Big investors steer clear of gilts as high UK inflation lingers

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Big investors say they are steering clear of UK government bonds despite some of the highest yields in the developed world, fearing that the country’s outsize inflation problem will push borrowing costs higher still.

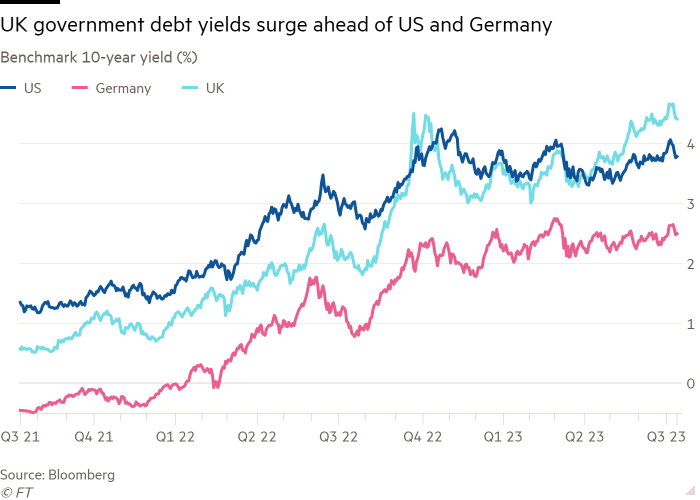

Their reluctance to dive into the market has pushed gilt yields well above those in other major bond markets, piling further pressure on the government’s finances as it attempts to find buyers for record quantities of gilts.

“You need a bigger risk premium on UK government bonds as a result of the more challenging inflation backdrop, the more challenging labour market and the greater challenges for the Bank of England,” said Hugh Gimber, markets strategist at JPMorgan Asset Management.

Sinking prices mean UK borrowing costs have shot above those of rival economies this year — with a 10-year gilt yielding 4.4 per cent compared with 3.8 per cent in the US and 2.5 per cent in Germany.

Even the higher rates now on offer in the UK had failed to make gilts “standout attractive” compared with other sovereign bond markets, Gimber said.

Treasury yields have dropped since US headline inflation was last week shown to have dropped to 3 per cent. In the eurozone, it has also fallen to 5.5 per cent. But, on Wednesday, data is expected to show the UK rate running at 8.2 per cent, and investors are more sceptical of a pullback in gilt yields.

In addition, the country faces what many fund managers have called a “time bomb”. Unlike other countries, UK homeowners tend to have short-term mortgages that renew every two years. Last week the BoE calculated that 1mn households faced mortgage payment increases of £500 a month or more by the end of 2026.

That puts the BoE in a difficult spot. “You have a very problematic inflation trajectory in the UK and it’s not clear how the fiscal authorities will respond to the mortgage crisis,” said Christian Kopf, head of fixed income at Union Investment, Germany’s largest asset manager, who has “very little” exposure to gilts.

“A number of things could go wrong — the Bank of England could raise rates by less than is required and lift its inflation target because it’s too painful for mortgage holders, and there’s the risk the government will fail to undertake the necessary adjustments to prevent a further rise in the debt-to-GDP ratio.”

Investors are also wary of the UK relative to other big debt markets owing to a less predictable monetary policy path in the country, heightened last month when the Bank of England surprised markets by raising rates by 0.5 percentage points to 5 per cent.

In early March, the BoE signalled that interest rates, then at 4 per cent, were close to their peak, and the bank has been criticised over the accuracy of its forecasting and failure to assess the lack of spare capacity in the labour market.

“The Bank of England has had a chequered history in sending comforting signals to investors,” said Anders Persson, fixed income chief investment officer at Nuveen Asset Management, which manages $1.2tn of assets.

“And it is unfortunate that there have been mis-steps from the government approach more broadly.” Persson said he was “neutral” on gilts while he saw more attractive opportunities in US and European sovereign bond markets, where central banks were closer to the end of their rate-rising cycle and where he believed the risk of a prolonged recession was lower.

The reluctance on the part of some large asset managers is awkward as it comes at a time of intense need for investor funding on the part of the government. The UK plans to sell £241bn of gilts in the current financial year, a sharp increase from £139.2bn issued in the last financial year, with issuance net of BoE bond sales and purchases expected to be about three times more than the average over the past decade.

This year, UK government debt rose more than 100 per cent of GDP for the first time since 1961. The Office for Budget Responsibility, the UK’s spending watchdog, said this month that UK public finances were in a “very risky” position and “more vulnerable” when it came to debt than other advanced economies.

Some buyers have been keen to take advantage of higher yields, such as small investors keen to earn better returns than those on offer from bank savings accounts. Winterflood Securities, a government-appointed dealer for UK debt that ensures there is a continuous supply of gilts available for private investors and wealth managers, said its retail trading volumes rose seven-fold last month compared with the previous year.

Others will take more convincing. Greg Peters, co-chief investment officer of PGIM Fixed Income, added that it was “too premature” to increase exposure to gilts given the UK’s “continued inflation problem”.

“Ultimately, the UK is a rock in the middle of the ocean that has separated itself from the world with Brexit,” he said. “Candidly, the more entrenched the inflation issue is the more central banks feel like they have to raise rates in order to shake it out of the system.”

Comments