Will hot US inflation data unsettle markets?

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Will hot US inflation data unsettle markets?

US government bonds rallied on Friday following a weaker-than-expected reading on American job growth for the month of May. But a key report on consumer price inflation will provide a fresh test for investors.

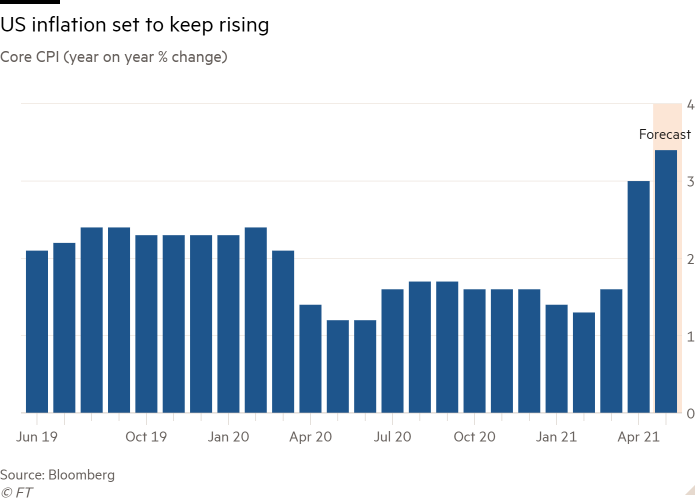

Consumer prices rose at its fastest pace in more a decade in the 12 months to April, but analysts project that it has picked up even more since then, raising fears that the economy is overheating.

Economists surveyed by Bloomberg expect the year on year inflation rate to have jumped to 4.7 per cent in May in figures to be released by the Department of Labor on Thursday, compared with 4.2 per cent in April.

The “core” inflation rate, which excludes the more volatile prices for food and energy, is expected to have risen from 3 per cent in April to 3.4 per cent in May, economists polled by Bloomberg project. That would be the highest level since the mid-1990s.

Jay Powell, the Federal Reserve chair, has been adamant that higher consumer prices are transitory, and that the central bank should maintain its $120bn a month bond-buying programme. Wall Street, on the other hand, is debating whether rising inflation might prove more persistent than expected, while investors say May’s result, even if higher than April’s, is likely to be too early to provide a definitive signal.

Rising inflation expectations have been a key factor in a sharp sell-off this year in US Treasuries, which has sent borrowing costs rising and caused several bouts of volatility in other markets.

“It’s probably going to be another 4 per cent number [for non-core inflation], which temporarily will reinforce the fear side of the equation,” said Jason Pride, chief investment officer in Glenmede’s private wealth practice. In July and August, he added, “we’ll probably start seeing more consistent moderation in the CPI figures. And that will finally start reinforcing the thesis that it’s transitory.” Aziza Kasumov

How will a brightening eurozone outlook affect the ECB’s policy plans?

The prospects for the eurozone economy have brightened considerably since the European Central Bank’s last monetary policy meeting in April.

Coronavirus lockdowns are being lifted across Europe. Vaccinations are accelerating after a slow start. Business activity, consumer confidence and inflation have all bounced back strongly.

But a string of ECB council members have said they still see little reason to change policy at this Thursday’s meeting, and its president Christine Lagarde even said late last month that it was “far too early” to discuss plans for reining in its €80bn monthly bond purchase programme.

Inflation in the 19-country eurozone bloc shot up to 2 per cent in May from 1.6 per cent the previous month, exceeding the central bank’s target for the first time in more than two years. However, ECB officials have said this is a temporary rise that will fade next year, meaning the central bank needs to maintain its supportive policy stance for longer.

Most economists agree. Holger Schmieding, chief economist at Berenberg, said: “As the current spike in headline inflation so far reflects only temporary factors, the ECB can afford to keep the pedal on the metal for another three months.”

The problem is that some countries, such as Germany, are set to recover faster than others like Italy and Spain, which credit rating agency Moody’s said in a report last week “will pose challenges for the ECB in terms of calibrating a common monetary policy”.

But Moody’s added: “We believe the ECB will maintain its highly accommodative monetary policy for the next several years, well after relatively stronger economies such as Germany have exhausted their spare capacity.” Martin Arnold

Will the renminbi resume its sharp ascent?

The renminbi will be closely watched by traders after the Chinese government took steps last week to slow a sharp rally.

The measures, announced by the People’s Bank of China, will force lenders to hold more foreign currency — a method of tempering the currency not deployed since the financial crisis.

The renminbi has gained 11 per cent against the dollar over the past year, notwithstanding a wobble last week. The rally has come against a backdrop of China’s rapid recovery from the pandemic. Investors last year rushed to invest in Chinese stocks and bonds, helping to further support the currency.

Its strength now poses yet another challenge for policymakers already grappling with high commodity prices and concerns over leverage across an unbalanced economy.

The country’s recovery has been fuelled by industrial growth and, despite the strength of the renminbi, booming exports. But central bank members have expressed mounting concerns over the impact of a global commodity rally on factory gate prices in China.

Last month, an editorial from a PBoC official suggested the renminbi should be allowed to appreciate to offset higher commodity prices, but the article was subsequently deleted. A stronger renminbi against the dollar makes Chinese imports cheaper.

This week, data on both trade and inflation, out on Monday and Wednesday respectively, will shed further light on the economy’s progress, and stand to inform future central bank policy interventions on the renminbi. Thomas Hale

Comments