Stocks make gains as investors bet on smaller Fed rate rise

Simply sign up to the US equities myFT Digest -- delivered directly to your inbox.

US equities rallied on Monday, with investors increasingly confident the Federal Reserve will slow the pace of interest rate rises when it meets next week.

Wall Street’s blue-chip S&P 500 gained 1.2 per cent, with all sectors except energy closing in positive territory. Advanced Micro Devices, Qualcomm and Nvidia advanced 9.2 per cent, 6.6 per cent and 7.6 per cent, respectively, after Barclays upped its price targets for semiconductor groups.

The tech-heavy Nasdaq Composite advanced 2 per cent. Spotify’s shares jumped as much as 6.4 per cent after the music streamer said it would axe 6 per cent of its workers — the latest in a series of large cuts announced by high-flying technology groups. It later pared gains to close 2.1 per cent higher.

“The market’s taking a risk-on approach at the moment, viewing that we’re going to have a soft landing and a more positive outlook for rates and inflation,” said Neil Birrell, chief investment officer at Premier Miton. On Monday’s strong gains for chipmakers, “Barclays’ note has been quite influential,” Birrell added. “They’ve been big bears, so to turn positive is a big shift.”

The moves come after Fed governor Christopher Waller last week threw his weight behind a 0.25 percentage point interest rate rise at the US central bank’s next policy meeting in early February, even as he warned there was a “considerable way to go” before inflation fell back to 2 per cent. The Fed lifted borrowing costs by half a point at its previous meeting in December.

Waller’s comments helped the S&P 500 rise 1.9 per cent on Friday, though the index fell over the course of last week on the back of data showing a slowdown in US retail sales in December and weekly jobless claims hitting a four-week low.

The former suggests slowing economic growth, with the latter indicating resilience in the labour market. Lorie Logan of the Dallas Fed last week said the outlook for inflation “hinges in large part on how much and how rapidly” the persistently tight labour market eases.

Equity markets have nevertheless enjoyed a strong start to 2023 despite a mixed bag of fourth-quarter results. Consensus earnings forecasts for the S&P 500 for the final three months of last year have been steadily falling and are currently at minus 2.8 per cent year on year, down from an expected increase of 10.6 per cent in July, according to Vladimir Oleinikov, senior analyst at Generali Investments.

“A weaker [dollar] is supportive for firms’ profitability but is not likely to offset the effects of the weakening economy,” he said. Johnson & Johnson, Microsoft and Tesla are among the US companies reporting results later this week.

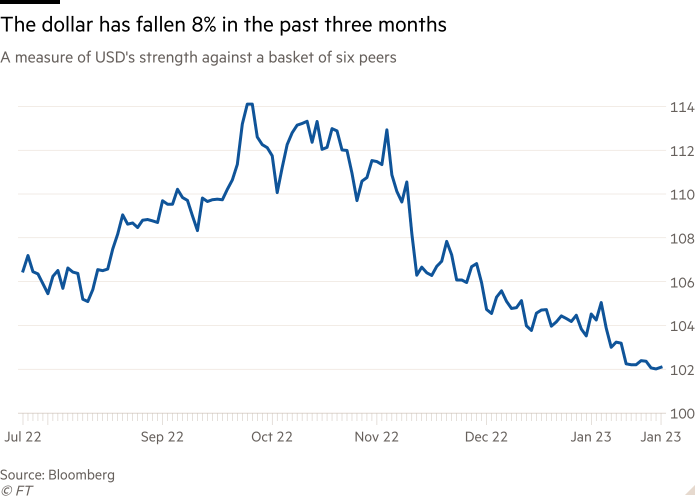

A measure of the dollar’s strength against a basket of six other currencies was up 0.1 per cent, having earlier declined 0.3 per cent. The world’s de facto reserve currency has weakened 8.2 per cent over the past three months, thanks in part to China’s recent reversal of strict zero-Covid policies, which has boosted global growth forecasts and dented the dollar’s appeal.

US government bonds came under pressure on Monday, with the yield on the benchmark 10-year Treasury rising 0.04 percentage points to 3.52 per cent. The yield on the equivalent German Bund was slightly higher at 2.21 per cent. Bond yields move inversely to prices.

Europe’s Stoxx 600 rose 0.5 per cent, while Germany’s Dax added 0.4 per cent and London’s FTSE 100 gained 0.2 per cent. The indices have risen 5.9 per cent, 7.2 per cent and 3.1 per cent, respectively, so far this year, helped by cooler energy prices and the receding risk of a recession across the eurozone in 2023.

In Asia, Hong Kong’s Hang Seng index added 1.8 per cent and China’s CSI 300 gained 0.6 per cent. Japan’s Nikkei 225 index rose 1.3 per cent.

Prices for Brent crude, the international oil benchmark, settled 0.6 per cent higher to $88.19 a barrel, up from about $82 at the start of January.

Comments