Fidelity clawback of free ETF trading costs to hit investors

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Fidelity plans to start charging investors $100 per trade to buy exchange traded funds if sponsors do not agree to make “support payments”, pushing back against retail brokers’ long-standing policy to offer customers low-cost trading.

Fidelity’s brokerage arm is asking ETF sponsors to pay 15 per cent of total fund revenue to avoid the $100 charge, said multiple people with knowledge of the support payment agreements.

The charge would be $100 for ETF purchases with values of $2,000 and above, and 5 per cent of the trade value for smaller buys, said a person with knowledge of the fee structure.

Fidelity declined to comment on the size of the support payments.

The proposed higher charges for buying ETFs comes after more than a decade in which brokers have squeezed fees on trading to attract customers. To offset that, many have established revenue-sharing deals with fund sponsors, charging issuers fees to include products on their platforms — a type of arrangement that in the past has drawn scrutiny from the Securities and Exchange Commission.

But handful of brokerages are now bucking the trend and beginning to charge for some types of deals. Fidelity, which alongside Charles Schwab is one of the major platforms for US investors to access the $8.9tn US ETF market, started asking fund sponsors to make support payments several months ago, multiple issuers told the Financial Times.

FT Survey on UK investment

Have you found a great British bargain? Tell us the UK stocks that you think are worthy of including in your Isa - and why via a short survey

Fidelity maintains the new charges are important for the maintenance and development of its commission-free ETF trading platform.

Some ETF providers affected by Fidelity’s new service charge plan, which takes effect in June and was first reported by Bloomberg, are resigned to paying the support fees — smaller issuers in particular have little choice but to pay for exposure on big platforms such as Fidelity’s.

Some issuers say they are still negotiating with the firm over the size of the support payments, which vary by sponsor and could drive up costs for investors in future ETF launches.

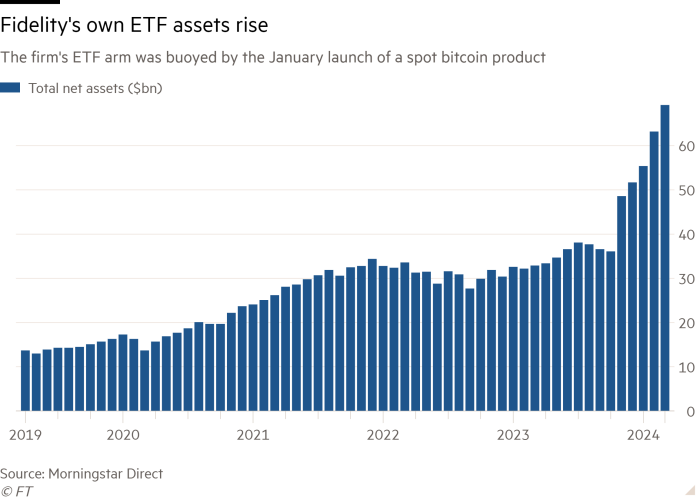

Fidelity’s business includes its large brokerage platform and a separate $69bn ETF arm as part of its $4.9tn in assets under management.

“We’re just getting hammered, and this is just another hammering,” said David Young, founder and chief executive at southern California-based Regents Park Funds, which is one of the nine ETF firms Fidelity has put on notice. “The next ETF we come out with, we’re going to go to the market with the maximum fee we can justify.”

Fidelity’s latest brokerage fee schedule says the support fees are meant to cover “shareholder support services, the provision of calculation and analytical tools, as well as general investment research and education materials regarding ETF” and that it “does not receive payment from these ETF sponsors to promote any particular ETF to its customers”.

“We remain committed to providing clients choice with an open architecture investment platform,” a Fidelity spokesperson said. “Support fees help maintain the technology and service operations needed to ensure a secure and positive experience for investors.”

Charles Schwab, which also provides commission-free ETF trading on its platform and already charges a small group of ETF sponsors fees of 10 per cent, would not comment on whether it was also considering a similar fee programme, saying only that “the commission for all ETFs available on Schwab’s platform is $0 for US-listed ETFs traded online”.

The notion of a $100 charge to buy an ETF is “well out of line” with investor expectations for how much trading an ETF should cost, said Elisabeth Kashner, director of global fund analytics at FactSet, a data provider. She noted that should asset managers increase their expense ratios to offset the new charges, “every additional basis point is a competitive disadvantage”.

“If those Fidelity trading fees are socialised across the fund base as increased fund expenses, that makes the fund more expensive for everybody,” Kashner said.

The nine issuers whose investors are in line to pay the new $100 fees specialise in active management, and none are in the top 50 by market share in the US, according to Morningstar. Smaller active ETF managers are among the fastest growing in the field, and they are generally seen as innovators in the ETF industry.

Todd Rosenbluth, head of research at VettaFi, a New York-based consultancy, said: “If this becomes prevalent, we could see a slowdown in product development, because this would an additional cost to launching and maintaining and growing an ETF.”

Wes Gray, chief executive of ETF shop Alpha Architect, said his company had been able to negotiate with Fidelity over the past few months to avoid paying any support fees. Still, he lamented the rollout of the fee programme and said he thought it could hurt Fidelity’s reputation.

“I really do think they’re going to walk all this back,” Gray said.

Comments