Cole, an economist at Goldman Sachs.

Ales Koutny, Vanguard’s head of international rates, said the UK was receiving “a lot of attention as high yields start to entice buyers” but argued that it was “not yet” the time to start buying gilts.

“It is true that valuations have become very appealing, the spread vs the US is now as high as it was in the depth of the ‘mini’ Budget crisis,” he said. But he added that while bonds rebounded quickly last autumn, the risks this time were different.

“A toxic combination of stubborn high inflation, higher global yields and political risks should limit the magnitude of any UK bond rally,” he said.

Comments