Global stocks rise on hopes of central bank stimulus

Simply sign up to the Equities myFT Digest -- delivered directly to your inbox.

US equities followed European stocks higher on Wednesday on mounting expectations central banks would unleash yet more monetary stimulus.

The S&P 500 index gained 1.5 per cent to close at a record high for a second consecutive day. The benchmark, up 10.8 per cent for the year to date, was buoyed by reports that US Treasury secretary Steven Mnuchin had restarted talks with Nancy Pelosi, the Democratic speaker of the House of Representatives, over an extension of support for out-of-work Americans.

The technology-focused Nasdaq Composite index rose 1 per cent to close above 12,000 points for the first time.

Europe mirrored Wall Street’s strength with the Stoxx 600 index ending the day up 1.7 per cent, also supported by a rebound for the dollar versus the euro and pound. In London the FTSE 100 was up 1.4 per cent, rallying from a three-month low.

The latest rise in equities, which have rebounded vigorously from their March lows, comes as investors wagered the European Central Bank would increase its efforts to stimulate the continent’s pandemic-stricken economy by purchasing even more financial assets.

Data on Tuesday showed the eurozone had slipped into deflation, meaning prices of basic goods were falling for the first time in four years.

“The market is likely expecting more stimulus from the ECB,” said Erica Blomgren Dalsto, strategist at the Scandinavian bank SEB.

Such speculation was evident in the European government debt market, where by late morning in London investors had submitted €16bn of bids for a 10-year bond issued by the Greek government, which bankers said was expected to price at a relatively low yield of 1.22 per cent. The yield on the German 10-year Bund — which moves inversely to price — declined by 6 basis points to minus 0.471 per cent.

Growing hopes for a fresh round of stimulus measures from Europe come just days after the Federal Reserve said it would tolerate rises in inflation past the 2 per cent rate it had typically targeted. Investors interpreted that message to mean the Fed would be prepared to hold rates lower for longer.

Data released on Wednesday that showed the US private sector added far fewer jobs than forecast last month added to the idea that the Fed would need to keep policy loose in its attempt to shore up the world’s biggest economy.

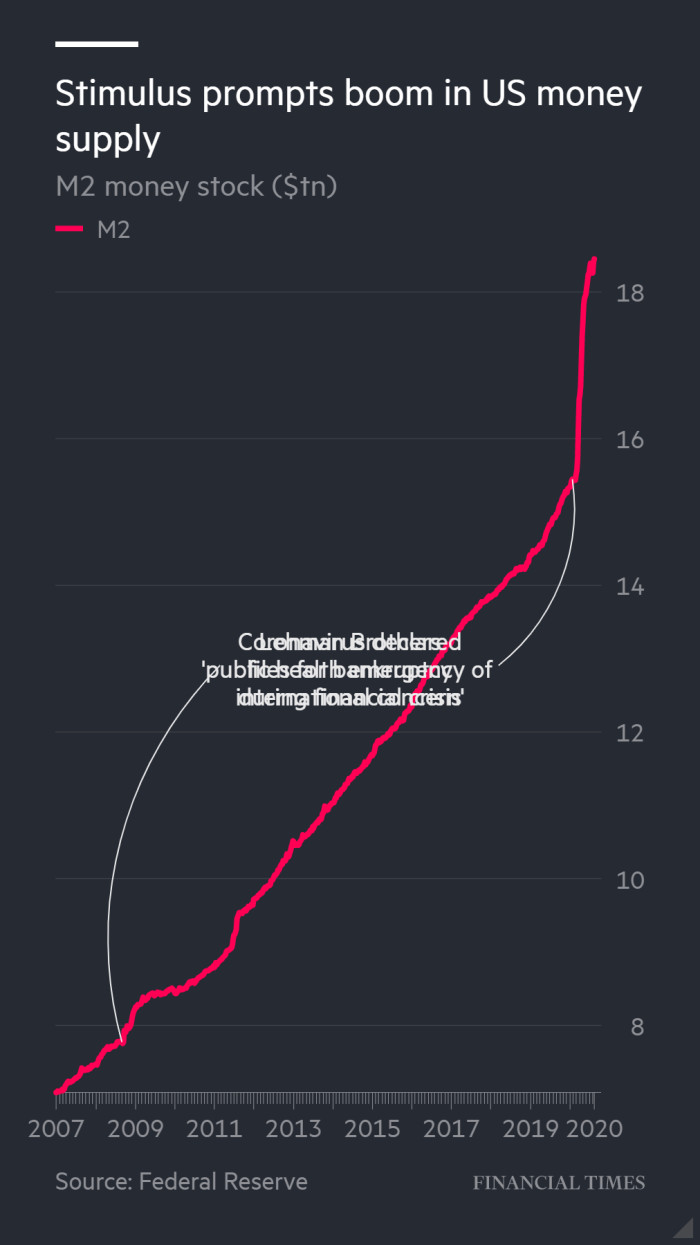

M&G fund manager Maria Municchi said a key driver of the US rally had been expectations for a long stretch of accommodative monetary policy from the Fed. “The amount of liquidity that’s been injected is huge,” she said, pointing out that M2, the broad measure of money circulating in the US financial system, rose from $15.4tn in March to $18.3tn in July.

Economists say this figure has been boosted both by the Fed and a major fiscal stimulus effort by the government.

The strong performance of global equities is not a situation all investors expect to continue smoothly for much longer.

Ms Municchi said she expected markets to increasingly question whether the Fed’s interventions were helping companies to make money. “At some point investors start to ask, is this just liquidity that expands [money supply] or will it be liquidity that contributes to earnings,” she said.

Analysts at Bank of America went further, writing in a note that markets were already positioned for a “continued recovery” in the US economy as well as “a persistent central bank put”. This, they wrote, made equity valuations “increasingly vulnerable in the context of upcoming US elections and ongoing uncertainty around the [coronavirus] vaccine timeline and fiscal support”.

The spectre of ECB action helped to relieve pressure on the dollar, which had come under heavy pressure for much of Tuesday’s session before steadying. The euro fell 0.5 per cent against the greenback to $1.185 after briefly hitting $1.20 on Tuesday. Sterling also came under pressure, dropping 0.3 per cent to $1.34.

Oil futures weakened to their lowest levels in almost a month after weekly data showed a drop in domestic crude supplies and production following Hurricane Laura. November deliveries of Brent crude, the global benchmark, fell 2.5 per cent to $44.44 a barrel.

Comments