Equities rally takes FT stock pickers by surprise

Simply sign up to the Equities myFT Digest -- delivered directly to your inbox.

People “have had enough of experts”, said Michael Gove, now UK housing secretary, during the Brexit campaign in 2016. In 2023 the stock market agreed.

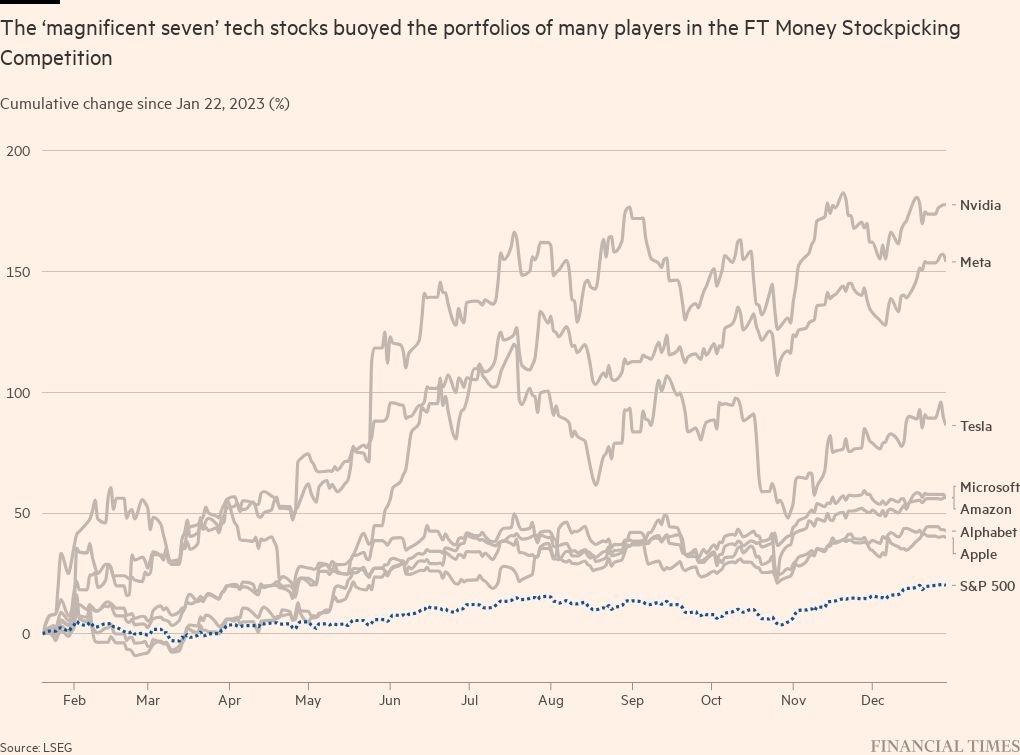

Professional investors were wrongfooted by the unexpected strength of the US economy. Bets on consumer cyclical stocks such as Nestlé, which might have performed well in a recession, floundered. Any portfolio without at least some of the “magnificent seven” tech stocks, or some esoteric, crypto-related companies, was basically sunk.

This is, of course, the FT’s annual stock picking competition. Readers are invited to compete against and trounce FT journalists by making long or short bets on five individual companies (no funds, trackers or commodities).

The competition is an exercise in humility. The brave triumph against the cautious; amateurs vanquish experts and, in 2023, those who rode high in 2022 were brought back down to earth.

Few exemplify this humility more than the FT’s very own markets whisperers Rob Armstrong and Ethan Wu of Unhedged, whose bet on a US recession and the downfall of crypto left them last among FT journalists and 17 places from the bottom of the 750 entrants, with a 70 per cent loss.

“Our macro bet, an all-in bet on recession, was perfectly wrong . . . I’m surprised we didn’t do worse to be honest”, says Armstrong, peeling an egg off his face. “The mistake we made was putting all our chips on the consensus, along with some raw stupidity.”

Are you a champion stock picker?

Enter this year’s stock picking competition at FT.com/stockpick2024

“All the big financial institutions went into 2023 thinking there would be a massive US recession and they all got their arses handed to them,” says FT markets columnist Katie Martin. “Everyone was far too bearish.”

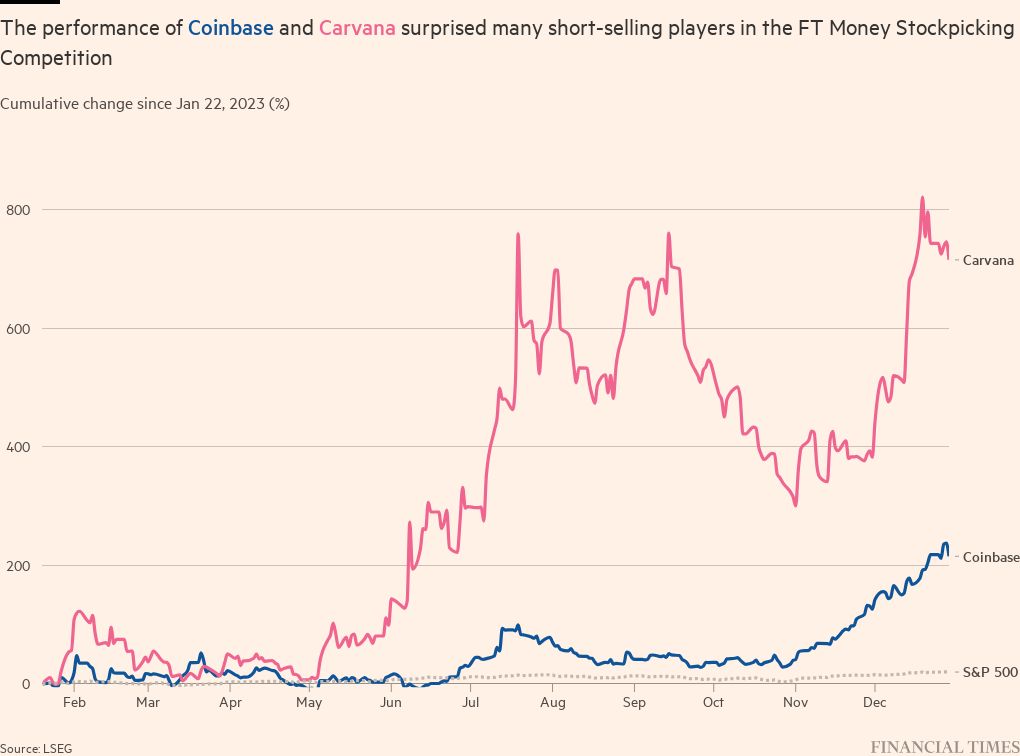

The humiliation of Armstrong and Wu, and with them the investor consensus that 2023 would be a bumpy recession year, points to the unexpected outcome in the markets. The US economy’s surprising strength led to a surge in growth investments and speculative bets on tech stocks, cryptocurrencies and online auto dealership Carvana.

“Developed equity markets [rose] to an all-time high,” says Kevin Thozet, a member of the investment committee of Carmignac, a French asset manager, who did not participate in the contest.

“US equity markets were notably helped by the so-called magnificent seven [Alphabet, Amazon, Microsoft, Meta, Tesla, Nvidia and Apple] and obesity treatment stocks, which were up by more than 100 per cent . . . Defensive sectors such as utilities, staples and healthcare posted close to negative returns, as did energy.”

Almost 60 per cent of the readers and journalists who braved the fantasy finance tournament made money in 2023, far more than the quarter of entrants who did so in 2022, when tech stocks plummeted and crypto withered.

In a sign of the strength of this bull market, the top five portfolios were all long on stocks, while most of the punters who recorded triple-digit percentage losses shorted the same stock — Arizona-based Carvana, which recorded a 715 per cent increase.

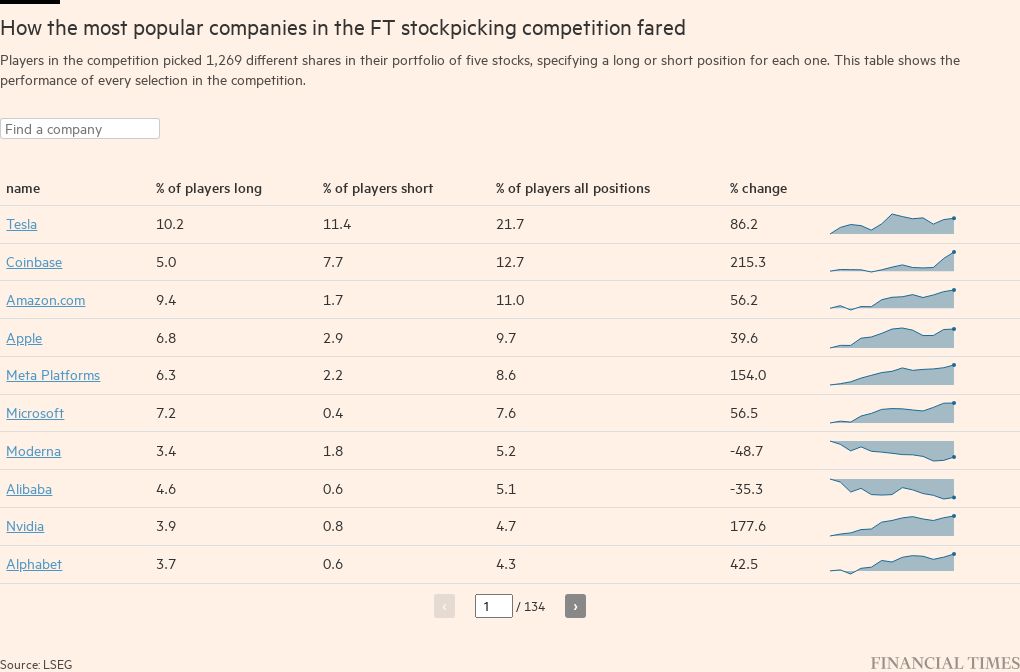

Elon Musk’s Tesla was, as usual, the most picked stock, although in the latest contest more people opted to short it rather than bet on its success. The world’s second largest EV automaker was followed by crypto exchange Coinbase and the rest of the magnificent seven in the popularity stakes.

What went well for some investors?

At the start of 2023 it would have been hard to imagine that the winning portfolio, with a 146 per cent return, would include a mobile games business, a buy-now-pay-later company, and Coinbase.

The winner, Neil McLean from Scotland, even managed to find a Chinese stock that went up last year: EV automaker Xpeng.

He says he looked to the US as he thought its economy was more resilient to higher interest rates. “I began with around 20 companies whose share price had fallen the most and picked the ones that looked to have the most exciting or sustainable ideas,” wrote McLean, who is an angel investor. One of his bets did not pay off: Californian EV maker Lucid, which went public via a special purpose acquisition company (Spac) in 2021.

Brendan Mountjoy from Ireland, who came second, hitched his fortunes to five companies in the biotech industry, three of which performed strongly. Another, Seagen, was acquired by Pfizer.

“Since this was a competition with a short investing timeframe, I looked at stocks that had high upside potential in the near term,” Mountjoy, who works in the pharmaceutical sector, says. “This worked out but I would be the first to admit that it was pure luck.”

Some investors benefited from exposure to the rebound in cryptocurrency prices, which confounded many professionals who had practically written off the digital assets after a series of scandals and collapses. Bitcoin hovered around $20,000 in January 2023, but has since more than doubled to $48,000.

Kadhim Shubber, the FT’s UK news editor, came first among the journalists and seventh overall with a contrarian bet on five bitcoin miners, some of which were teetering on the edge of bankruptcy at the time he chose them.

“I thought that bitcoin is the future and therefore I wanted to put all my eggs in the bitcoin basket”, he says, tongue firmly in cheek. “People need security, ease of use and cheap transactions, which is definitely what bitcoin provides . .. ” He claims he will stick with exactly the same strategy in his 2024 picks.

Bonus season - are you headed for a payout or a doughnut?

For the third year in a row, the Financial Times is asking readers to confidentially share their 2024 bonus expectations, and whether you intend to invest, save or spend the cash. Tell us via a short survey

The third-placed punter took a nakedly short-term view of the stocks likely to prosper after the stock market rout of 2022.

Dimitrios Gotsis, a 26-year-old graduate student in electrical and computer engineering from Indiana, says that many megacap stocks were “beaten up [and] cheap”, adding that he was encouraged that “cost cuts” made by companies like Tesla and Snapchat made them strong potential bets.

Gotsis is considerably less optimistic about the market in 2024. “It looks like the ‘delayed but not derailed’ recession may finally happen,” he says, adding that he plans to broaden his stock picks from tech to commodity and pharmaceutical companies.

Tech investors also had a good 2023. Louis Ashworth, a reporter for Alphaville, the FT’s markets blog, would have taken the silver medal among journalists with a portfolio that tilted towards US tech, with investments in Nvidia and Microsoft.

Unfortunately he included Scottish Mortgage Investment Trust in his portfolio. Investment trusts, along with other kinds of fund, are firmly against the rules of the competition. Bad luck, Louis.

“The ‘flight to shite’ (investors rushing into more speculative assets), as Alphaville editor Robin Wigglesworth poetically dubbed it, was already well under way by the start of 2023, and I was confident — unlike those gloomsters over on Unhedged — that there wouldn’t be a US recession,” Ashworth says.

“From this position, buying US tech mega-caps to ride a resurgent tech wave seemed like the safest bet,” he added, lamenting that a “home bias” influenced him to opt for Tesco and Games Workshop, which lowered his overall returns.

With the clarity of hindsight, Ashworth would have simply chosen “five of the magnificent seven”, and for this year he intends to double down on the US economy — looking for smaller companies that are “still priced for recession”.

Ashworth’s second place slot was taken by South China Correspondent Will Langley, whose bet on Rolls-Royce, a favourite among British retail investors this year, soared 180 per cent.

Another of his picks, Chinese EV manufacturer Li Auto, also performed strongly, rising 60 per cent, although a punt on financial services giant Charles Schwab and a short position in BP both failed to move the dial.

“I thought a post-Covid turnaround in China might boost metals and tried to be too smart with a punt on the decline of oil,” says Langley.

“Neither really materialised. Luckily, Rolls-Royce really gathered momentum after some bullish projections late in 2022 and I did well out of jumping on the EV hype bandwagon.”

And in a show of how seemingly arbitrary stock market success was in 2023, eighth place overall went to Raymond Weir from Edinburgh, who randomised his selection and ended up with four penny stocks and telecoms company Vodafone. One of them, Eyepoint Pharmaceuticals, was up 450 per cent by the end of the year.

“I guess after all there may be is some truth to Princeton professor Burton Malkiel [saying] ‘A blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by experts’,” Weir writes.

What went wrong for everyone else?

While betting against big tech and crypto cost dearly in 2023, exposure to energy, the UK and China also failed to deliver in many cases.

The energy theme took up a lot of column inches early in the year, with speculation that Europe would face blackouts and energy shortages due to Russia’s full-scale invasion of Ukraine.

As it transpired, many miners and energy companies fell back in 2023, alongside the price of Brent crude, the oil benchmark. The unfortunate investor who came last in the contest overall recorded losses on Rio Tinto and Anglo American, despite writing that they originally believed the valuations were “sensible”. BP, on which 2 per cent of entrants went long, declined by 2 per cent in the year.

Commiserations to 2022’s winner Tyler Yarnell, who in 2023 came third last with a portfolio betting on Canadian oil companies — and a short position on Carvana.

“The Canadian oil stocks were a bet on a pipeline becoming operational that would allow more oil to flow to Asia,” says Yarnell, who added that since the Trans Mountain pipeline’s completion was delayed until at least 2024, the expected bump to his companies did not materialise.

Looking ahead to his 2024 strategy, Yarnell says he would “not short anything for sure”, after his failed Carvana bet showed the dangers of taking such positions. “I’m leaning towards picking one or more copper producers,” says the former business support manager who described himself as an “unemployed vagabond seeking job opportunities”.

Shorting was indeed a perilous game in the 2023 bull market. Tesla, the stock most shorted by FT readers and journalists, rose 86 per cent. The second most shorted stock was Coinbase, which ended the period up 215 per cent.

At the start of 2023, many investors hoped that the end of zero-Covid restrictions would trigger a strong bounceback in the Chinese economy — but they were left disappointed. Some 5 per cent of competitors took a long bet on Alibaba, which fell 35 per cent over the year.

A few readers made a return from shorting two of the original meme stocks: GameStop (down 10 per cent) and Bed Bath & Beyond (down 97 per cent), but most investors lost money betting stocks would go down.

As a parting shot, we’ll leave you with some wise (or perhaps hubristic) words from Messrs Armstrong and Wu from their column explaining their strategy. You can decide whether they lived up to these principles, and how you might do in this year’s contest.

“The point of stock picking contests is not to maximise expected returns. It is to maximise expected glory, while minimising expected humiliation. That is to say, all that matters is coming in first, not coming in last, and looking clever doing it.”

OK, so how do I sign up for the 2024 contest?

Stock pickers and competing FT journalists will face tricky questions in 2024 when they come to make share price predictions. The US economy put in a strong performance in 2023, as tech companies pushed ahead with growth and profits. But central banks will walk a tightrope this year as they try to find the right balance between keeping inflation on the wane and not choking off growth. Getting it wrong could mean the difference between prosperity and recession.

And that is before stock pickers try to factor in the impact of big elections, notably in the US and UK. Would a return to power for Donald Trump set off a new phase of disruption in global markets? How would UK investors respond to the advent of a Labour government?

Astute investors, of course, can ferret out good companies in even the most uncertain periods. Why not try your hand at finding those that will profit or lose, by pitting your wits against FT journalists in the next instalment of our annual stockpicking contest?

Contestants must choose five listed stocks from anywhere in the world and take either a long or short position — betting that the shares will either rise or fall. The winner is the person who generates the highest overall return on their portfolio. No money is wagered — so the only potential loss is your pride.

Entries will close at 23:59 GMT on Sunday, January 28, and the contest will be judged on gains and losses made between January 29 and December 31.

The competition entry form is at FT.com/stockpick2024. If you are a subscriber or a registered user, and you are logged in to FT.com, the link will give you access to the form. If you have not registered, click on the link and register for free to gain access.

Remember, no funds, commodities or trackers are allowed, only individual companies. Ignore currencies and dividends. You can keep track of your performance throughout the year by logging on to your portfolio. Good luck!

Comments