The public are clueless about inflation

Simply sign up to the Central banks myFT Digest -- delivered directly to your inbox.

This article is an on-site version of our Chris Giles on Central Banks newsletter. Sign up here to get the newsletter sent straight to your inbox every Tuesday

Eurozone headline inflation fell much more than expected in November, to an annual rate of 2.4 per cent. In the US, lower core PCE (personal consumption expenditures) inflation in October prompted former inflation hawks, such as Jason Furman, to capitulate. Barack Obama’s former economic adviser said last week: “We’re almost at the soft landing.”

The main piece today argues that the public are likely to be unimpressed with slower price rises, partly because they are clueless about the inflation process. What do you think? Email me: chris.giles@ft.com

Clueless

OK, I accept that is an aggressive adjective about my fellow global citizens. But I hope this piece will convince you of the importance of public perceptions of inflation; the differences between economists and most people in the way they think about prices; and that these issues matter — almost as much as the data — for monetary policy.

Many prominent US economists, especially Democrat-leaning ones, have recently had beef with fellow Americans over their economic gloom. Claudia Sahm complains that even Democrats are “being dismal” when the US economy has been growing strongly, real wages are rising, inequality is falling and inflation is way down. Paul Krugman and Arin Dube have made similar points recently.

As my colleague John Burn-Murdoch has brilliantly noted, there is a partisan bias in the way Americans answer questions about economic conditions.

But I don’t think that quite captures the way people think about inflation and why they’re still mad as hell. My evidence and the consequence is below. The shorter version is that if you tell people they should be happy about inflation coming down, the most likely response you get is the full Cher in Clueless: “Ugh, as if.”

People overestimate inflation

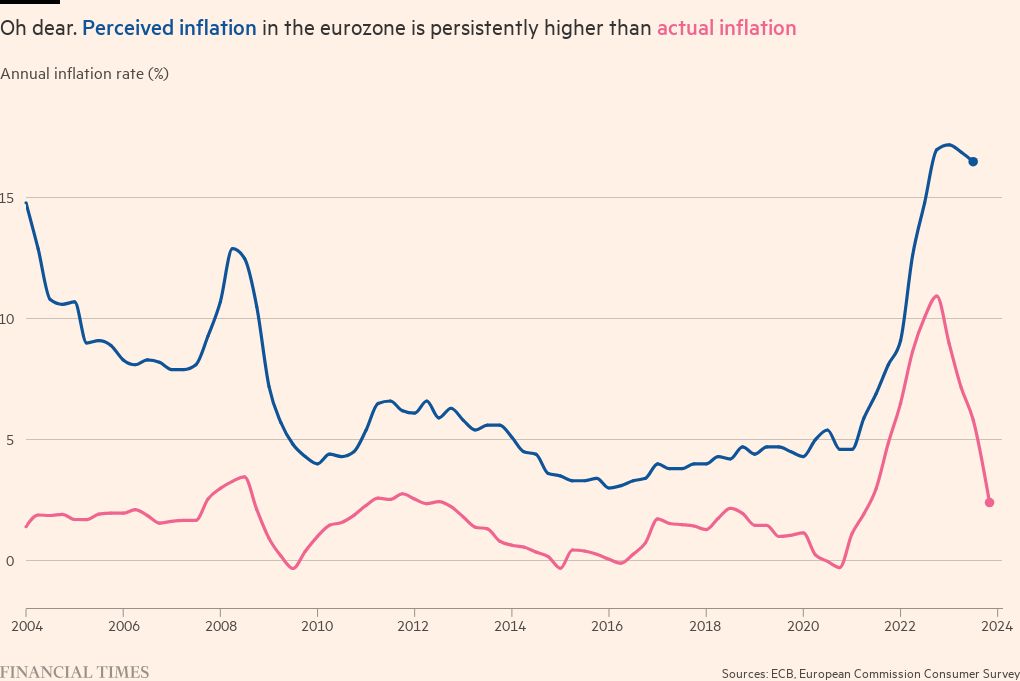

It does not matter where you look, but people tend to think inflation has been higher than official statistics suggest. In the US, consumers generally perceive inflation to be between 0.75 to 1 percentage point higher than official estimates. The US data is a bit sketchy, however, and far better indications come from the European Commission’s consumer survey.

The ECB has monitored inflation perceptions since 2004 after it had a difficult time in the early years of the single currency. People were convinced that companies were using the switch to the euro to raise prices. They still think they are being diddled. The eurozone clearly has a problem of perceived high inflation with people across the bloc thinking prices are rising on average 4.9 percentage points more than the reality. They are wrong. Wrong and unhappy.

People don’t think like economists

When you spend more than a few seconds thinking about it, economists are pretty weird in using one year as the basis of comparison for price changes. I’ve commented about this before. So, when people come along brandishing their PhDs and saying, “look, inflation is down to 2.4 per cent”, it is perfectly probable and reasonable that the public will reply, “You what? Prices are way higher than they were and it makes me really annoyed.”

Notice I did not use a time period and nor do most people when thinking about how prices have changed. Who can remember exactly what prices were on December 5 2022? I recently wrote a column on why the time element spells trouble for both Joe Biden and Rishi Sunak in their elections next year.

There are tipping points in public perception

One of the dangers of allowing inflation to take off is that the public’s general desire not to think about prices can change abruptly. The Bank for International Settlements talked in its 2022 annual report of a “high inflation world” where rapid price rises are normal, dominate daily life and are difficult to quell.

Subsequent research by Oleg Korenok, David Munro and Jiayi Chen has attempted to quantify the tipping points at which people start paying attention for many countries. They find that when inflation rises, there are “attention thresholds” above which the internet goes red hot in many countries. It all suggests that the public finds inflation starting with a three highly problematic in most countries, but not Mexico.

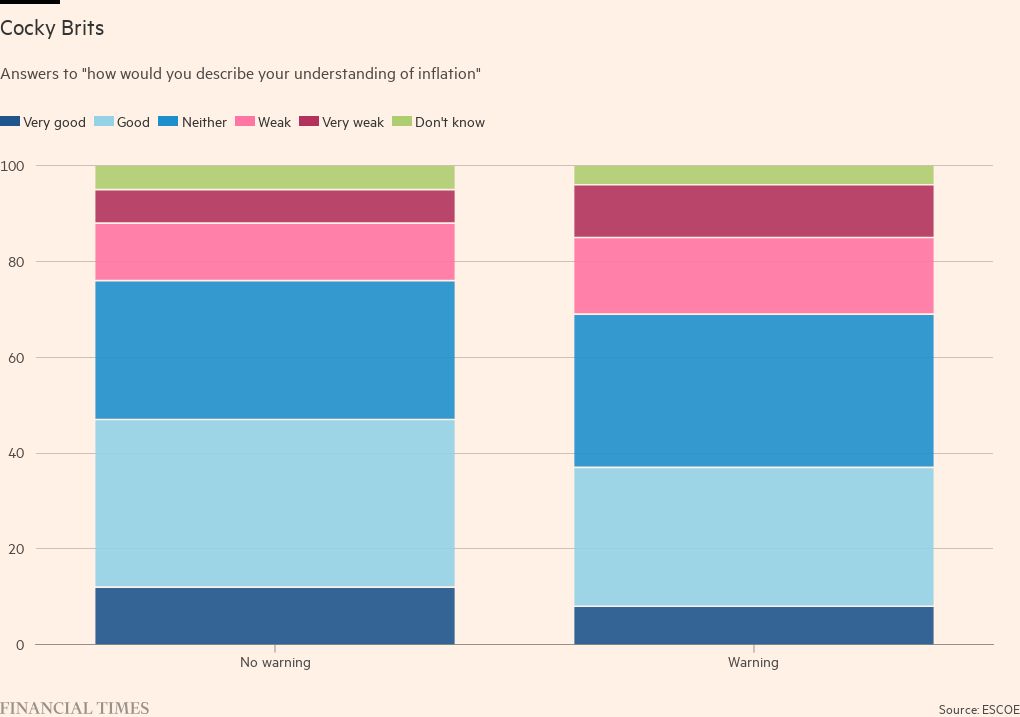

The public are ignorant know-it-alls

Despite being objectively clueless, that’s not how people perceive their knowledge of inflation. A fascinating assessment of UK public understanding of economic data was undertaken before the pandemic by Johnny Runge and Nathan Hudson. It is a horror show. As the chart shows, even when warned they would be tested on their knowledge later, only 25 per cent of respondents in a survey and focus groups thought their knowledge of inflation was “weak” or “very weak”.

While the participants had a good understanding that inflation measured the increase in prices, the authors found they could not explain why prices change, only a fifth thought that prices rising around 2 per cent a year was best for the economy, most had little idea how inflation was measured and thought companies could deceive statistical agencies with shrinkflation.

“Only a few participants mentioned using interest rates to affect inflation,” the authors reported. Then again, this is a live debate in the economics world, too.

The public prefer a recession to inflation

Did I say the public hate inflation? I meant they really hate inflation. It’s old, but this study by Nobel laureate Bob Shiller examined how much people disliked prices rising and why. Posing detailed questions to respondents in the US, Germany and Brazil, he first found people didn’t really worry about recessions and prized low inflation.

In the US, 75 per cent of his survey preferred a world with 9 per cent unemployment (12mn) and 2 per cent inflation to one with high inflation and low unemployment. Germans took the same view, with 72 per cent favouring the recessionary world, while the results in Brazil were closer, but still 54 per cent wanted to avoid high inflation.

On deeper probing, Shiller found that people think inflation is something done to them by government or companies (they really believe in greedflation), but if their wages rise, they earned it all by themselves.

These findings are in line with a recent Morning Consult survey that found 63 per cent of respondents would prefer to get better off by prices falling than their own incomes rising.

So when President Joe Biden posted the following incoherent words on X, he might have known what he was doing, at least politically.

Let me be clear to any corporation that hasn’t brought their prices back down even as inflation has come down: It’s time to stop the price gouging.

Give American consumers a break.

So what?

The evidence suggests people overestimate inflation, do not think in neat annual chunks of time, worry when prices rise above quite low thresholds, overestimate their knowledge, want prices to come down but wages to stay high and blame others for a rising cost of living.

Given all this, if I was a central banker, I’d want to be absolutely sure I’d got inflation licked before cutting interest rates. Leaving interest rates high for a long time is likely to lead to a policy mistake. But because central bankers do not want to err on the side of leaving inflation too high and the public would punish them for it, they are unlikely to rush down from Table Mountain.

What I’ve been reading and watching

The wind of change is blowing through the ECB. In an interview on Tuesday, executive board member, Isabel Schnabel, now says inflation is “on track”. She had previously been hawkish.

There is something deeply ironic about the Polish central bank seeking protection from European institutions, but it shows how difficult central bank independence can become when it is politicised.

After Fed hawk Christopher Waller signalled there might be room for interest rate cuts early last week, the boss, Jay Powell, pushed back. Traders believed Waller.

The great and the good of the central banking world called for a new “humble approach” to central banking, acknowledging the difficulties of forecasting, forward guidance and prolonged interventions such as quantitative easing. It is an important report from the so-called G30.

A chart that matters

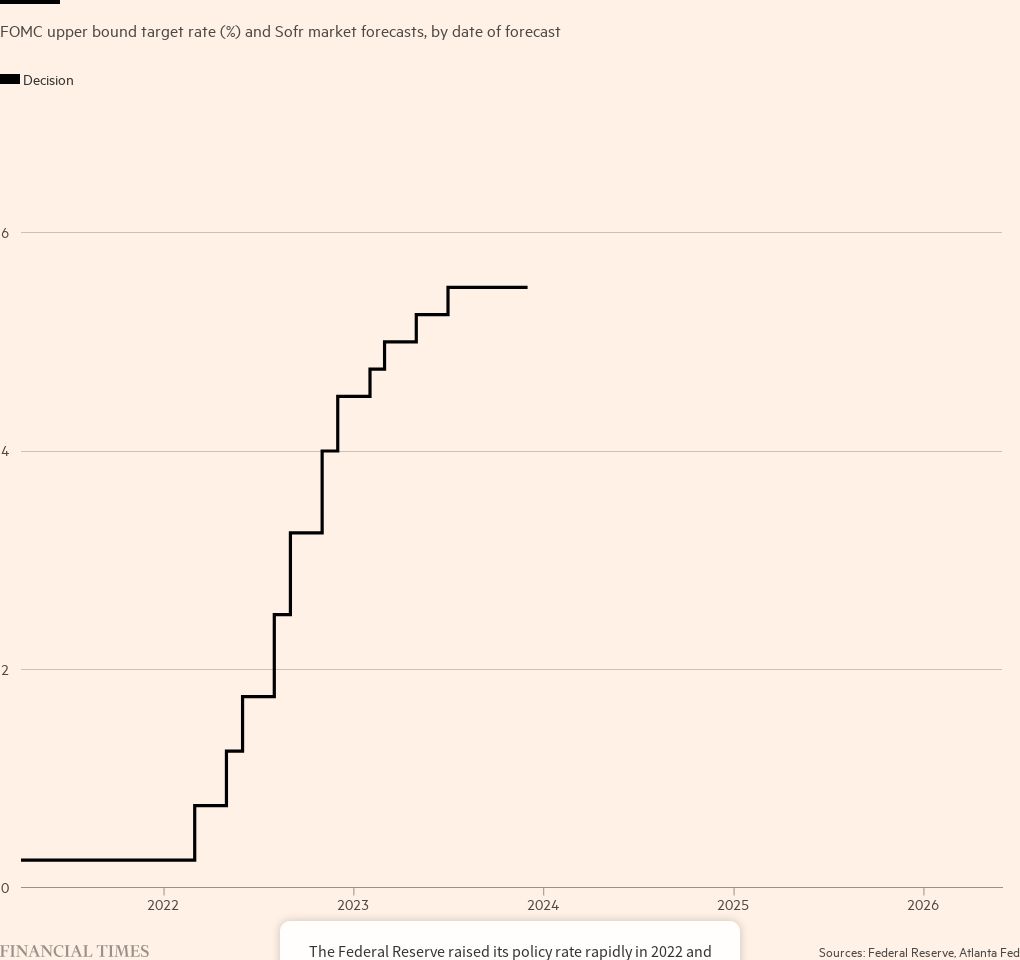

Let’s look briefly at how quickly interest rate expectations in the US have changed. The difference between financial market expectations today and in the middle of October is now extreme.

Letter in response to this newsletter:

Comments