How PIF’s financial power bought a seat at the table

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The US PGA Tour’s pact with Saudi Arabia’s sovereign wealth fund was meant to bring a peaceful resolution to golf’s civil war. Instead, the truce has provoked greater scrutiny and given rise to questions about how the oil-rich Gulf state’s billions are reshaping golf and sport, in general.

Documents published this week showed how the truce was months in the making, with initial contact going back to at least December last year, as the Saudis pushed for a central role in the business of golf and in the established US circuit.

Golf’s civil war spanned sport, finance and politics, pitting star players against each other and drawing interventions from the likes of Donald Trump. Last year, the former US president had predicted an “inevitable MERGER” with the Saudi-bankrolled breakaway competition LIV Golf, and celebrated the “big, beautiful, and glamorous deal” when it was announced.

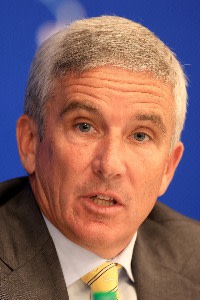

That happened in early June, when PGA Tour commissioner Jay Monahan and Yasir al-Rumayyan, governor of the Saudi sovereign wealth fund — or Public Investment Fund, as it is known — put their differences aside, telling the FT and other media that they had agreed to end their costly legal battles, and that their competitions would not solicit one another’s players.

They also agreed to create a new company to house the commercial activities of the PGA Tour, the European Tour and the PIF’s LIV Golf, as part of a wider ranging commitment to work together.

That’s how the PGA Tour ended its longstanding resistance to Saudi Arabia’s grand vision for the sport. This was despite the lack of revenue tied to LIV, which has failed to build a sustainable business so far.

At a hearing this week, in front of the US Senate Homeland Security Committee’s investigations subcommittee, documents released highlighted how the $650bn PIF had used its financial heft to pressure one of the richest and most powerful US sports organisers into giving it an influential position in a sport that can open doors in the business world and other corridors of power.

As such, US senators are now scrutinising the tie-up, forcing PGA Tour power brokers to defend the deal. Senator Richard Blumenthal suggested the Senate hearing transcended golf, showing “how a brutal, repressive regime can buy influence — indeed even take over — a cherished American institution simply to cleanse its public image”.

In Blumenthal’s words, the Saudi regime had “killed journalists, jailed and tortured dissidents, fostered the war in Yemen, and supported other terrorist activities, including 9/11”.

PGA board member Jimmy Dunne’s response was telling: “My fear is if we don’t get this agreement, [the PIF] have a management team that wants to destroy the Tour.”

Although the PGA Tour and the PIF have agreed to end their highly public legal battles, they are yet to reach a definitive agreement.

“I have no idea how the peace deal will look,” said English golfer Lee Westwood, a former world number one who joined LIV last year.

PIF has emerged as one of the most aggressive sovereign wealth funds betting big on sport. Institutional investors increasingly view sport as an asset class in its own right, targeting lucrative media right and events revenues. Hence, sovereign wealth funds, which have access to long-term capital, are joining private equity firms in putting money into clubs and leagues.

This month, the Qatar Investment Authority took a stake in the owner of Washington’s professional basketball and hockey teams, a first for sovereign wealth fund money in US sport.

The PGA Tour has stressed that it will retain its position of authority, even though al-Rumayyan is set to chair the new company that the PGA Tour plans to establish with PIF. The tour, a tax-exempt non-profit organisation, would hold a majority stake in the new entity that would be bankrolled by the PIF.

Monahan, who has been taking leave for medical reasons, is designated to be the entity’s chief executive, with the tour appointing a majority of its board.

PGA Tour chief operating officer Ron Price has argued that the framework agreement is beneficial because it gives the US circuit control over operations and strategy. Saudi funding will also give the tour the firepower to invest in players, events, venues and technology, he wrote recently for The Athletic. Price stressed that the PIF will be a non-controlling, minority shareholder.

But a year before relenting to Saudi pressure, Monahan had posed a moral question to golfers considering a future beyond the PGA Tour. He referenced the 9/11 hijackers, most of whom were Saudi citizens. “As it relates to 9/11, I have two families that are close to me that have lost loved ones and so my heart goes out to them,” Monahan said in June last year. “I would ask any player that has left, or wants to leave, have you ever had to apologise for being a member of the PGA Tour?”

Monahan has since appeared to go back on the spirit of those words. Meanwhile, the PGA Tour, which suspended players lured by LIV, has come under antitrust scrutiny.

LIV golfer Phil Mickelson, for one, has taken the opportunity to respond. Mickelson, who despite ditching the PGA Tour had earlier called the Saudis “scary motherfuckers”, reacted to news of the merger between the PGA and LIV in a forthright tone: “Awesome day today.”

And, whether or not the PGA/PIF deal goes ahead, Saudi billions have already changed golf. The PIF has exposed the vulnerability of the non-profit PGA and European tours to the disruptive ambitions of a kingdom aiming to become both a tourist destination and a much bigger player on the world stage.

Comments