Global art market shrinks as big-ticket sales stall

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

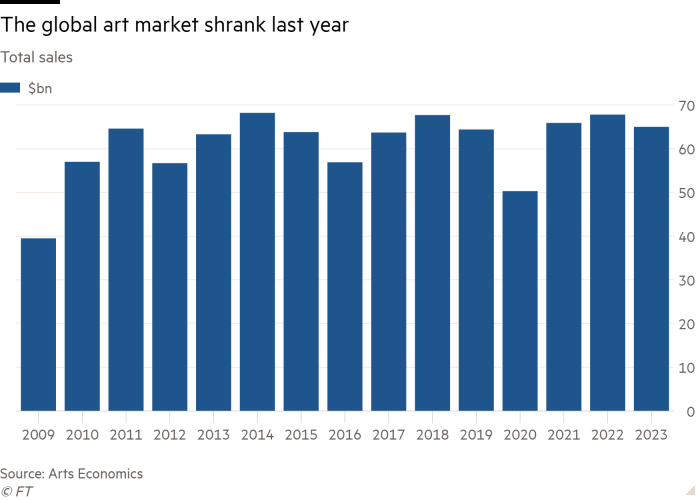

The world’s art market hit the buffers in 2023, falling 4 per cent to a three-year low of $65bn as the macroeconomic and geopolitical backdrop slowed activity at the top end, according to a new report. The annual Art Basel and UBS Art Market Report found that the wealthy “are not immune to disruptive financial, social or political changes”, according to author Clare McAndrew of Arts Economics. Continuing uncertainty points to “stable” expectations for 2024, she said.

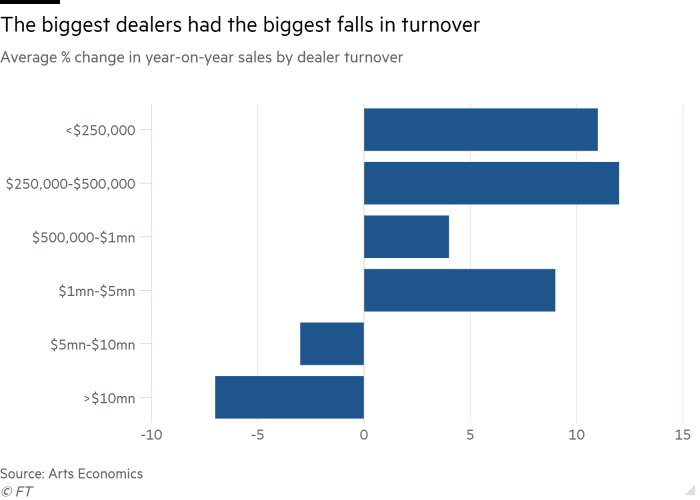

In a stark reversal of recent trends, the greatest falls were for the highest-priced works. Values fell sharply for art priced at more than $10mn at auction — the only segment to grow in 2022 but down by 40 per cent last year. The largest private dealers, with annual turnover of more than $10mn, reported an average decline in sales of 7 per cent, based on McAndrew’s survey of more than 1,600 galleries.

There was some better news at the lower end of the scale as volumes improved and dealers with turnover below $500,000 had the largest increase in sales (11 per cent). This dynamic helped boost online sales, mostly made below $50,000, which accounted for 18 per cent of the market’s total turnover, double the share from 2019.

The pressure of rising costs came through clearly in the dealer survey, which showed that issues including increased rent and payroll meant profits fell for 40 per cent of the sample (up 8 percentage points on 2022). Many found it an “intensely difficult year to balance their budgets”, the report said, with buyers looking for larger discounts in 2023, averaging at 18 per cent — and higher for more expensive work.

The market’s overall fall, which took it back to just ahead of its pre-pandemic total in nominal terms, was not as dramatic as some had expected, partly rescued by stronger results from China in the first half of the year. Here sales were up 9 per cent year-on-year to $12.2bn, meaning China took the second spot from the UK (down 8 per cent to $10.9bn). The US remained the art market’s leading geographic area with sales of $27.2bn, accounting for 42 per cent of the global market. The US total still represented a year-on-year fall of 10 per cent, as the highest-valued items tend to come for sale in New York and London.

China’s relative strength, however, was mostly a result of sales that were postponed because of Covid restrictions still in place in 2022. This “unique reopening context” reversed in the second half of the year, McAndrew said, compounded by the country’s real estate slump. Meanwhile, persistent non- and late-payment problems still characterised China’s market. Data from the Chinese Auctioneers Association used in the report showed that only 54 per cent of the value of goods sold in 2022 was fully settled by May 2023, though this was up by 8 percentage points on the previous year.

The challenging environment and its accompanying depressed pricing looked set to continue through 2024 as economies representing 40 per cent of global output held elections, the report noted. “Election years are known to be complicated for the art market, especially when divisive,” Noah Horowitz, Art Basel’s chief executive, told the Financial Times.

Hopes for the uncertain future rest on what UBS describes as a Taylor Swift effect, namely that people will now pay premium prices for entertainment and leisure activities. UBS said that the social aspect of art collecting, “which has always mixed physical acquisitions and fun”, is a potential silver lining for a fragile year ahead.

Comments