Emerging market central banks may be trumping the Fed and ECB

Simply sign up to the Central banks myFT Digest -- delivered directly to your inbox.

This article is an on-site version of our Chris Giles on Central Banks newsletter. Sign up here to get the newsletter sent straight to your inbox every Tuesday

Hello again. This week, Argentina has voted for another economic experiment by electing the radical libertarian Javier Milei as president. Experience suggests it will not go well. As the main analysis shows, the extra difficulty for the South American nation is the success of many other emerging economies which have been trying economic orthodoxy.

Elsewhere, the October inflation figures have been exceptionally well behaved in the US, UK and eurozone, leading financial markets to disregard all the central banker talk about higher for longer. Do you think central bankers are now behind the curve, still broadly correct or facing impossible communications challenges? Email me at chris.giles@ft.com.

Advanced tortoises and emerging hares

Since I started a career in economics more than three decades ago, it has been something of a regularity that you shouldn’t underestimate emerging economies.

Measured properly at purchasing power parity exchange rates, China caught up with the US as the largest economy in the world in 2014 (accurate to 1 percentage point of each nation’s share of global GDP) and was definitively ahead by 2018. I know people will complain about PPP exchange rates and at market exchange rates things can look different, but PPP is the only proper way to do these long-term comparisons. The US can still be the world’s most powerful economy despite producing fewer goods and services than China.

On a broader canvas, advanced economies accounted for more than 60 per cent of global GDP in 1991 and are now down to about 40 per cent.

Although these are economic facts, few thought advanced economies had much to learn from emerging markets in the fields of central banking, inflation management and financial stability. Until now.

Robin Brooks, chief economist of the Institute of International Finance, tells me, “the large emerging economies have run monetary policy better than developed markets”. He said they were faster to spot the inflationary threat, faster to raise rates and kept their credibility more than the Fed, ECB or BoE.

He is not remotely alone. In its recent World Economic Outlook, the IMF (slightly grudgingly) noted: “Monetary policymaking in many [emerging economies] is better equipped than 15 years ago to serve as an anchor of stability.”

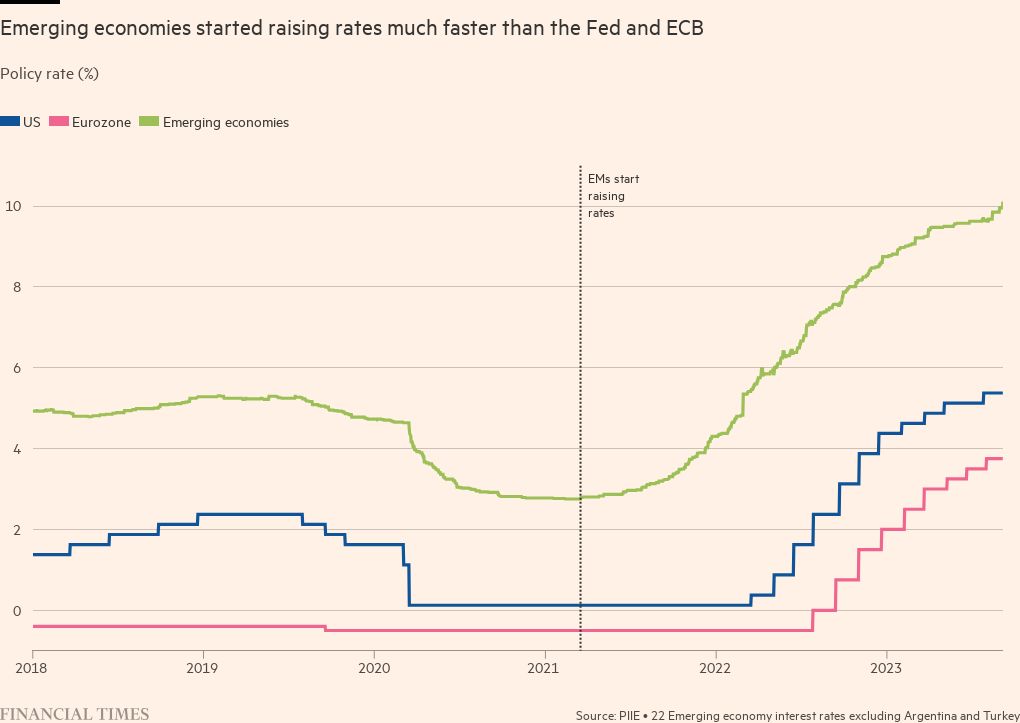

It’s impossible not to come roughly to this conclusion when you look at the monetary policy response to the global inflation shock starting in late 2020. After all, emerging markets central banks began to increase interest rates in early 2021, about a year ahead of their big counterparts on both sides of the Atlantic. They correctly worried about global supply chains, imported inflation as their currencies weakened against a rampant US dollar and the potential for temporary price rises to become persistent as the chart below shows.

Emerging market central banks were not just faster to respond to inflationary pressures, they have been quicker to ease policy with interest rates in Brazil, Chile, Peru, Costa Rica, Hungary, Poland, Georgia and Kazakhstan on the way down.

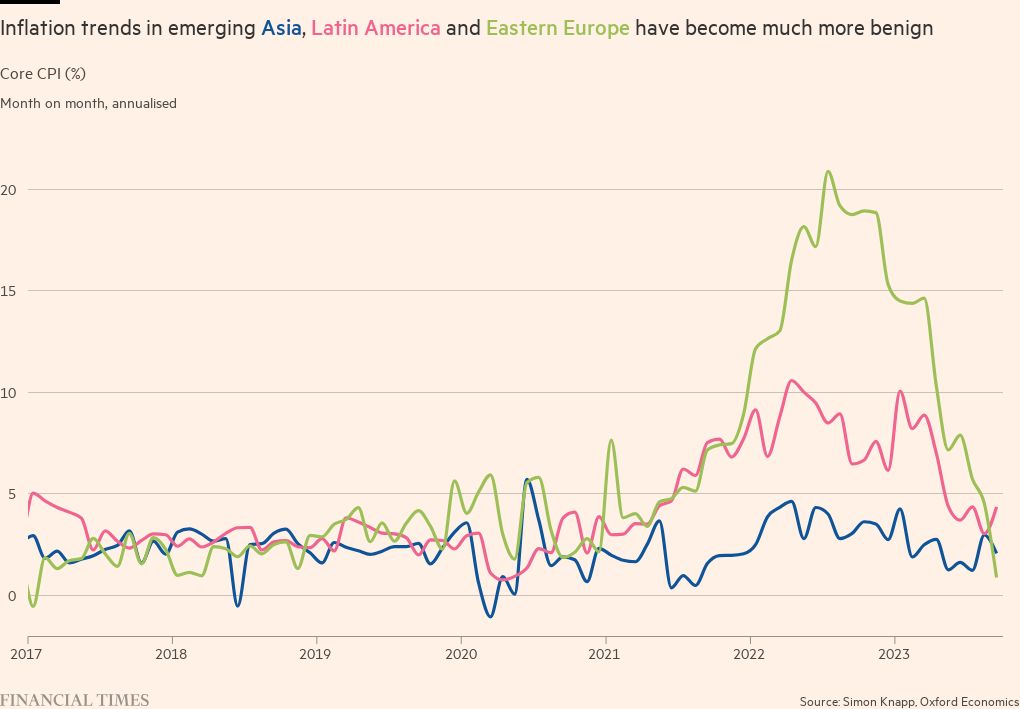

It’s one thing to praise emerging central banks for their rapid action. The medicine also needs to work. Separate data from Oxford Economics shows that monthly rates of core inflation — excluding food and energy prices — have already come down close to desired levels in the big emerging economies of eastern Europe, Latin America and Asia as the chart from Oxford Economics shows.

By far the most detailed research on what emerging market central banks have done right is published in a Peterson Institute of International Economics paper. It concludes that emerging economies started monetary tightening earlier allowing the process to be more gradual, both controlling inflation better and allowing commercial bankers more time to adjust without failing, unlike Silicon Valley Bank and Credit Suisse.

The kicker:

“In these critical areas of central banking, emerging markets appear to have overtaken the ‘masters’.”

Elina Ribakova, non-resident fellow at PIIE and one of the authors of the report, told me the key to superior performance was that emerging market central banks had not made strict forward guidance to keep monetary policy extremely loose for a long time during the pandemic and so they did not “muffle their response to inflation”.

The innovation in the paper is an extremely detailed look at the communication of emerging market central banks using various forms of AI and machine learning approaches.

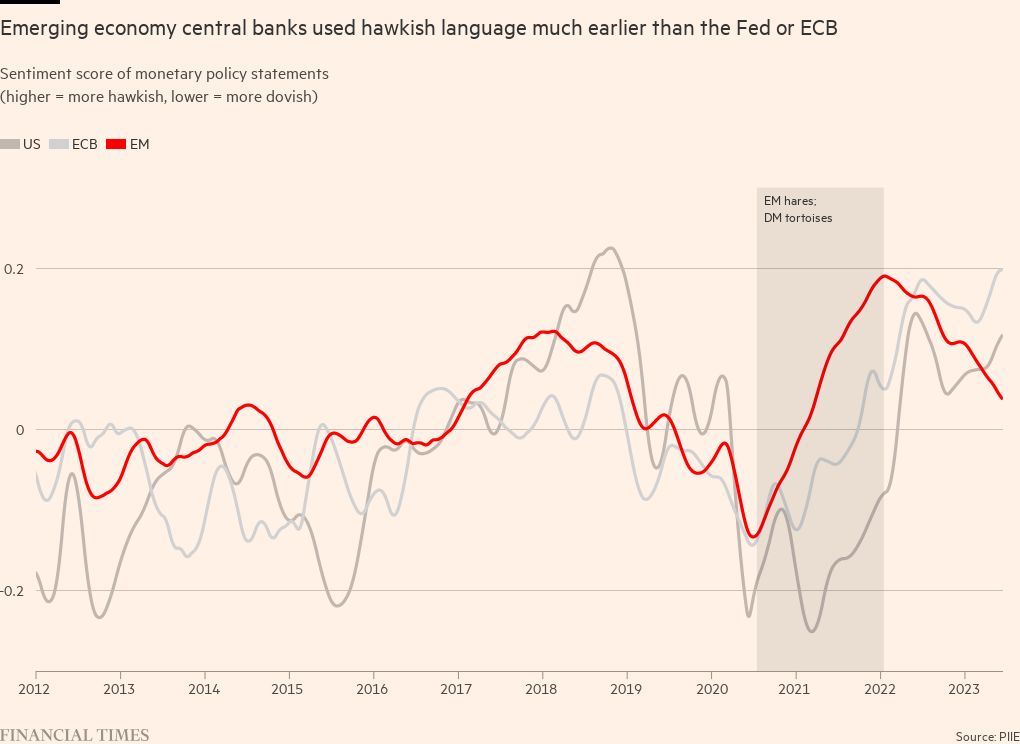

Readability and transparency of emerging market central bank statements and other communication is at or above the level of the Fed and ECB, it found. But the area of difference was that as the pandemic subsided in late 2020, emerging economy central banks responded to the inflation threat faster, were clearer in their communications, did not rely on failing fancy economic models and did not get bogged down in side issues. They were still behind the inflation curve, but not as far.

As the sentiment index chart below shows, where hawkish statements are positive and dovish ones negative, emerging market central banks had tended to equivocate in the past, but were decisive this time and well ahead of the Fed and ECB.

Ribakova tells me there was a sliver of luck in all of this because many emerging economies had experienced more recent bouts of inflation, but she added “the clarity of statements” and focus on what really mattered was better than that in advanced economies. The one area emerging central banks still really needed to improve, she said, was in making sure they followed their words with action.

Some caveats

I can’t write an analysis like this without highlighting some caveats.

First, the plaudits go to many, but not all emerging economies. Argentina and Turkey do not win any prizes. As MUFG wrote in a note last week: “It is hard to be constructive on EMs on a homogenous basis.”

Second, the IMF rightly points out that emerging economies had a worse pandemic and lost more output relative to previous expectations than developed economies.

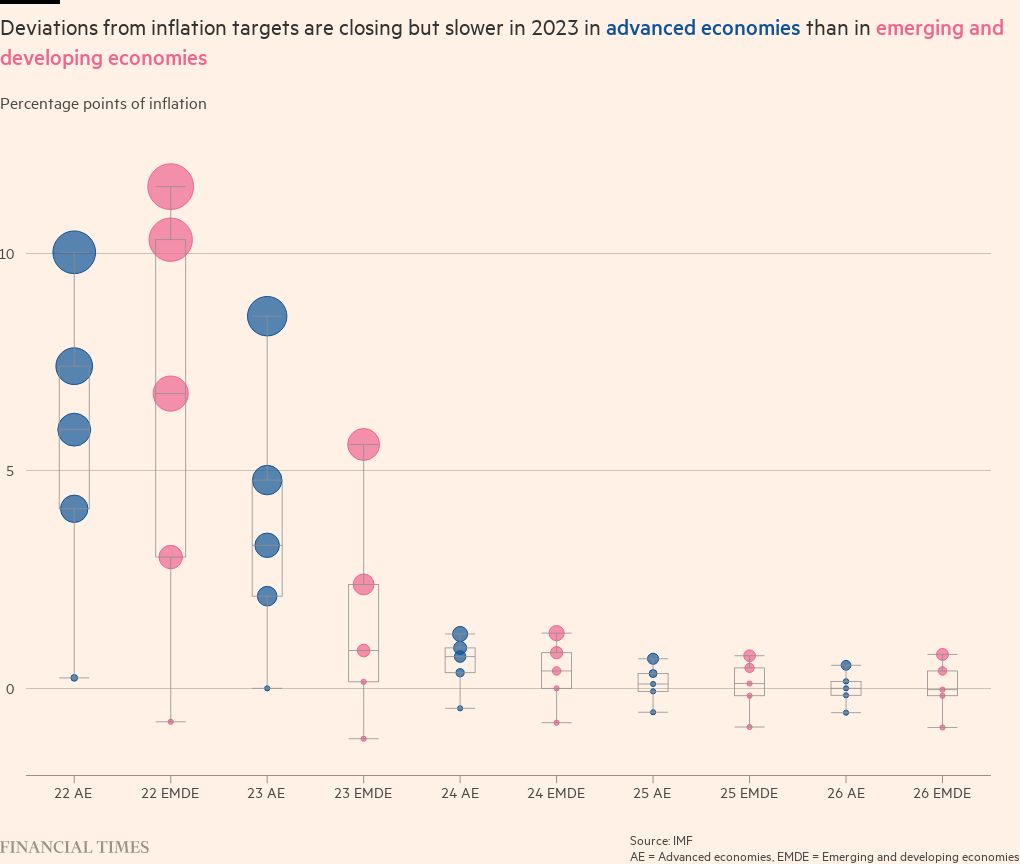

It also says that inflation is likely to prove stickier in emerging economies because households are not yet sufficiently forward looking, implying that price stability mandates are not yet fully embedded in thinking. We shall see, however, because as the fund’s chart from the same document below suggests, EM inflation expectations for 2023 and beyond are as good or better than those in developed economies.

A chart that matters

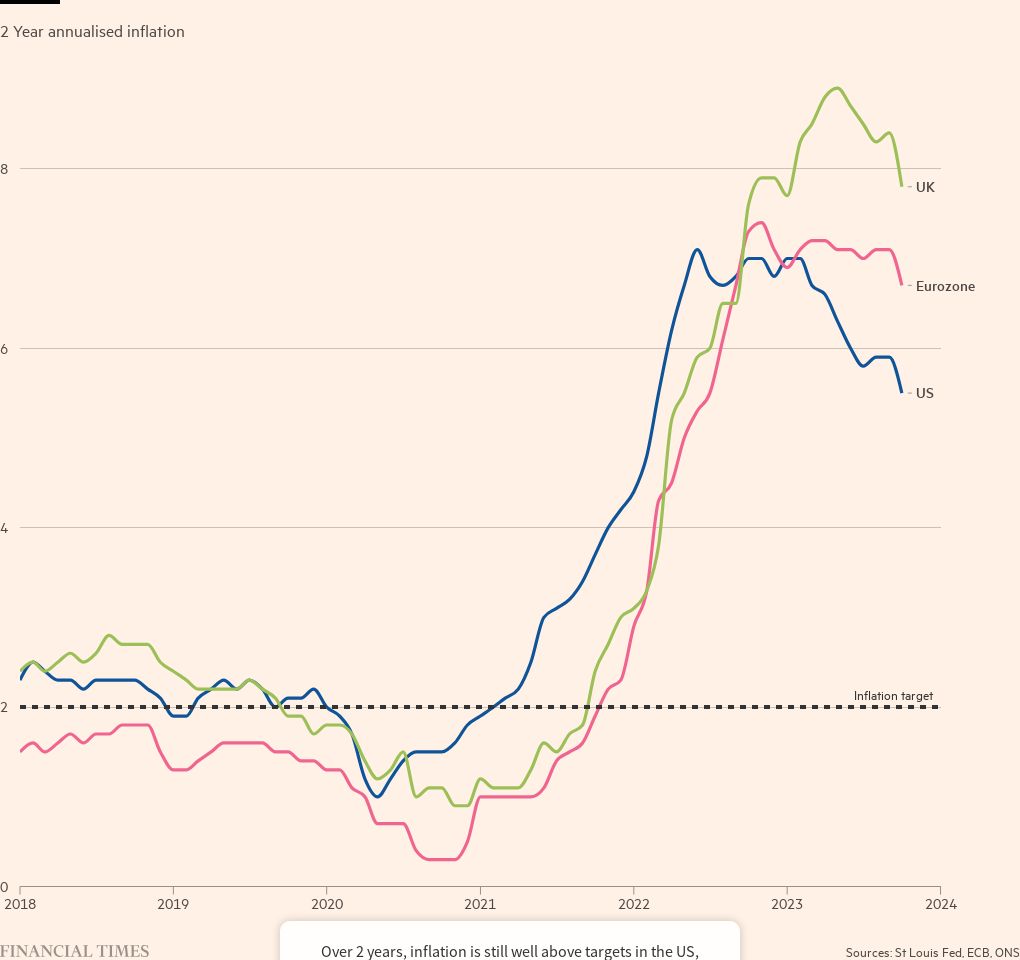

I said I would bring you the latest inflation numbers from the UK, US (CPI) and eurozone. The chart shows that recent months have much better annualised inflation performance than comparisons over longer periods.

What I’ve been reading and watching

Olivier Blanchard at the Peterson Institute warns that higher interest rates make public finances much less sustainable. It’s quite a change from his previous position, showing how much interest rates matter. He elaborates in Unhedged.

Matt King argues that high government debt is associated with low interest rates not high ones. Governments keep interest rates down when debts are high, he argues, and economies are weaker, leading to lower rates. I am not sure the causality works, but it is an interesting read.

We’ve heard a lot about how higher interest rates are complicating the lives of people in the green tech sector. Catherine Mann, an external member of the BoE’s Monetary Policy Committee, talks about how environmental policy affects monetary policy. Her conclusion: it’s complicated.

Martin Wolf pivots and finds the case for monetary policy loosening is growing.

Comments