Book review: the most powerful behaviours are those that never change

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

A decade ago, Morgan Housel says he set a goal that led to “one of the most enlightening changes of my life”. He resolved to read more history and fewer forecasts, with the result that he became ever more comfortable about the uncertainties of the future.

Housel’s previous book, The Psychology of Money, made a strong argument that financial decisions are driven less by maths-derived data and spreadsheets than by subjective human characteristics and behaviours, such as ego and hype.

His new book tries to develop this thesis by suggesting it is better to make predictions based on how people behave rather than by trying to anticipate events. Greed, fear, opportunity, exploitation, risk, uncertainty, tribal affiliations and social persuasion are all common traits to take into account, he claims. While change captures the attention because it is surprising, he says the most powerful behaviours are those that never change, and provide pointers to the future.

That offers a tempting opener to the book, which he illustrates with examples such as Jeff Bezos, the Amazon founder, who, he argues, succeeded by focusing on customer demands that remain even as technology and shopping habits change: low prices and faster shipping. Bezos also said that, when the anecdotes and the data disagree, the anecdotes are usually right and “there’s something wrong in the way you are measuring it”.

Housel says subjective factors rather than numbers are key to understanding many significant events, ranging from the Great Depression of the 1930s and the Covid-19 pandemic, via the tech bubble and the global financial crisis.

Lehman Brothers had a strong tier I capital ratio (a measure of financial strength) in September 2008, but failed because investors no longer believed in it. By contrast, GameStop, the video game retailer, was struggling financially in 2020, but was saved after the stock surged on the back of a “cultural obsession on Reddit”.

Robert McNamara’s faith in statistics may have worked when, as an executive and president of Ford Motor Company, he deployed it to boost car manufacturing. But the idea manifestly failed to deliver when, as US defence secretary during the Vietnam war, his obsession with metrics failed to take into account the emotional reactions of the people in the conflict.

Throughout the book, there is an implicit (and insufficiently critical) homage to the power of “storytelling”: the Silicon Valley version of good writing and presentation encapsulated in slick TED Talks and venture capital pitches. Housel’s conclusion is: “If you have the wrong answer but you’re a good storyteller, you’ll probably get ahead (for a while).”

In 24 concise chapters, he skims across a range of examples drawn from history, science and finance to distil a series of conclusions. Some make considerable sense: we are very good at predicting the future except the surprises, which tend to be all that matter; people don’t want accuracy, they want certainty; progress requires optimism and pessimism.

Others are truisms that add little new: it’s easy to discount the potential of new technology; most competitive advantages eventually die (illustrated by the rise and fall of retailer Sears); everything worth pursuing comes with a little pain; nothing is more persuasive than what you’ve experienced first-hand. He has some interesting views on how the transition from local print newspapers to today’s social media has driven a shift towards more pessimistic news: “The world is not more broken, we just see more bad stuff.” His advice is not to abandon the media, but to read books for greater context.

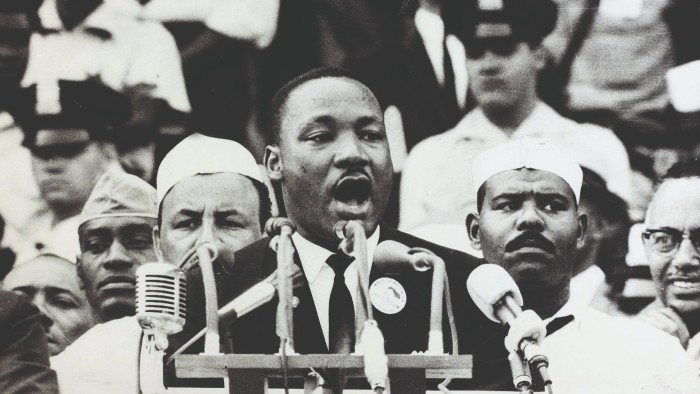

There are some nuggets in his book, such as how a chance comment by gospel singer Mahalia Jackson triggered Martin Luther King to abandon his laboriously prepared text in favour of the spontaneous initial words launching his famous “I have a dream” speech. Or insights into how US documentary film-maker Ken Burns adapts his scripts to fit the accompanying music.

Housel cites the wisdom of others, including the scholar Nassim Nicholas Taleb, who invest in preparedness rather than prediction; and the investor Charlie Munger, who says it is not greed but envy that makes the world go round. But he adds little interpretation of his own.

The problem, as Gertrude Stein once said, is that “there’s no there there”. There isn’t much of a central thesis, and the multiple examples — each no more than a few paragraphs long — are summarily described and discarded so swiftly that there is scant space to digest them, let alone explore them in depth.

Despite Housel’s role as a partner at the Collaborative Fund, which describes itself as supporting “companies at the intersection of for-profit and for-good”, there are few efforts to link this to business advice. His rule of thumb is described as simply: “Plan like a pessimist, dream like an optimist; save like a pessimist, invest like an optimist.”

He opts out of recommendations at the end of the book, suggesting “everyone is different, universal guidance is rare”. Instead, he offers a brief set of questions on which readers should reflect, leaving this one to wonder: “Is this a cop-out?”

Same as Ever: Timeless Lessons on Risk, Opportunity and Living a Good Life by Morgan Housel, Harriman House, £11.99

This article is part of FT Wealth, a section providing in-depth coverage of philanthropy, entrepreneurs, family offices, as well as alternative and impact investment

Comments