Bank of Japan ends era of negative interest rates

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

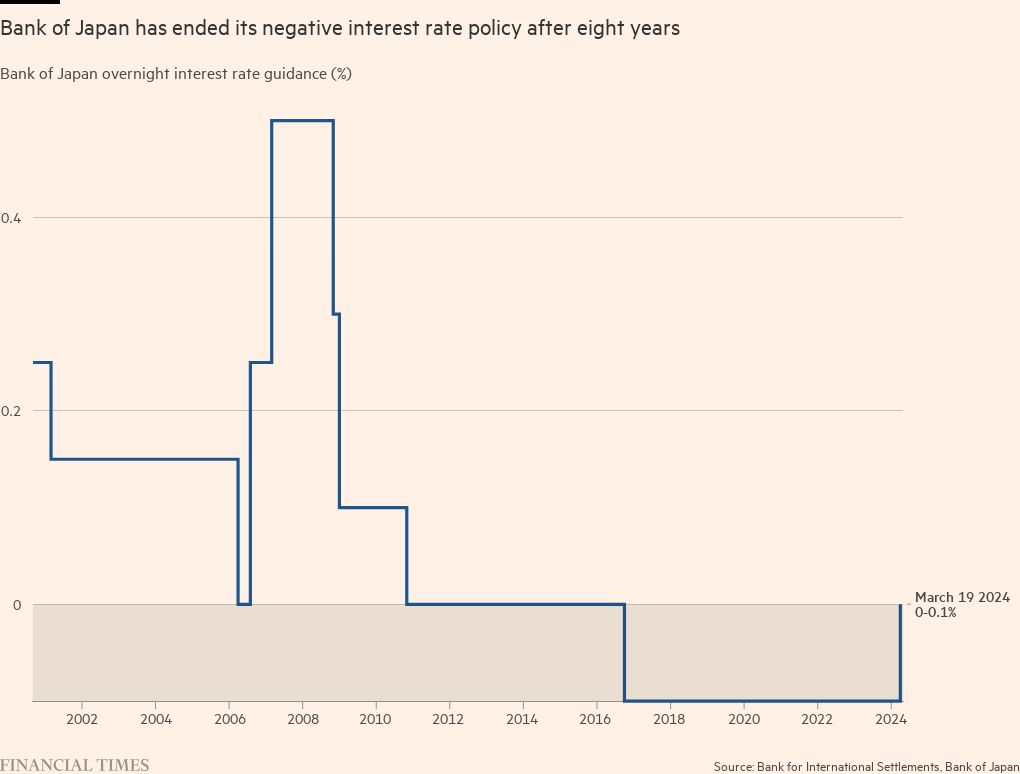

The Bank of Japan has ended an era of negative interest rates, raising borrowing costs for the first time since 2007 in a historic shift as the country puts decades of deflation behind it.

Kazuo Ueda, the BoJ governor, brought an end to more than a decade of ultra-loose monetary policy, abandoning a swath of easing measures that were put in place to stimulate Asia’s most advanced economy.

Following a 7-2 majority vote, the BoJ said it would guide the overnight interest rate to remain in a range of about zero to 0.1 per cent, making it the last central bank to end the use of negative rates as a monetary policy tool. Its benchmark rate was previously minus 0.1 per cent.

The BoJ turned to negative interest rates in 2016 as it tried to encourage banks to lend more in order to generate spending and contain the risks of a global economic slowdown.

Other central banks — in the eurozone, Nordic countries and Switzerland — also cut rates below zero, sometimes angering savers and breaking with hundreds of years of established policy.

Negative rates helped stave off deflationary threats, but increased costs for the banking system and allowed zombie companies to survive but not thrive — making central banks keen to avoid a repeat of the experiment.

Tuesday’s policy’s shift by the BoJ is likely over time to trigger shifts in global investment flows, and comes as signs emerge of broader change in the Japanese economy.

Workers at some of Japan’s largest companies have secured their biggest pay rise since 1991, giving Ueda enough confidence that mild inflation will continue — a goal that has been central to the bank’s policies for years.

More companies are also passing on inflation costs to consumers and labour shortages are contributing to higher wages.

Investors have also grown more confident in the economy’s prospects. In February the Nikkei 225 stock index finally surpassed the level reached 34 years ago.

Despite the return to positive interest rates, Ueda signalled that borrowing costs would not increase sharply since inflation expectations have not yet been anchored at its 2 per cent target.

With few signals of further rate rises, the yen weakened 0.8 per cent against the US dollar to ¥150.33 after the BoJ’s move. The Nikkei 225 stock index closed 0.7 per cent higher on the day while the broader Topix index closed up 1.1 per cent. The yield on 10-year JGBs fell to as low as 0.725 per cent.

Inflation, which was sparked by a rise in imported energy and food prices, is past its peak. Core inflation, which excludes volatile fresh food prices, slowed in January for the third straight month.

“It is important to maintain accommodative financial conditions even as we carry out a normal monetary policy,” Ueda said at a news conference.

On Tuesday the central bank also removed its yield curve controls, another policy put in place in 2016 to reinforce its massive monetary easing measures by capping the yields of 10-year Japanese government bonds.

The BoJ said it would maintain its policy of buying about ¥6tn ($40bn) a month in Japanese government bonds, a pledge that underscores continuing weakness in the economy as household consumption remains sluggish.

But it will discontinue purchases of exchange traded funds and Japanese real estate investment trusts.

As part of the new framework, the BoJ will apply an interest rate of 0.1 per cent to deposits held with the central bank, removing a complicated three-tier system of borrowing costs that was adopted to limit the negative rate policy’s hit to commercial banks’ earnings.

“Now that large-scale monetary easing measures have fulfilled their roles, we will need to think about reducing our balance sheet. At some point in the future we will lower the amount of JGB purchases,” Ueda said.

While the end to negative interest rates was widely expected, economists had been divided on how far the BoJ would go in scrapping other measures such as yield curve control and ETF purchases.

Sayuri Shirai, a former BoJ board member who opposed the introduction of negative interest rates in 2016, said that because economic conditions were not yet in place for additional rate increases, the BoJ appeared to have decided it only had one chance to act.

“We have to give credit to Mr Ueda for his resolve and boldness. Instead of doing it gradually, he just quit everything altogether and that also likely means that this is it,” she said.

But UBS economist Masamichi Adachi said the BoJ’s new forward guidance gave Ueda flexibility to raise rates, since it did not lay out the conditions for maintaining its easy monetary policy stance. “Markets still reacted in a dovish way because they do not believe that inflation will stabilise in Japan and that the BoJ will be able to raise rates,” he added.

Adachi expects the BoJ to raise its benchmark rate to 0.25 per cent in the autumn, and carry out another increase in the spring of 2025 if US economic conditions remain robust.

Ueda’s decision was opposed by two BoJ board members, with one arguing that it should have avoided removing both negative interest rates and yield curve controls until the “virtuous cycle” between wages and prices had become more solid.

Additional reporting by William Sandlund in Hong Kong

Letter in response to this article:

Era of unsustainably low-cost capital is over / From James Sproule, Chief Economist, Handelsbanken UK, London E1, UK

Comments