Deutsche and Commerzbank: why Berlin is backing a merger

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

On an uncharacteristically bright early February day in London, German finance minister Olaf Scholz and his deputy Jörg Kukies spent the afternoon holed up in a series of discreet meetings at their embassy on the south-west corner of the city’s most exclusive square.

Amid the chandeliers, Teutonic tapestries and silver service of the 19th-century Belgrave Square townhouse, the duo quizzed a succession of investment bankers from the likes of Goldman Sachs and Bank of America on the issue consuming the German finance sector. Not the slowing economy. Not Brexit. But what can be done to revive Deutsche Bank? And could a merger with Commerzbank save them both?

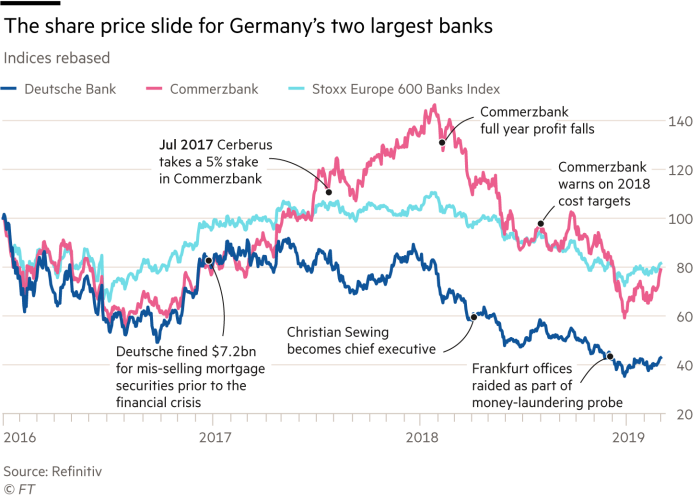

Since the financial crisis, the condition of the two 149-year-old Frankfurt-based lenders has become parlous. Both have seen their share prices plunge more than 90 per cent in the past 11 years as they churned through eight chief executives — including the two incumbents, flip-flopping on strategy while raising more than €30bn in new equity.

Deutsche has become the symbol of pre-crisis hubris for European banks trying to mimic American-style “casino” finance. At one point it even ended up owning a $4.3bn Las Vegas casino by accident.

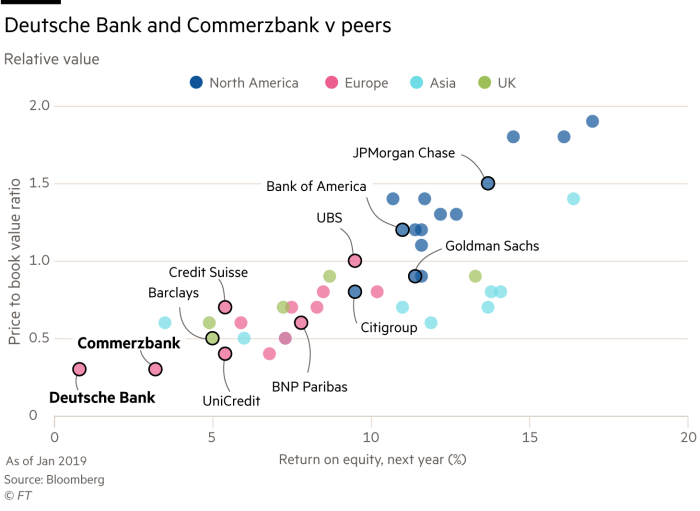

On almost any measure of financial performance, Deutsche will be at or near the bottom of the list. It makes the lowest return on equity, has the worst cost-income ratio and pays the most to raise funds of its continental peers. Between 2011 and 2018 it made a cumulative net loss of €6bn and was fined $14.5bn for everything from mis-selling mortgage securities to its role in the Libor scandal.

A combination with Commerzbank has long been floated as a way of reviving the fortunes of both banks, with rumours of a deal swirling around for more than a decade. But the match has never been consummated as both were busy removing toxic assets from their balance sheets, working through a series of post-crisis misconduct investigations and waiting for interest rates to rise again, to provide a boost to earnings.

Their self-help strategies have not worked. Deutsche’s stock has plunged to a record low and analysts openly question the viability of its business model.

And as Mr Scholz and Mr Kukies’ clandestine London meetings show, the idea is now gaining traction in Berlin. Policymakers and corporate bosses see a stable national banking champion as the backbone of their export-led industrial policy, vital if the country is to weather the next downturn that many economists warn looms large.

In turn, they hope a merger would help to re-establish Deutsche as a top-level capital markets player with the scale and reputation to hold back the encroachment of a revitalised Wall Street. Paul Achleitner, Deutsche’s chairman, has become the pivotal internal champion of a deal, according to people briefed on his thinking.

“It is important that we in Europe remain strong and independent,” says Simone Menne, former chief financial officer of German airline Lufthansa and drugs maker Boehringer Ingelheim. “It may make sense to join forces and, when it comes to financial policy, to pursue a more European approach.”

Yet, despite growing support for a merger in some business circles, there are many investors and executives arguing that combining the two banks would not remedy their problems.

“We think a deal only happens in the near term if Deutsche’s plan A is clearly failing and the share price is under [even more] severe pressure,” says Stuart Graham, founder of Autonomous Research. “A deal [would be] born out of desperation and hatched by a government seeking to prevent contagion.”

The minister

Olaf Scholz

Olaf Scholz joined the Social Democrats aged 17 and rose to be mayor of his home city Hamburg. Noted for his business-friendly attitude, his finance ministry has met Deutsche executives two-dozen times already as he wrestles with what to do with Germany’s problem child. At home he is known as “Scholz-o-mat” for his robotic, deadpan delivery.

Politicians have been forced off the sidelines after a particularly turbulent 2018 that started with Mr Achleitner firing dour British chief executive John Cryan in favour of Deutsche “lifer” Christian Sewing, and ended with police raiding the bank’s headquarters in a money laundering investigation. Bank insiders suggest these raids added some urgency to Berlin’s merger discussions.

Deutsche is also embroiled in a scandal at Danske Bank, the Danish lender. And the US Congress continues to investigate its longstanding business relationship with President Donald Trump.

Leading the government’s Deutsche project is the softly-spoken, cerebral Mr Scholz, a business-friendly Social Democrat who Angela Merkel named vice-chancellor last year. Mr Kukies is his emissary to the financial world. The Harvard-educated, ex-Goldman Sachs derivatives trader is the opposite of his boss: confident, brash, ebullient.

The uber-bank they imagine would be the second-largest eurozone lender behind BNP Paribas, with about €2tn of assets. It would hold €845bn of deposits, almost the size of Citigroup, have more than 2,500 branches and employ 141,000 people — compared with Deutsche’s 92,000 today. As many as 20,000 of those jobs could be lost, analysts say.

The outcome of this saga has implications not only for the companies involved and Germany itself, but the continent’s banking industry as a whole.

Few European banks generate double-digit returns, considered the bare minimum by investors. That explains why many have repeatedly called for consolidation among the region’s 6,000 banks.

Speculation over any merger is being taken more seriously this time. Mr Scholz has adopted a far more activist stance than his predecessor, arguing that having strong and stable banks is a question of “national sovereignty”. He told a conference that the troubles of German banks had created problems for industrial policy because they “don’t have the scale and global footprint necessary to escort the corporate sector [overseas]”.

A person close to the politicians says their desire for a national flag-bearer stems from the 2008 crisis, when panicked banks restricted the supply of credit. “Foreign banks repatriate capital in times of distress,” he says. “One really has to be mindful of that.”

The dealmaker

Paul Achleitner

Paul Achleitner’s almost seven years overseeing Deutsche will not go down as a golden period in the bank’s history. But the chairman has a chance at redemption if he can pull off a mega merger — that he is lobbying for internally — to save Germany’s floundering lenders. Famed for his connections, he is treasurer of the secretive Bilderberg Group of political and business elites, hobnobbing with the likes of Santander chairman Ana Botín and venture capitalist Peter Thiel.

Another of the ministry’s concerns is that Deutsche alone may be incapable of escaping from what James von Moltke, its chief financial officer, has called a “vicious cycle of declining revenue, sticky expenses, lowered ratings and rising funding costs”.

Last year the bank generated a net profit of €341m — its first since 2014 — but it was forecast to be 20 per cent higher. The group made a return on tangible equity of only 0.5 per cent in 2018, a 20th of its target, and its struggling investment bank made a €303m loss last quarter as big institutional clients took their business elsewhere.

The government is even worried about the viability of Deutsche’s bread-and-butter corporate lending business in light of its escalating funding costs and deteriorating credit rating.

“Counterparties wanting to do a 10-year [interest rate] swap are starting to ask themselves how long the lender will be around,” says a senior European regulator, who asked not to be named.

Mr Achleitner, who has overseen Deutsche for almost seven years, has become the key figure in the saga. He knows Mr Kukies well; both went to Harvard and ran Goldman Sachs’ operations in Germany and Austria earlier in their careers. The wily, gregarious 62-year-old Austrian, who started his career at Bain & Co, is one of the best-connected power brokers in German-speaking finance, also sitting on the boards of Daimler and drugs group Bayer.

However, his dealmaking record is chequered. As an executive at Allianz, Mr Achleitner oversaw the €24bn purchase of Germany’s Dresdner Bank in 2001. But within seven years Dresdner had lost half its value and the government was forced to broker a deal to sell it to Commerzbank.

He is said to believe Deutsche is well-positioned to take on the mantle of Europe’s champion because investors and corporates are wary of US capital markets hegemony in light of rising economic nationalism.

“There is a real demand for services that are not American,” a person close to Mr Achleitner says. “The American national interest might not be identical to the Europeans. To be that alternative, you just have to be the best of the rest.”

Internally Mr Achleitner has argued that the acquisition of a broader base of retail deposits could also reduce and stabilise Deutsche’s funding costs, which have been snowballing in the past year.

The chief executive

Christian Sewing

The 48-year-old has spent almost his entire career at Deutsche, working his way up from an apprentice in a branch in the north Rhine town of Bielefeld. While a specialist in risk management, since taking over in April 2018 he has tried to restore a “hunter mentality” among cowed staff beaten down by years of losses and negative headlines. Mr Sewing has said he wants to get his own house in order before considering a merger, but is careful to never contradict his chairman, in public or private.

Yet many, inside both banks and investors, question the chairman’s arguments. “Economically, it does not make sense and it would be a total gift to our competitors,” says a Deutsche executive who asks not to be named. “People in Commerzbank don’t want the deal either. But I tell you who would love it — JPMorgan and BNP Paribas — because we would spend years distracted by it.”

Mr Sewing has already complained to colleagues that the merger speculation has overshadowed the fact that the bank beat its targets on costs, job cuts and capital last year.

Several of the bank’s top shareholders, contacted for this article, say Deutsche’s main problem is that it does not have a profitable core business to fall back on if it were to further overhaul its sprawling investment bank.

One executive at a rival likens the restructuring of big banks to repairing a jumbo jet mid-flight. As long as three of the four engines are still going, the plane stays aloft. “The problem is Deutsche only has one engine,” he says.

Swiss banks UBS and Credit Suisse have trillion-franc wealth management businesses. Barclays is supported by reliably profitable retail and credit card units. By contrast, Deutsche and Commerzbank operate in a fiercely competitive and structurally unprofitable domestic market, dominated by hundreds of municipality-owned savings banks, known as Sparkassen, and regional co-operative lenders with no obligation to maximise profits.

In February, Commerzbank chief executive Martin Zielke abandoned almost all of its 2020 revenue and profitability targets, blaming anaemic interest rates and local competition. However, its cheap valuation — 33 per cent of the book value of its assets — and market-leading position lending to Germany’s Mittelstand companies make Commerzbank a potentially attractive target for foreign buyers.

Mr Zielke favours a domestic merger over a foreign takeover “because he thinks that he would have more control in such a scenario”, a senior German policymaker says. The government still owns a 15 per cent stake in Commerzbank after its 2009 bailout.

Many observers argue, however, that a foreign takeover of one or other bank is preferable because there would be less overlap and fewer job losses. But few suitors have emerged.

“To buy the problems of the Germans would be absolutely mad,” says the chairman of one bank that has been linked with Deutsche. “All mergers need to be executed in a brutal way; ‘synergies’ is just another word for brutally slashing costs.”

In discussions with the government, Mr Achleitner has asked for guarantees he would be allowed to restructure without interference, arguing Germany’s low unemployment rate and social security net means it can cope with job losses. Whether he receives that assurance is another matter.

Cerberus, the US private equity fund, is one of the largest shareholders in both lenders. Despite sitting on paper losses from the share price fall of about €600m, the company backs the merger, sources familiar with its thinking say. However, Cerberus has few allies. Five other top 10 shareholders in Deutsche told the Financial Times they are highly sceptical about, or staunchly opposed to, a merger.

Their concerns are rooted in Germany’s terrible record of bank integrations, particularly the painful state-arranged 2008 merger of Commerzbank and Dresdner, as well as Deutsche’s own botched acquisition of retail lender Postbank the same year. “Combining two sick men does not create a healthy one,” warns one shareholder.

Verdi, Germany’s service sector union, is also in the no-deal camp. “We do not back such a scenario because we are concerned about another big loss in jobs,” says Jan Duscheck, head of its banking group and a member of Deutsche’s supervisory board.

Analysts are also unpersuaded about the numbers. JPMorgan’s Kian Abouhossein estimates a tie-up could generate €2bn in cost synergies within five years, but they would be offset by €4bn of integration costs. Moreover, due to client overlap the German superbank would lose close to €1bn in revenue, he adds.

Mr Graham of Autonomous Research says regulators would impose a higher “global systemically important bank” capital surcharge of 50 basis points, so the bank would have to hold more than 14 per cent of common tier one equity, to reflect the joint group’s larger balance sheet and complexity. That means the group might need to raise an additional €3bn in equity.

“From a financial market stability point of view, this would be an extremely bad idea,” because it would create a behemoth “even more difficult to wind down in a crisis”, says Isabel Schnabel, a member of the government’s Council of Economic Experts.

However, with an influential chairman campaigning for a deal — and a government prepared to take charge of Germany’s biggest systemic risk — politics could trump the pessimists.

Letter in response to this article:

Deutsche-Commerz tie-up is no laughing matter / From Peter D Hahn, London, UK

Comments