Fed up with low rates on deposits, US savers snap up government debt

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

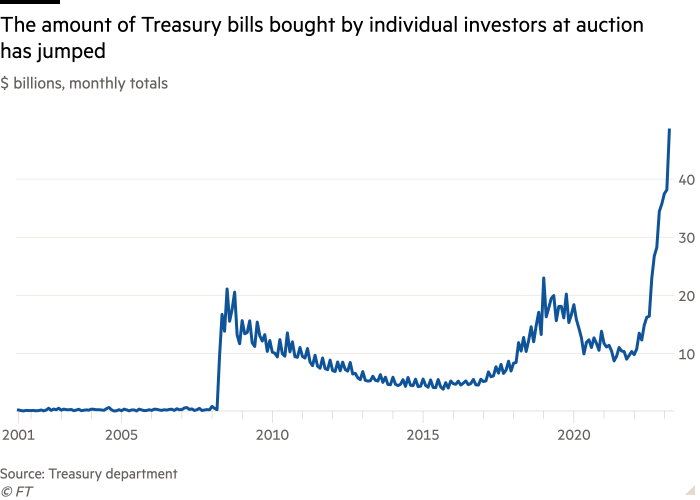

Retail investors are snapping up new US Treasury bills at a record pace, as they broaden their search for higher-yielding alternatives to bank accounts with rock-bottom interest rates.

Individuals buying Treasury bills through accounts on the Treasury department’s TreasuryDirect site purchased $48.4bn of the debt auctioned by the US government in March, official data shows, with demand continuing apace in early April.

Meanwhile, executives at brokerages say retail investors have also stepped up buying of Treasury bills in the secondary market, particularly since a number of regional bank failures in March prompted savers to look again at where they were stashing their money.

Treasury bills are short-term bonds that mature anywhere from a few days to a year after they are issued, and they can offer yields as high as 5 per cent now that the Federal Reserve has raised US interest rates to fight inflation.

“Retail demand for T-bills has been strong since the beginning of the year due to the attractive yields versus bank deposits,” said Kathy Jones, chief fixed-income strategist at the Schwab Center for Financial Research, part of the brokerage Charles Schwab.

“The bank failures seem to have accelerated the trend as more investors began to focus on short-term rates,” she added.

Big US banks such as JPMorgan Chase, Bank of America and Wells Fargo are still by and large paying customers near-zero returns on their deposits, even though the Fed has pushed official interest rates to a range of 4.75 per cent to 5 per cent.

That disconnect has drawn out competition for bank deposits from all corners. Some smaller banks have started paying more interest, but customers are also being lured elsewhere, to new players in the financial industry such as Apple — which last week announced it would offer 4.15 per cent on a savings account — as well as to money market funds and the US government directly.

Deposits at US banks dropped to their lowest level in nearly two years in mid-April, at $17.2tn, down by roughly $1tn from a year ago, according to the Fed.

Purchases of Treasury bills by individuals through TreasuryDirect accounts have set new monthly records each month since September, rising to $48.4bn in March from $13.4bn in the same month last year.

Such purchases typically make up a small proportion of overall demand in auctions of new Treasury bills, but the share has grown dramatically in recent months.

Individual investors last month bought 3.7 per cent of the $1.3tn in new bills sold, up from 1.1 per cent a year ago when the Fed had just started raising interest rates. March’s figure marked the highest level since July 2008. In the first week of April, the most recent for which data is available, individual investors bought 3.8 per cent of the $266bn on offer.

Retail investors have also been active in the secondary market through brokerage platforms such as Interactive Brokers and Charles Schwab.

Interactive Brokers does not make public its retail Treasury trading data but said that overall bond trading on its platform is now roughly 800 per cent higher than nine months ago as investors hunt for yield.

“There is a lot more interest in Treasuries as well as in municipal and corporate bonds,” said Steven Sanders, executive vice-president of marketing and product development.

Bank accounts “lost their competitive edge, and now the trend is to move to TreasuryDirect . . . and to Interactive Brokers for the secondary market”, he said.

Retail investors have also been accessing Treasury bills indirectly through money market funds that invest in government debt. Government money fund assets reached an all-time high of $4.4tn in April, according to ICI research.

“Initial inflows to money market funds can be attributed to a flight to quality driven by uncertainty around regional banks,” said John Madziyire, head of Treasuries at Vanguard. “Then, investors started to focus more on liquidity and yield, which again can be achieved in money market funds.”

There is one potential worry for retail investors in Treasury bills: the US debt ceiling. Congress must vote to raise the $31.4tn limit by the summer if the federal government is not to default on its debts, but political posturing means negotiations could go down to the wire and investors have become warier of certain debt.

Bills maturing in late July and early August have dropped in price in recent weeks and are likely to be harder to trade, analysts said, potentially making it trickier for an investor to cash out early if needed.

Still, as long as deposit rates remain low, the trend is likely to be towards more retail buying of Treasury bills.

“We’ve been in a golden age for borrowers for years, at the expense of savers,” said Bill O’Donnell, an interest rates strategist at Citi. “It now feels like the tables have turned. It’s now the golden age for savers, at long last.”

This story has been amended to correct the sum of assets in government money funds in April to $4.4tn.

Comments