The era of relentless Swiss franc appreciation is coming to an end

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The writer is global head of FX strategy at Union Bancaire Privée

Since the October 7 attacks carried out by Hamas in Israel, the Swiss franc has risen from already lofty levels to new all-time highs, reflecting its long status as a haven on currency markets in times of turmoil.

Clearly, the prospect of a wider regional conflict has spooked investors. Given the geopolitical uncertainties, it is, of course, too early to tell whether that risk occurs. But if the threat recedes, the franc’s current high valuation is unlikely to be sustained.

In June 2022, the Swiss National Bank started to favour a policy of implicit franc appreciation as a means of reducing imported inflation. It correctly judged that the rise in Swiss inflation had been driven largely by imported effects, and franc appreciation would reduce those effects. Since then, roughly speaking, the euro has fallen from 1.05 to 0.95 against the franc. Even the dollar, so strong against other major currencies recently, has fallen from 1.00 to a July level of 0.85.

The policy has been successful, since Swiss inflation is now back below 2 per cent, meaning that the SNB is the only major central bank currently hitting its inflation target. Its latest forecasts project headline inflation of about 2 per cent over the coming two years.

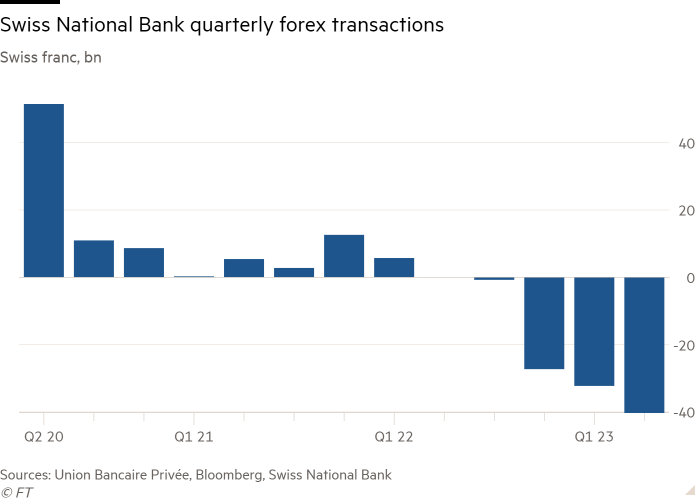

The key to this policy of nominal franc appreciation has been the use of the SNB’s large stockpile of foreign exchange reserves, built up over the previous decade. The SNB’s latest quarterly foreign exchange transaction data shows that since the first quarter of 2022, it has spent just over SFr100bn on interventions to prop up the franc, selling euros and dollars and buying the Swiss currency. Without these interventions, the franc would probably be weaker.

To get an idea of how overvalued the franc currently is, it is useful to look at its exchange rates with similar currencies. A cursory look shows that the Swiss franc is trading around 50 per cent above its pre-pandemic level against the yen. This is an astonishing development when we consider that relative inflation trends have been very similar.

At its September meeting, the SNB opted to maintain its deposit rate at 1.75 per cent, and indicated that it would remain on hold for a considerable period. In a typical “buy the rumour and sell the fact” move, the franc weakened as investors took profits on “long” positions in the currency. Investors then turned significantly short, betting on a fall in the franc, as shown by IMM futures data.

In its statement, the SNB noted that headline and core inflation were almost wholly domestically generated, meaning that imported inflation effects have more or less dissipated. With headline inflation set to continue falling in the major economies over the coming year, the implication is that the SNB will no longer need to spend its foreign exchange reserves to prop up the franc. The recent bout of risk aversion has clouded this development, but the principle remains intact. The upshot is that when the current phase of risk aversion passes, investors will look to short the currency once again.

The return of meaningful positive interest rates among the major G10 currencies means that carry trades are likely to come back into fashion. This involves selling low-yielding currencies and buying higher-yielding ones with the aim of pocketing the interest-rate differential. The spreads of nominal interest rates in Switzerland and big economies have widened meaningfully against the franc in recent months. And the “higher for longer” mantra from the major central banks means that these spreads will be sustained. This marks a big change from the last decade, when nominal rate spreads were absurdly low.

This implies that investors will increasingly look to use the franc as a funding currency once again, with the result that it will face modest weakening pressure. The franc has all the necessary characteristics to fulfil the role of a funding currency: Switzerland has low and falling inflation rates, stable interest rates and a current account surplus.

Franc-denominated capital flows are unlikely to match those of the period before the global financial crisis. We very much doubt that international regulators will allow individuals to take out franc-denominated mortgages as they once did, thus preventing any aggressive weakness in the currency such as that seen between 2002 and 2006.

However, it is clear that franc valuations have moved towards unsustainable levels on a bilateral basis, and we now have several catalysts for a change in the currency’s underlying trading regime. The era of relentless franc appreciation is indeed coming to an end.

Letter in response to this article:

Comments