Covid’s winners: a blip, or the new normal?

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

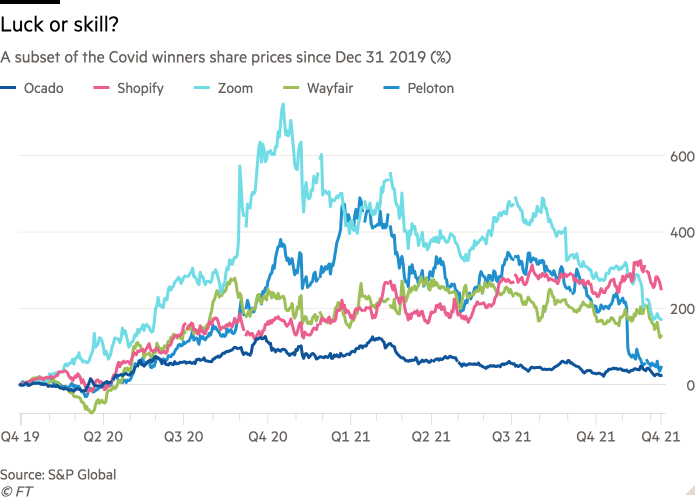

Everyone knows about the companies that won from the pandemic, and vice versa. While at one end you had ruinous sell offs in travel, industrials and energy, the flip side was a boon for ecommerce, telecommunication and digital payments. These companies in the latter category — perhaps best personified by names like Zoom, Peloton, Ocado, Shopify and Wayfair — were crowned “the Covid winners” due to the fortunate positions they found themselves in through little skill of their own.

But the lingering question for these businesses, and their share prices, was whether their explosive top line growth during pandemic just represented future growth being pulled forward into one short year, or a new normal of market dominance. In other words, would a Peloton bike permanently replace the gym, or become an expensive coat rack in a second bedroom?

Well, Wall Street seems to be giving us a clue. Not just down to the sell-offs in the stocks mentioned above this year, but also in how analysts estimates are shifting.

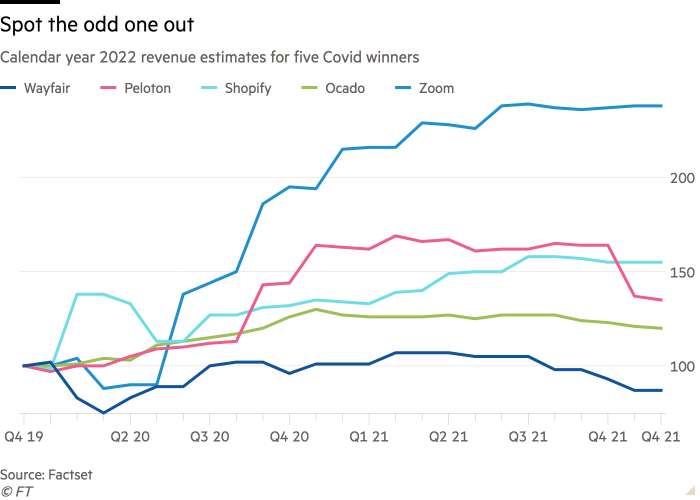

Take a look at this. Here is a chart depicting how the revenue estimates for the 2022 calendar year for Ocado, Shopify, Wayfair, Peloton and Zoom have changed since the onset of the pandemic. See if you can spot the odd one out:

That’s right, Wayfair’s current revenue estimates for next year are below where they were in December 2019. In effect, Wall Street’s soothsayers are worried that all of the online furniture retailer’s demand was condensed into 2020, and now its market is tapped out. The stock, meanwhile, is still up 127 per cent since the end of 2019.

Back in March, FT Alphaville wrote a mea culpa on what we got wrong about Wayfair. What we didn’t expect, however, was that the business would hit a demand cliff so soon after Covid. Maybe, dare we suggest, we were right after all?

Related Links:

Wayfair: what we got wrong — FT Alphaville

Wayfair is nuts, when’s the crash? — FT Alphaville

Comments