Investors pull record sums from corporate bond ETFs as lending rates soar

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Investors pulled record sums from corporate bond exchange traded funds and pumped money into lower-risk government equivalents last month as benchmark lending rates soared to 16-year highs.

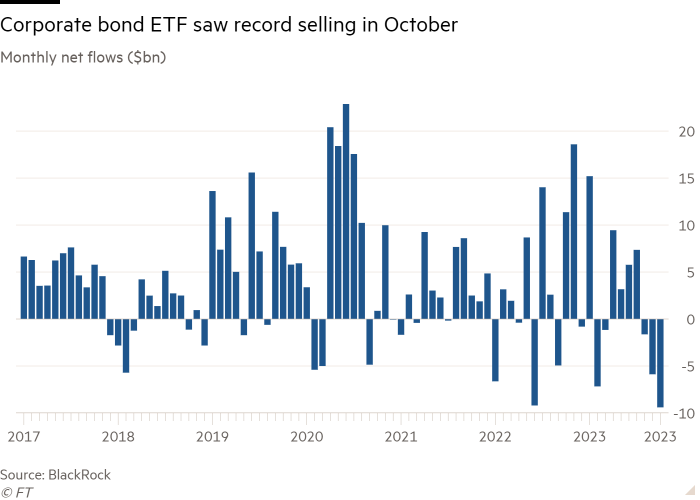

Corporate bond ETFs leaked a net $9.4bn in October, according to figures from asset manager BlackRock, exceeding the previous record of $9.2bn in June last year, when strong US inflation data prompted fears of aggressive rate rises.

In contrast, government bond ETFs sucked in $30.4bn, nearly double the level in September, with almost all this money heading into US Treasury funds.

The switch in flow came as US government bond yields and lending rates soared in October on expectations that the Federal Reserve would keep interest higher for longer to stamp out inflation.

The US’s key lending rate, Sofr, touched 5.3 per cent last month, the highest level since its predecessor, Libor, soared before the financial crisis.

“The game-changer is a short-term, risk-free rate north of 5 per cent,” said Nate Geraci, president of financial adviser The ETF Store.

“There’s a camp of investors growing more concerned about a potential economic slowdown, which would widen credit spreads. Those investors are entirely comfortable simply parking in short-term US Treasury bond ETFs yielding 5 per cent-plus and reducing or even shunning corporate credit risk,” Geraci added.

“The extra juice from credit isn’t worth the squeeze of spreads blowing out.”

The wave of selling rippled right across the corporate bond market. High-yield bond ETFs saw $4.8bn of outflows, according to BlackRock. The iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and SPDR Bloomberg High Yield Bond ETF (JNK) bore the brunt, with outflows of $2.8bn and $1.6bn respectively, according to VettaFi’s data.

But lower risk investment-grade ETFs were not immune, shipping $4.6bn — their biggest ever rout bar the Covid crash of March 2020 — with the Vanguard Short-Term Corporate Bond ETF (VCSH) accounting for $1.9bn of this.

“We saw a spike in bond yields and anticipation that higher interest rates for longer was going to be a reality in 2024 and investors pared out some of their risk exposure,” said Todd Rosenbluth, head of research at the VettaFi consultancy.

“We are in a low growth environment in the US. In Europe we are probably already in recession. We are in an environment where investors will demand more risk premium to own credit,” said Karim Chedid, head of investment strategy for BlackRock’s iShares arm in the Emea region. “Valuations are not cheap and that is driving some of the de-risking.”

Geraci believed there could be more to come if Treasury yields remain high by recent standards.

“There’s generally a more cautious attitude among bond investors right now, in stark contrast to the aggressive reaching-for-yield behaviour we witnessed several years ago,” Geraci argued. “As long as risk-free yields remain elevated, I don’t expect this recent behaviour to materially change any time soon.”

However Adam Gould, global head of equities at Tradeweb, an electronic marketplace, attributed much of the selling to volatility going “through the roof” in October, something that may not be repeated, as well as the likelihood of some seasonal tax-loss selling in the US.

Given the “tough year for a lot of corporate bonds, people might be taking the tax loss”, he said.

Inflows broadened out in the Treasury bond market, however. In recent months investors have focused primarily on short-term bonds, but in October long-term paper was almost as popular, with $10.4bn of net inflows, versus $12.6bn for short-term.

This was reflected in the two most popular fixed income ETFs in October, the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) and the iShares 20+ Year Treasury Bond ETF (TLT), which attracted $6bn and $2.9bn respectively, Rosenbluth said. In a sign of the times, an actively managed ETF, Pimco Enhanced Short Maturity Active ETF (MINT), also stood out, drawing in $1.1bn, VettaFi data shows.

Geraci believed that the flows into longer-term Treasury ETFs “include investors hedging against the Fed [US Federal Reserve] failing to orchestrate a soft landing, which would drive the back end of the [yield] curve down”.

Chedid said BlackRock had closed its tactical underweight call on duration in light of investor flows.

Emerging markets were out of favour in October, though. EM bond ETFs saw $3.2bn of selling, the largest outflow for a year, while EM equity ETFs leaked $1.7bn, their first net outflow since mid 2021.

Chedid said sentiment towards emerging markets had been damaged by the strength of the US dollar, which has rallied 6 per cent since July. The greenback and EM assets have traditionally exhibited a negative correlation.

Moreover, “If investors are finding good opportunities in developed markets, in a zero-sum world” that was likely to dim the attractions of emerging markets.

Click here to visit the ETF Hub

Rosenbluth said $2.2bn was withdrawn from the iShares MSCI Emerging Markets ETF (EEM) and $1.2bn from the iShares JPMorgan USD Emerging Markets Bond ETF (EMB), something he attributed to October being a “risk-off mentality month”.

However he noted that one bright spot was the iShares MSCI Emerging Markets ex-China ETF (EMXC) which took in $1.6bn, a sizeable sum for a fund that even now has just $7.2bn of assets.

“For some investors [it’s a case of] let’s go where the fundamentals are stronger and remove China which has been a poor performer,” Rosenbluth said.

Another bright spot was Japanese equity ETFs, which took in an unusually punchy $3.7bn, mostly from domestic investors.

“There is a key structural driver for this,” Chedid said. “Inflation has reached Japan. That is driving a shift in investment culture: it’s not as easy to sit in cash when you have high inflation. You invest in stocks.”

Comments