The counterintuitive truth about deficits for bond investors

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The writer is founder of Satori Insights and former global markets strategist at Citi

The recent squeeze lower in bond yields has done little to lessen the angst over chronic fiscal deficits. The US’s last remaining major AAA rating has been put on negative outlook.

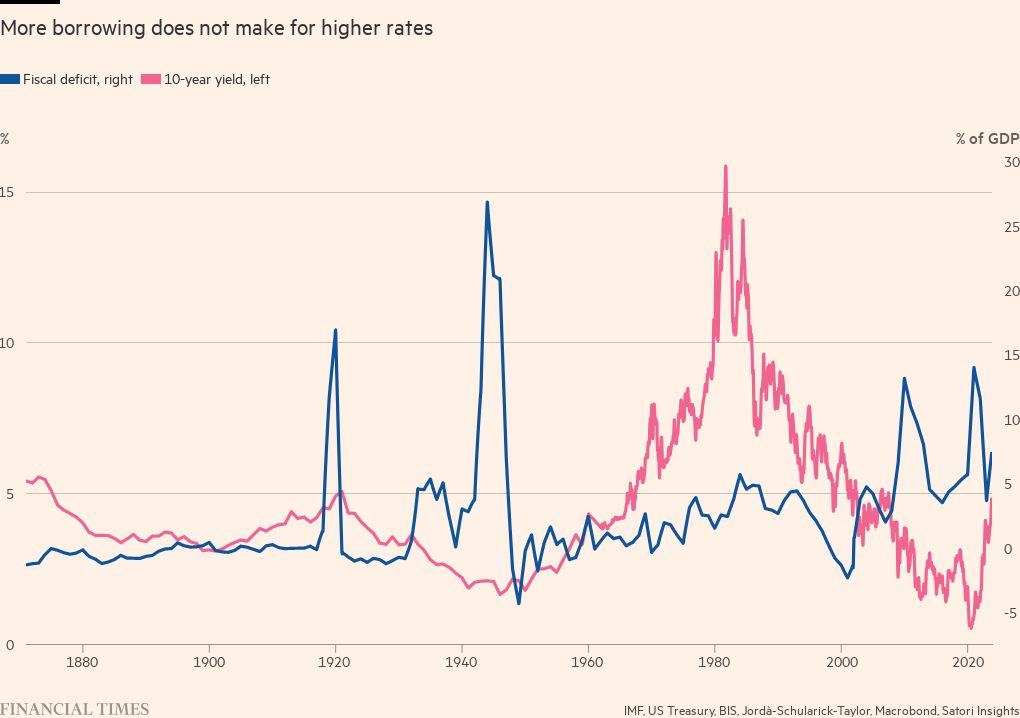

There has been much worry about a potential doom loop with burgeoning deficits forcing governments to borrow more, in turn spurring them to raise rates to draw buyers. But what might seem a statement of the obvious — that increased borrowing makes for higher bond yields — turns out to be at odds with the historical record.

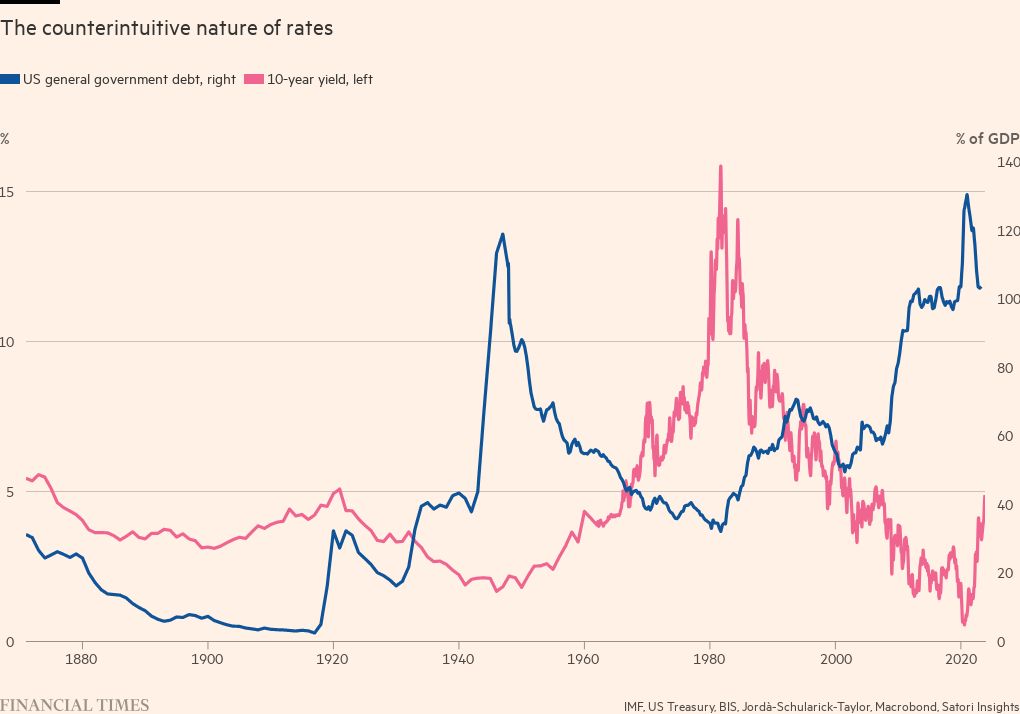

Higher government debt levels in advanced economies have almost always been associated with lower bond yields, not higher. This finding is not confined to the US: it holds in Germany, Italy, Japan, the UK, Switzerland and Australia back to the 1880s.

Even when we look at fiscal deficits, arguably a fairer test of the impact of the actual process of borrowing, the picture remains deeply counterintuitive. On either annual or longer-term changes, with and without lags, for every occasion where it looks like increased borrowing may have driven yields higher, there is at least one where the relationship looks more like the opposite.

We see three reasons — two empirical, one theoretical — why this phenomenon has held historically and is likely to hold in future. The first is financial repression, where governments and central banks force down yields. During eras of particularly high debt, governments famously make use of every tool at their disposal, from quantitative easing to accounting regulations to capital controls, to help minimise their funding costs. But the relationship of higher debt and lower bond yields holds even in jurisdictions and periods when financial repression was not widespread. And the impact of QE in particular in holding down bond yields is less straightforward than is sometimes argued. Likewise for the perceived impact of the reverse process — quantitative tightening — in driving yields up.

A second, more powerful, argument is that invoked amid some acrimony by US treasury secretary Janet Yellen. Economic strength and future rate expectations, not deficits, are the primary drivers of bond yields. Indeed, the correlation between yields and deficits tends to be negative: deficits and debt usually fall during periods of economic growth when bond yields are rising, and rise during recessions when yields are falling. Heavy supply does cause government bonds to become cheaper relative to interest-rate swaps but this is very different from driving yield levels.

The third reason why large deficits are not associated with high bond yields is that, contrary to intuition, most borrowing is much closer at a system level to being self-funding than is widely recognised.

You don’t need to work in an investment bank’s syndicate department to see the intrinsic logic in the statement that “someone needs to buy” each bond issue. Usually this involves a private investor withdrawing deposits from their bank account. But take a moment to consider the process as a whole. Provided the proceeds from the bond sale are at some point spent in the real economy, they produce an increase in bank deposits which exactly offsets the amount the private investor drew down for the purchase. Total bank deposits — or narrow money — are left unchanged.

Stranger still is the impact on broad money, or credit. When an actor levers up, the system as a whole gains assets as well as liabilities. The process of borrowing therefore itself creates “money”, at least in the broad sense of total credit, from nothing. This applies not only when borrowing is funded by bank lending — a process made familiar by a Bank of England paper — but even when funded by the bond market. It is also why aggregate borrowing correlates better with asset prices than with bond yields.

None of this condones unlimited deficit spending. As Liz Truss’s UK government all too clearly showed, there is a point where deficits come to matter, and do have the intuitive effect of sending yields spiking higher. But just as increases in corporate defaults tend to be sparked less by looming debt maturities and more by collapses in earnings, so fiscal crises in bond markets tend to be driven less by the inevitability of compounding interest payments and more by sudden collapses in credibility, currency runs and imported inflation.

Even more so than economics, finance is a non-linear subject. The long-term unsustainable can in the short term often prove surprisingly investable.

Comments