Small crypto exchanges take advantage of Binance’s decline

Simply sign up to the Cryptocurrencies myFT Digest -- delivered directly to your inbox.

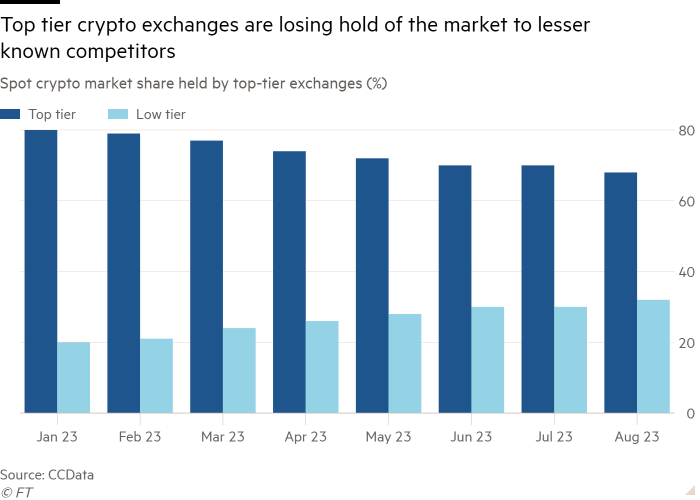

Small cryptocurrency exchanges rated as having higher levels of risk for customers have been the main winners from Binance’s hefty decline in market share in the five months since US regulators charged it with violating federal laws.

Companies such as Huobi Global and KuCoin, both based in the Seychelles, are among those that have been able to increase their share of the trading of crypto tokens such as bitcoin and ether since the start of this year, according to data from industry research provider CCData.

In contrast, exchanges that are rated by CCData as “top tier” — due to them surpassing a “minimum threshold for acceptable risk” to customers — have suffered a fall in their collective market share from 80 per cent to about 68 per cent since the start of the year. In the same period Binance, the industry leader, has fallen from 56 per cent to slightly more than 40 per cent.

The shifting landscape shows traders’ sensitivity to two lawsuits filed against Binance by US regulatory agencies this year. In March the Commodity Futures Trading Commission alleged it illegally accessed US customers. The Securities and Exchange Commission followed in June, accusing 13 Binance-related entities of violations including allegedly mixing billions of dollars of customer cash.

“For a large portion of crypto traders, anonymity and the ability to exchange funds that may have come from a high risk source is more important than trading on an exchange with a reputation for compliance,” said Tom Robinson, chief scientist and co-founder of blockchain tracing firm Elliptic.

Digital assets dashboard

Click here for real-time data on crypto prices and insights

CCData defines “top tier” exchanges as those that have the most robust approaches to protecting customer funds, security and anti-money laundering standards, to name a few.

Huobi — which has increased its share of the market by almost 6 per cent since January — has led the way in 2023 for exchanges increasing their share of the market while not being rated top-tier by CCData.

Others include DigiFinex and KuCoin, who have increased their share of the crypto market by 3.5 per cent and 1.3 per cent respectively since January. Huobi, DigiFinex and KuCoin did not immediately respond to requests for comment.

“It may be an opportunity for smaller exchanges because they’re still operating under the radar, and they haven’t been sued by regulators,” said CK Zheng, co-founder and chief investment officer at crypto hedge fund ZX Squared Capital.

“If I’m a newcomer to crypto and I don’t know how exchanges work, I would at least get scared if I saw one getting sued,” he added.

Other notable top-tier exchanges that have lost ground include Coinbase and Binance US — the American arm of the Changpeng Zhao-led group — both of which have surrendered more than 1 per cent of their share of the market since January.

“The Binance effect is huge. Their market share took a big hit after the US’s crackdown on crypto,” said Ilan Solot, co-head of digital assets at London broker Marex.

Click here to visit Digital Asset dashboard

Comments