Europe’s refineries in demand as Ukraine war boosts oil margins

Simply sign up to the EU energy myFT Digest -- delivered directly to your inbox.

When energy trader Vitol launched a bid to buy one of Europe’s largest oil refineries last month, it demonstrated how Russia’s invasion of Ukraine has boosted competition for increasingly scarce refining capacity.

The agreed deal to purchase a controlling stake in Saras, which has a refinery in Sardinia, from the family of Italian billionaire Massimo Moratti came less than a year after Vitol had lost out to rival Trafigura in a battle for control of another giant refinery in Sicily.

Europe’s refineries have been in long-term decline, as major oil companies shut plants to try to meet net zero emissions targets and face the threat of electric vehicles.

But, with war in Ukraine and tensions in the Red Sea, energy analysts now believe they may have a profitable future after all, thanks to elevated margins for refined oil products such as diesel and gasoline. Those margins could be driven even higher if Europe suffers further supply shocks.

The danger to supplies from sudden geopolitical instability was highlighted on Wednesday as drone strikes by Ukraine on refineries inside Russia contributed to a 2.7 per cent jump in the price of Brent crude.

“For refiners that can be the last standing, and for companies with a higher risk appetite that are acquiring these ageing assets, there is arguably more money to be made than ever refining crude in Europe,” said Elliot Radley, head of European refined product prices at Argus Media, a data group.

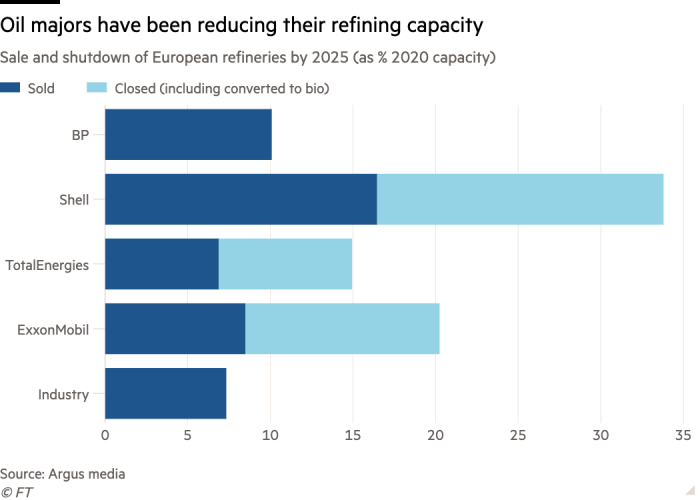

Europe will have reduced its crude distillation capacity by about 7 per cent by 2026 compared with levels in 2020, according to Argus. Taking into account plant closures and sales, Shell will have reduced its capacity by 33 per cent over that period, while BP’s will have fallen by 10 per cent.

Tighter capacity has already helped push up the premium, or the extra amount that refineries can charge, for diesel over benchmark crude to a global average of $29.77 per barrel this year, according Argus. That compares with $15.69 per barrel for the period between 2010 and 2019. Meanwhile, the spread for gasoline this year has been around $18.09, about three times the 2010-to-2019 average.

While that is below the highs of $38.82 for diesel and $24.21 for gasoline set after the full-scale invasion of Ukraine in 2022, they are well above long-term averages despite sluggish economic growth in some advanced economies.

The rise in premiums for refined products has been much greater than the move in benchmark oil prices: gasoil futures, which track distillate trading in Europe, have risen 13.2 per cent this year, while Brent crude futures are up 10.7 per cent.

Europe is now more reliant on imports of refined products, but it is vulnerable to supply shocks such as the attacks on shipping in the Red Sea. Many suppliers from Asia are taking a longer route via southern Africa.

“Life is more complicated for Europe because our products have to come much further [and] if we need diesel there aren’t short-term supplies,” said Russell Hardy, Vitol’s chief executive, at a recent energy conference in London.

The market for petroleum products was likely to be “more interesting” than that for crude, Hardy said. “Product markets are more vulnerable [and] that’s where we are seeing the stress and strain . . . We need to improve our refining capacity.”

Europe relied on Russia for about a third of its refined oil products before the EU banned its imports in retaliation for the invasion of Ukraine. Energy consultancy Wood Mackenzie estimates that those sanctions will not ease until at least 2030, while disruptions in the Red Sea will probably persist through the year.

Even so, the resilience of gasoline, which usually rises during the US summer driving season, has surprised analysts.

Natalia Losada, an oil products analyst at Energy Aspects, said gasoline prices are being supported by the adoption of hybrid vehicles — which require motor fuel — as well as a recovery in tourism after the coronavirus pandemic and a shortage of components to produce gasoline that meet European summer specifications.

European refineries are suited to Russian “medium-sour” oil but the switch to other types of crude has reduced their capacity utilisation, according to Jakub Zasada, natural resources and commodities director for Europe, Middle East and Africa at Fitch Ratings. Saudi Arabia’s production cuts have also limited the availability of similar oil that could be a “typical replacement” for Russian crude, he added.

Wood Mackenzie had previously predicted that European refineries would need to rationalise in 2024-25 but the consultancy has been “forced to change that view”, said Alan Gelder, vice-president for refining, chemicals and oil markets.

Gelder now expects refineries to enjoy “healthy margins” for the rest of the decade. The Covid-19 outbreak, which crushed demand for oil, had brought the sector’s consolidation forward and left Europe with insufficient supply.

“That margin strength has brought other players in”, while enabling the majors to find buyers for their unwanted assets, Gelder said. “In that case, everyone is a winner.”

Among companies taking advantage is London-based oil supply company Prax Group, which in December agreed to buy a 37.5 per cent stake in the PCK refinery in Schwedt, north-east Germany, from Shell. It also struck a deal to buy a stake in a refinery in South Africa from TotalEnergies.

However, margins could start to be pulled back down as new refineries in the Middle East and Africa open.

“The global fuel market remains overall tight, supporting margins in the short term, but a combination of weaker demand and new capacity coming online could quickly change the macro backdrop,” Zasada said.

Additional reporting by Tom Wilson in London and Silvia Sciorilli Borrelli in Milan

Comments