Past performance suggests S&P 500 has further to go after record high

Simply sign up to the US equities myFT Digest -- delivered directly to your inbox.

Wall Street’s S&P 500 index is likely to set new highs and deliver double-digit returns in the coming months after racking up records so far this year if its historical performance is any guide.

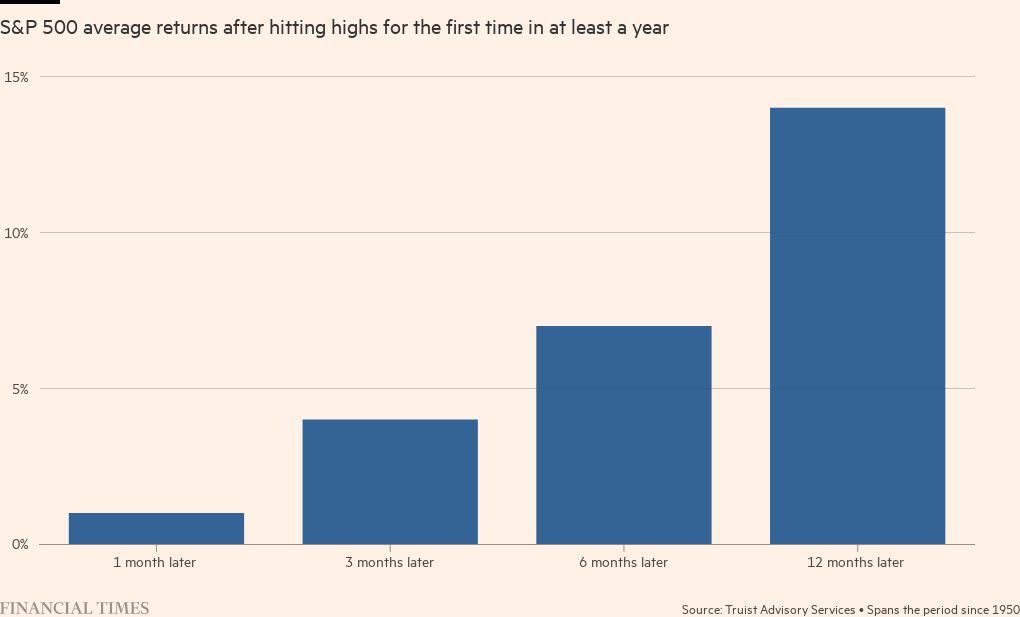

Since 1950 the blue-chip index has typically hit multiple all-time highs in the 12 months after it has once breached a record, providing more than a year has passed since its previous high, according to Keith Lerner, chief market strategist at Truist Advisory Services.

Once it has broken its dry spell, the S&P tends to rise an average of 14 per cent in the subsequent year, he said.

Debate over the S&P’s prospects this year come after the index hit a new high in January, eclipsing the record set in November 2022, and has continued to push higher, led by large technology stocks. On Friday the index closed up 0.6 per cent to finish above 5,000 for the first time. Its strong start to 2024 has caught out many analysts, who expected economic worries to depress prices.

The gains have been spurred by the fervour surrounding artificial intelligence and cloud computing, led by companies like Nvidia, Meta and Amazon.

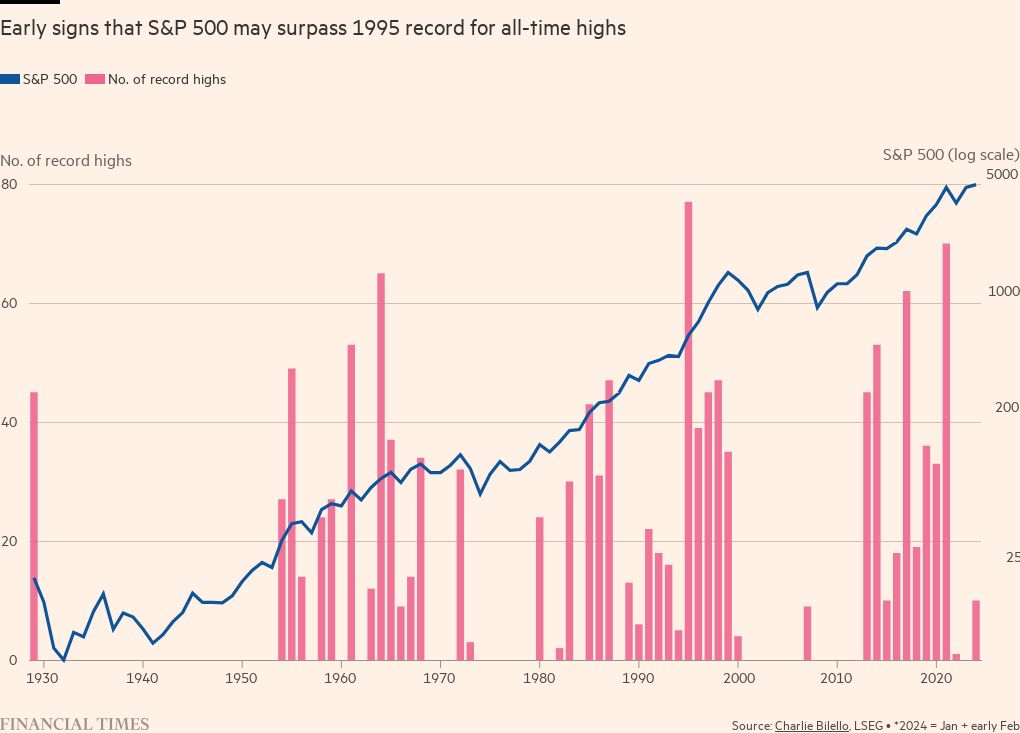

If the index continues to hit new highs at the current pace — 10 so far in 2024 — this year would surpass 1995, which saw 77 all-time highs achieved, said Charlie Bilello, chief market strategist at wealth manager Creative Planning.

He tracks the number of US records and has tallied 1,180 new all-time highs since 1957, with the S&P 500 achieving that peak “on average, every 19 or 20 days”.

Economists’ concerns over the S&P have been largely driven by fears that the Federal Reserve’s policy of aggressive rate rises to tame inflation would lead to a sharp economic recession.

However a stream of robust economic data and the falling levels of inflation has quelled such fears. Bank of America analysts said 75 per cent of investors now expected a so-called soft landing for the economy, leaving 20 per cent forecasting no landing at all and just 5 per cent a hard comedown.

Outside of a recession, the concentration of gains in just a handful of large technology stocks is another potential obstacle that could scupper the S&P 500’s winning streak.

The so-called Magnificent Seven — Microsoft, Apple, Alphabet, Amazon, Nvidia, Meta and Tesla — drove the market higher in 2023 and accounted for 45 per cent of the S&P 500’s return in January, calculated BofA.

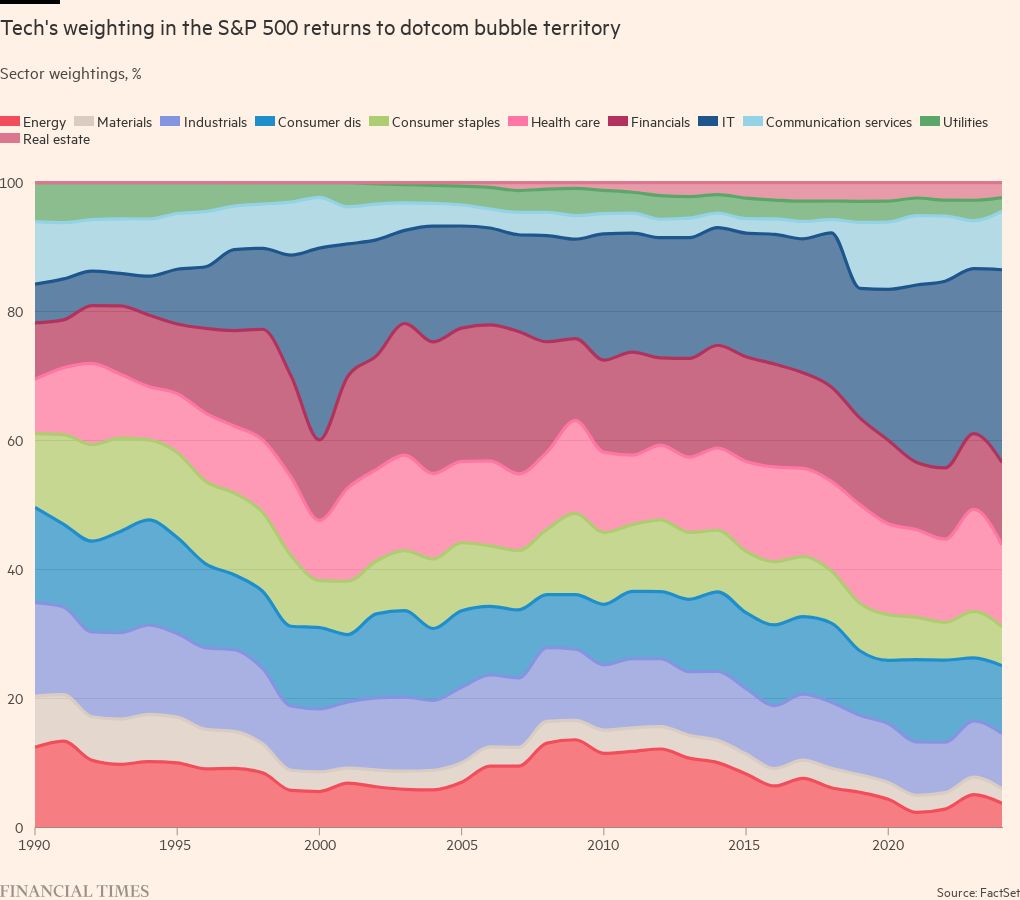

That has led to parallels being drawn with the dotcom bubble of the late 1990s.

In 1995, information technology had a weighting of around 8.5 per cent of the S&P and rose to more than 29 per cent in 2000 just before the dotcom bubble burst. Today IT again has a weighting of around 29 per cent of the index.

The top 10 largest companies include all of the Magnificent Seven. “The key takeaway is that extremely concentrated markets present a clear and present risk to equity markets in 2024,” said analysts at JPMorgan.

“Just as a very limited number of stocks were responsible for the majority of gains in the MSCI USA, drawdowns in the top 10 [stocks] could pull equity markets down with them,” the bank added.

Comments