Best of FT Money 2023: How to solve your million pound pension problem

Simply sign up to the Pensions myFT Digest -- delivered directly to your inbox.

As far as financial problems go, having a pension pot worth more than £1mn is something most people would count as a blessing.

However, with a general election looming, political uncertainty over future tax rules means readers with well-funded pensions have a lot to worry about.

From the likely shape and timing of any post-election tax changes to the future of defined benefit pensions, FT Money readers certainly have a lot of questions.

Hundreds of you responded to our request to email us via money@ft.com including small business owners (and generous parents) eager to make the most of pension benefits.

We put your queries to a panel of pensions experts in the Money tent last Saturday at the FT Weekend Festival in the grounds of Kenwood House in north London.

Here is the distilled wisdom of former pensions minister Sir Steve Webb, now a partner with LCP; Nimesh Shah, chief executive of tax advisory firm Blick Rothenberg; and David Goodfellow, head of UK financial planning at Canaccord Genuity Wealth Management.

The future of the lifetime allowance

The pensions lifetime allowance (LTA) was by far the biggest concern for FT Money readers. Three-quarters of your emails were concerned with it and it’s easy to see why.

In the March Budget, chancellor Jeremy Hunt made the surprise move to scrap the LTA — then set at £1,073,100 — in a bid to stop highly paid NHS doctors taking early retirement to avoid tax bills on their pensions.

These changes also benefited an estimated 2mn Britons with pensions expected to be worth £1mn or more. Previously, savers would have faced a 55 per cent tax on lump sums withdrawn above the LTA’s level, or a 25 per cent charge in addition to income tax on regular withdrawals.

The chancellor also boosted the pensions annual allowance from £40,000 to £60,000. However, the good news was tempered by the Labour party’s immediate vow to reverse the changes if it won the general election.

The question on everybody’s lips was how Labour might go about this. Webb reckons the party “has no idea”.

“If you were to raid [shadow chancellor] Rachel Reeves’s office tonight, you will not find the answer,” he said, noting the speed of the party’s reaction to what was a wholly unexpected Budget day announcement.

“They have assumed that just because something can be abolished, if you just put the law back in, you have reversed it and everything goes back to how it was. But of course, the lifetime allowance doesn’t work like that.”

To explain what could happen in the event of a Labour victory, Webb used the analogy of a taxi cab meter that is constantly ticking up as you cash in different pension pots.

“Post-election we might hope we would all start with nothing on the meter, but that’s unlikely,” he predicted. “For those who have cashed in some pensions but not all, I think they would set the ‘meter’ at some estimate of what you have consumed so far, and then you’d risk going over the reinstated LTA if you cashed out further pensions on top.”

In their questions, readers quibbled over whether retrospective tax changes could even be legal. But Webb pointed out this is what happened on “Pensions A-Day” in 2006, when new pensions tax simplification rules came into force, meaning there was precedent for such a scenario. He also felt it was unlikely that Labour would be drawn into the finer details about what it would do (and when) ahead of the election.

According to Labour’s analysis, reinstating the LTA measures could raise £1bn a year in taxes; a comparatively small sum compared with the party’s other pledges to end non-dom status and reform carried interest rules. Yet given the problems with NHS doctors’ pensions which sparked the move, the panel felt there was still scope for Labour to reconsider its stance.

Should I pay in more to my pension before the general election, or take my benefits now?

These were very common questions from readers in their 50s and 60s, especially those who were on course to amass a pot of over £1mn or had already broken through this limit.

Goodfellow pointed out that for all the headlines, the LTA has yet to be abolished.

“What we have at the moment is a 0 per cent tax on excess benefits,” he said. The ghost of the LTA also lives on in another form, as the maximum amount of tax-free cash anyone can take from their pension is capped at £268,275 (equivalent to 25 per cent). Many readers feared a future government — and not just one controlled by Labour — could reduce this.

The panel urged caution about taking a lump sum before the election, if readers have no plans about how to spend their tax-free cash. It would bring the money inside their estate for inheritance tax (IHT) purposes, and it would no longer benefit from tax-free investment growth.

Goodfellow reasoned that wealthy readers might simply gift their lump sum to their children, gambling that they would survive for seven years and thus avoid IHT.

“Obviously it depends on people’s circumstances, but for those who have crystallised benefits up to the current LTA by taking their maximum tax-free cash, it makes sense to crystallise the rest of their benefits at a time where there is a zero rate tax,” he said. “I can’t imagine a way that a future government could trip you over on that.”

Hunt’s Budget day changes mean that readers who had previously taken out “fixed protection”, giving them a higher LTA of up to £1.8mn (and a higher tax-free lump sum) could now make further pensions contributions without invalidating this, although the panel felt few wealthy clients would be willing to risk it.

However, higher earners who do want to top up their pensions could have a longer opportunity to do so.

A general election must be held no later than the end of January 2025. In the event of a change of government, Nimesh Shah predicted that April 2026 was likely to be the earliest any pensions tax changes could take place “because of the tax complexity, the need for consultations and the long-term nature of pensions.”

This would mean readers with the means to do so could contribute up to £180,000 tax-free to their pensions while the higher annual allowance of £60,000 remains in place.

A further worry for the wealthy is the current consultation on the tax treatment of inherited pensions benefits, although the panel expected this to conclude early in 2024, long before the general election.

What else might the Labour party do?

Speaking elsewhere at the festival was shadow chancellor Rachel Reeves. She took to the main festival stage and defended her recent comments ruling out a wealth tax.

“We have the highest tax burden since the second world war. I don’t wake up every morning thinking how can we introduce new taxes,” she said.

Although she did not comment specifically on changes to the lifetime or annual allowance, back in May at the US edition of the FT Weekend Festival, Reeves said she had no plans to remove higher-rate tax relief on pensions; a fear many younger readers expressed.

Assuming Labour does reintroduce the LTA, the panel felt there was a chance a new fixed protection deal could be offered to savers who pledged not to make any more pension contributions.

Webb noted this has always happened in the past when the LTA has been cut. He speculated that if someone “filled their boots” before the election, pushed their pension over the old lifetime limit but did not draw on it, they would probably be able to lock in at a higher level.

“However, I suspect for anyone who’s under the limit they’ll deem the meter to have been running all the way,” he added.

How safe is my defined benefit pension?

The second most common theme in readers’ questions? Worries about how secure future income from defined benefit (DB) pensions might be, sparking emails from members of public and private sector schemes alike.

“I’d say in the private sector, things have never been better,” remarked Webb. Seven years ago, the combined deficit of private sector DB schemes was around £400bn according to one measure, he said. Today, there is a surplus of around the same amount.

“In the private sector, your DB pension is only at risk if simultaneously the firm you worked for goes bust, and the scheme is short of money,” he said, noting the relatively low number of bailouts by the Pension Protection Fund (PPF) in the past year.

Known as the “pensions lifeboat”, the PPF pays pensions to members after companies collapse, although rescue deals typically reduce the level of benefits.

Retired FT Money reader Jane said she had been receiving her NHS pension for two years, but was “worried there is a risk the money could run out in future”.

Webb said her fear that it could run out “implied that there was something in there in the first place,” noting that today’s nurses, hospitals and taxpayers in general are funding payouts from the NHS scheme.

“The only thing that could run out is the willingness of politicians to fund the pension promises they’ve already made,” he said, reasoning this would be highly unlikely. “With 6mn people and rising who work in the public sector, that would be quite a big step and it’s a pretty big voting bloc.”

And finally . . . what next for entrepreneurs and their pensions?

FT Money reader Rosie asked the panel why they thought so many entrepreneurs featured in our My First Million interview feature confess they do not pay into a pension.

“From a commercial and business perspective, the primary focus for my business-owning clients is very much on growing the business,” said Shah. “They tend to bootstrap the business at the very start, and any excess cash is used to invest in the business. Getting the maximum return on their investment and having a large capital sum upon their future exit from the business, that’s the real driver.”

Goodfellow commented that members of the entrepreneurial start-up community were often poorly advised about their own finances, noting low levels of pension saving for self-employed people in general.

“If you are running your own business, making employer contributions is a very tax-efficient way of getting money out of your company and into your pension,” he said, adding that many of his clients set up a SSAS (a small self-administered pension scheme) in order to do so.

You can watch a recording of this event and all other sessions from the 10 stages at the FT Weekend Festival by purchasing an on-demand pass for £70, valid for 90 days. Register now at ft.com/festival

Setting up pensions for children

Given the income pressures facing young people, many FT Money readers told us that they wanted to help their adult children save more into a pension. However, this topic divided our expert panel.

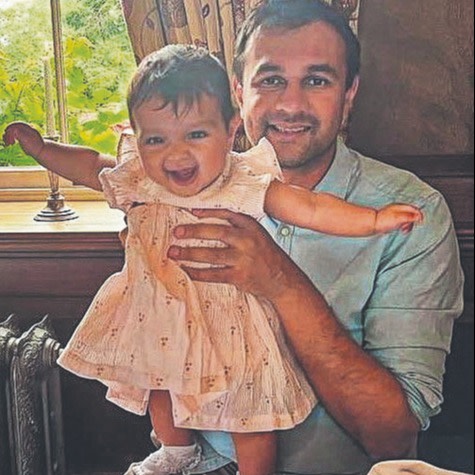

Nimesh Shah, chief executive of Blick Rothenberg, became a father for the first time in January. “To my wife’s disbelief, I started a stakeholder pension for my daughter the day after she was born,” he confessed to rapturous applause from the audience.

Children and non-earning adults can get basic rate tax relief on £2,880 worth of pensions contributions a year, meaning £3,600 can be invested for the future.

Shah is also investing the maximum amount of £9,000 a year into a Junior Isa, which he has invested in a portfolio of exchange-traded funds through a robo-advice platform.

“Assuming modest investment growth of 3 per cent per year, she should have over £250,000 by her 18th birthday, which gives you an example of the compounding effect of savings built up over a period of time in a tax-free environment,” he said.

When she turns 18, his daughter Clara will be able to access funds in her Jisa — something many parents find off-putting.

As for her pension, she’ll be able to take control of what it’s invested in at this age, but she can’t access the cash inside until around the time of her 60th birthday.

Funding pensions contributions for adult children is something more well-heeled parents are considering as part of tax planning, said panellist David Goodfellow at Canaccord Genuity Wealth Management. Structured as a gift out of excess income, there will be no future inheritance tax liability (tip: keep clear records so any gifts are easy to evidence).

However, Sir Steve Webb, partner at LCP, said he would not consider funding pensions contributions for his children, who are in their 20s.

“As an ex-pensions minister sitting in a pensions tent, I recognise this is borderline blasphemous,” he confessed. “But neither of my kids are homeowners, and the nightmare scenario for their retirement is having to fund paying rent out of their pension.”

Popular benchmarks for calculating “how much is enough” in retirement assume not only that retirees will be homeowners, but they will have paid off their mortgage by the time they stop working. Webb questioned how achievable this would be for younger generations of workers.

“While I am quite in favour of pensions, auto-enrolment and perhaps something beyond if your employer will match this, I do not want my kids to be renters in retirement.”

Comments