Activist shareholders target Samsung to unlock value

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

A group of investors has called on Samsung’s de facto holding company to increase dividends and institute share buybacks, as pressure mounts on South Korean companies to address their low valuations.

US hedge fund Whitebox Advisors, UK fund City of London Investment Management and Seoul-based fund Anda Asset Management submitted their proposals on Friday ahead of Samsung C&T’s annual meeting in March. The funds hold a stake of just over 1 per cent in the company.

The company, whose operations span construction and retail and through which the conglomerate’s ruling Lee family controls tech giant Samsung Electronics, trades at more than 65 per cent below its net asset value, making it a target for investors campaigning to narrow the long-standing “Korea discount”.

“Rather than address local and foreign shareholder concerns about this long-term underperformance, Samsung C&T’s board has repeatedly dismissed or ignored our suggestions for enhancing shareholder value,” the funds wrote to shareholders on Friday. “Our group has high conviction that this view is shared by a significant portion of the shareholder base.”

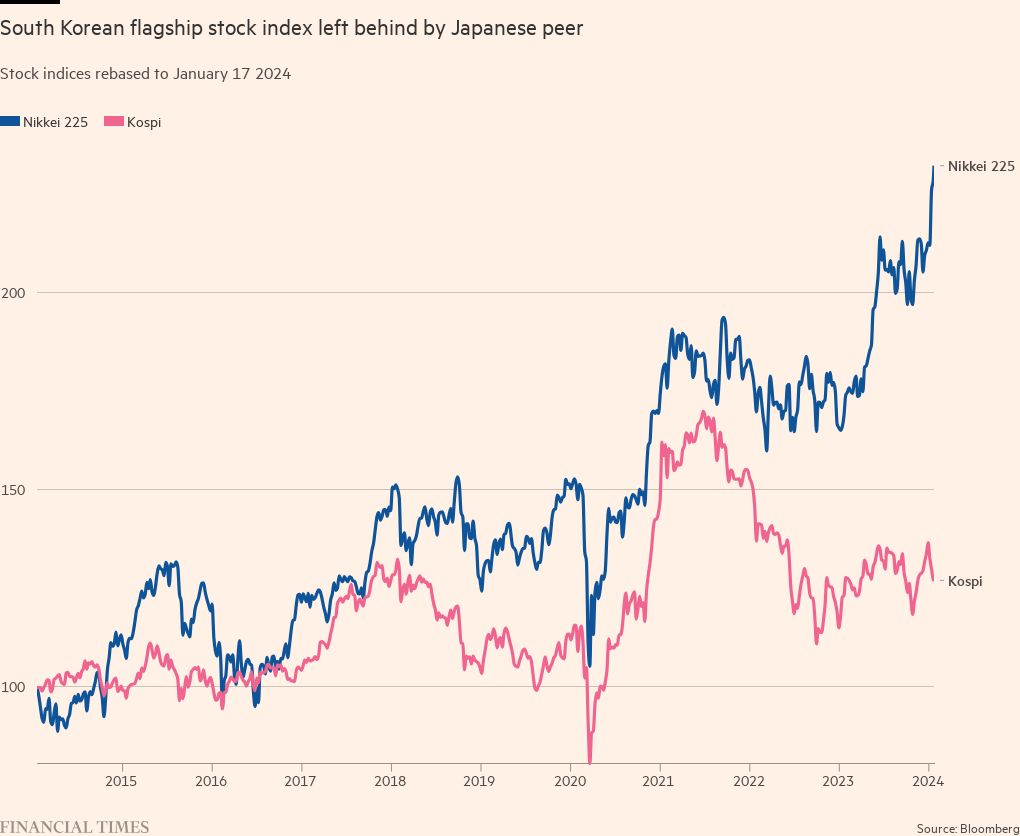

The attempt to shake up South Korea’s most powerful and storied conglomerate comes as the country’s leaders seek to replicate Tokyo’s drive to raise valuations. Japan’s Nikkei touched 34-year highs in January, driven by outflows of capital from China and a concerted effort from Japanese authorities to improve corporate governance.

President Yoon Suk Yeol has said boosting local stock valuations is one of his administration’s top priorities. Yoon said last month that he supported the introduction of a legal fiduciary duty to shareholders, while South Korea’s top financial regulator has floated the possibility of replicating Tokyo’s “name and shame” regime for companies failing to present proposals to improve valuations.

The price-to-book ratio of companies listed on South Korea’s flagship Kospi index is 0.91, significantly lower than the Nikkei 225’s 2.01. Investors accuse the founding families of South Korea’s largest conglomerates of prioritising control of their sprawling business empires over paying dividends and boosting profitability.

“The Korean stock market is still really cheap because of bad corporate governance and ineffective capital allocation,” said Darren Kang, chief investment officer at Seoul-based fund Life Asset Management.

But Changhwan Lee, an activist investor and founder of Seoul-based hedge fund Align Partners, said the “landscape has changed dramatically” since the number of South Korean retail investors more than tripled during the coronavirus pandemic.

That led to the introduction of reforms to protect the interests of minority shareholders, which in turn helped spur the growth of a new breed of local activist funds.

“Every time share prices rise in Japan while remaining flat in Korea, it strengthens the arguments of local advocates for reform,” said Lee.

South Korea had the third-highest number of activist campaigns in the world last year, behind only the US and Japan, according to Insightia. There were 60 activist campaigns in South Korea in the first half of 2023, compared with 18 in the first half of 2021.

Robin Baik, a Seoul-based partner at international litigation firm Kobre & Kim, noted that with parliamentary elections due in April, the authorities were under pressure to introduce new policies.

A senior investment banker in Seoul said larger foreign investors still needed to see more concrete signs of progress before redirecting capital away from larger markets such as Japan and India.

But James Smith, who oversaw a series of bruising campaigns at Samsung and Hyundai when he was head of Elliott Management’s Hong Kong office, said the case for investing in undervalued South Korean companies such as Samsung C&T remained “stunningly compelling”.

“We feel strongly that the Japanese precedent is driving incremental change in Korea,” said Smith, whose London-based fund Palliser Capital has called on Samsung C&T’s management to reform its capital allocation practices.

Kang said even modest progress by activists at Samsung C&T’s annual meeting would have a “cascading effect”.

“If they are successful, that will send a strong signal both to Korean companies and to foreign investors that it is possible for them to co-operate.”

Additional reporting by Andy Lin in Hong Kong

Comments