Yawning ESG trust discounts offer opportunities, say analysts

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Anyone thinking about investing sustainably will quickly come across plenty of options among mutual funds and exchange traded funds. Often, this is due to aggressive marketing that has drawn the attention of regulators concerned about greenwashing.

But there are other options for sustainable investors: investment trusts have for several years been expanding their sustainable offerings, often in the areas of renewable energy and infrastructure.

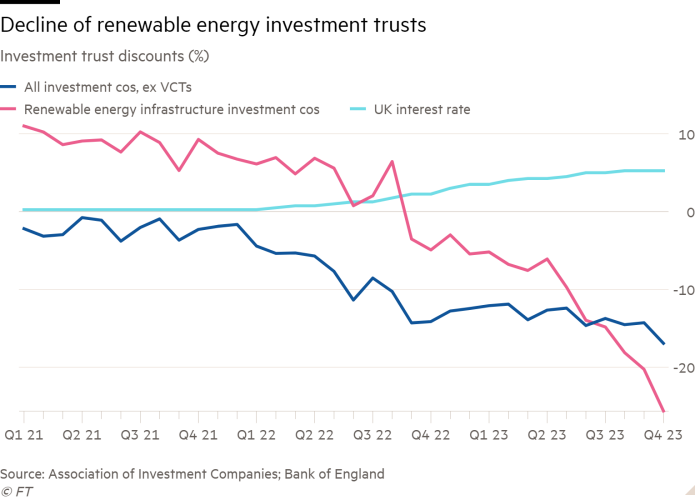

Discounts among these trusts have widened significantly over the past year as interest rates have risen and investors have opted for safer gilts ahead of steady but not quite as safe infrastructure yields. But analysts and professional investors say that this indiscriminate sell-off has created bargains.

“Given current ratings, trusts represent an opportunity to benefit from a ‘double whammy’ of improving NAV [net asset value] performance and tightening discounts once general investor sentiment improves,” says Elliott Hardy, an analyst at Winterflood.

Annabel Brodie-Smith, head of the Association of Investment Companies, the industry body for investment trusts, says investment trusts have been slower than open-ended funds (conventional mutual funds or unit trusts) to climb aboard the ESG bandwagon. Independent boards of directors are much more cautious about making claims that they can’t necessarily back up, she says, and indeed no investment trusts have ESG in their name. That has helped them to swerve some of the issues over greenwashing that open-ended funds have faced.

In many cases, investors buying “sustainable” investment trusts have done so primarily with financial performance in mind. Colette Ord, a director at investment bank Deutsche Numis, points out that most renewable energy infrastructure trusts predate the launch of specific ESG products and were launched with a financial return target in mind.

“Other sources of income have become more attractive to investors and there’s been a reallocation happening, but fundamentally we see specifically the listed infrastructure sector as being really good value for investors looking for assets that are managed well and give good returns.”

This is backed up by a survey by the AIC, which found that 44 per cent of investors in “sustainable or impact investment companies” were motivated by financial return and performance, compared with 19 per cent by a focus on ESG or sustainability.

Brodie-Smith argues that investment trusts, despite taking time to respond to the ESG trend, are well-suited to being genuinely sustainable investments. They can invest in assets that are more illiquid and difficult to trade, such as wind farms and solar farms, that open-ended funds find it harder to do due to the need to return money to investors when they want it.

There is no “sustainable” category as such for investment trust; many are found in more focused categories. There are just three in the “environmental” category. One is the long-running Impax Environmental Markets fund, which remains popular with analysts. It trades on a 7 per cent discount, having lost 14 per cent of its value in the past year, but with growth of 40 per cent over the past five years.

There are 22 investment trusts in the renewable energy infrastructure sector. All trade on a discount, from the largest, the FTSE 250-listed Greencoat UK Wind, which owns wind farms across the country, to the smallest, Aquila Energy Efficiency Trust, which is currently trying to sell its assets with a view to winding up.

Yet as recently as August last year, renewable energy infrastructure trusts were trading at a premium, unlike most of the rest of their peers. The rapid shift to an average 25 per cent discount, compared with 17 per cent for the wider investment trust sector, has come as interest rates have risen and the yield on infrastructure investments has looked less impressive — and more risky — by comparison.

Matthew Hose, an analyst at Jefferies, reckons that renewable energy infrastructure trusts benefited from sustainable flows in previous years, with new equity issuances around the time of the pandemic, but that this has dried up.

“The greenwashing thing doesn’t really apply as they do what they say on the tin, but they’re exposed to the wider issues in the investment company sector, with huge technical selling mainly from multi-asset investors,” he says. “Selling is pretty indiscriminate.”

Hose suggests that Greencoat UK Wind, with a simple strategy of owning wind farms to generate cash to pay an inflation-linked dividend, would appeal to sustainable investors, along with SDCL Energy Efficiency Income, currently trading at a 40 per cent discount with a portfolio that Hose says “the market doesn’t really understand”.

Other investment trusts are not obviously sustainable from either their name or the sector they are in. Pacific Assets Trust, for example, is in the Asia Pacific sector, but adopts a sustainable investment strategy on the belief that sustainability is a driver of investment returns and is the best way to protect investors’ capital over the long term.

This more thoughtful approach is another reason that such funds have not been caught up in the greenwashing accusations, reckons John Moore, investment manager at wealth manager RBC Brewin Dolphin. He is also a fan of Greencoat, on the grounds that it owns high-quality assets, and Impax as an early example of a thoughtful investor.

Of course, investment trusts are not free from scandal. Home Reit, set up as a landlord for the homeless, saw its shares suspended this year and faced a lawsuit from investors after tenants failed to meet rental payments.

Some in the renewable energy infrastructure sector, such as those focused on hydrogen, are particularly volatile — HydrogenOne Capital Growth is trading at a discount of 54 per cent, having lost 46 per cent of its value over the past year.

A common accusation of greenwashing made against open-ended funds is that they opportunistically relabel funds while making only tiny tweaks to the portfolio. This has not been an issue for the renewable sector so far.

The repurposing of funds could change, though. Brodie-Smith at the AIC predicts that there will be more sustainable trusts after the UK regulator decides how to properly label the funds, a decision that is expected by the end of the year. That could lead to investment trusts feeling more comfortable about calling themselves sustainable without drawing the ire of the regulator — and to more sustainable retail investors having investment trusts on their radar.

Alice Ross is an FT contributor. Her book, “Investing to Save the Planet”, is published by Penguin Business. X: @aliceemross

Comments