BlackRock shake-up aims to meet investor demand for new funds

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

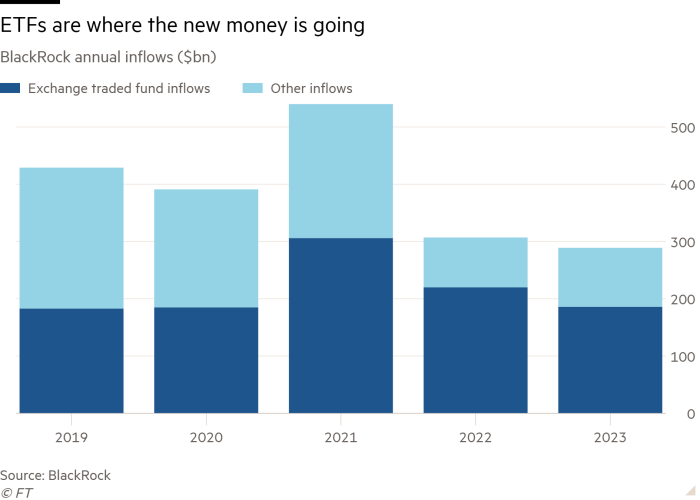

BlackRock’s biggest reorganisation in years reflects a belief that the $10tn money manager must move faster to capture a wave of investment from clients who will be moving out of cash and seeking new products, according to analysts and executives.

The shake-up, announced this month alongside BlackRock’s $12.5bn acquisition of Global Infrastructure Partners, will combine the various businesses that develop and manage the products it sells under a single executive.

The idea is a single product strategy that combines active and passive investing, and all the different wrappers, from exchange traded funds to separately managed accounts. It is also consolidating its international businesses, now that nearly half of new investor money comes from outside the US.

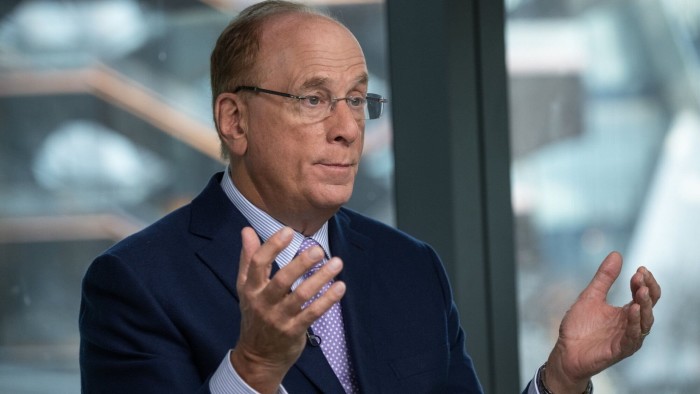

Chief executive Larry Fink told employees in a memo announcing the shake-up and the GIP acquisition that “this bold and ambitious transformation of our firm positions us better than ever before to . . . seize the opportunities ahead of us”.

Analysts said that the changes took aim at a longstanding problem for money managers. “The industry has a really bad product development record,” said Ben Phillips, an Oliver Wyman partner who advises asset managers. “What BlackRock has done is [try to address] what most of the industry is grappling with. I think you are going to see similar announcements from other asset managers.”

Fewer than one in 10 new funds ever crack $1bn, an industry thumbnail for success, according to data from Broadridge, a fintech consultancy.

Historically, BlackRock has managed its ETF products separately from other funds, a legacy of the 2009 purchase of the iShares index fund business from Barclays. That has complicated the firm’s efforts to capitalise on growing investor enthusiasm for actively managed ETFs and alternative investments. BlackRock is also responding to strong demand for products that mix asset classes and those tailored to different regulatory regimes as it expands overseas.

“We see more and more of our clients blending more types of investment products,” said Stephen Cohen, newly appointed chief product officer. “This is about ensuring we have the right ones . . . We talk a lot about ‘One BlackRock’. This is doubling down on that so we can deliver even more great ideas to our clients more quickly.”

Getting fund launches right is more important than ever, Broadridge data shows. Funds less than a year old are capturing one-third of positive inflows, up from 20 per cent 15 years ago. In addition, a fund that hits $100mn in its first year is three times more likely to eventually reach $1bn than one that grows more slowly.

That is partly because the industry is in the middle of a burst of innovation, with money managers bringing out new combinations of equities and debt, ETF versions of well-known mutual funds as well as entirely new asset classes. This month the first ever spot bitcoin ETFs were launched, which collectively pulled in nearly $900mn in the first three days of trading.

Several other asset managers have centralised their product function, and they report it has helped them respond more quickly to shifting client preferences.

“We saw an acceleration of what we were able to do. It was like a multiplier of five of what we could consider, design and then launch,” said Cheri Belski, global head of product development at T Rowe Price.

Having one team in charge also makes it easier for asset managers to address another nagging problem: small funds that struggle on for decades without turning a meaningful profit. As firms face fee compression and cost pressures, pulling the plug more quickly on unsuccessful products has become critical. In the past five years, T Rowe has merged, restructured or liquidated 65 per cent more funds than it did in the five prior years.

Asset managers see the next year or two as critical because so many investors are sitting on the sidelines in high-yielding cash accounts. US money market funds have a record $5.9tn in assets, according to the Investment Company Institute. As rates come down, much of that is expected to move into riskier investments. That creates a rare growth opportunity for firms that can offer what they want.

“Client buying patterns are changing. It’s not just about the strategy, it’s the way it is delivered,” said Tom Darnowski, global head of product strategy at Schroders. “Different vehicles are costly. How can you optimise for the client and for the firm?”

Comments