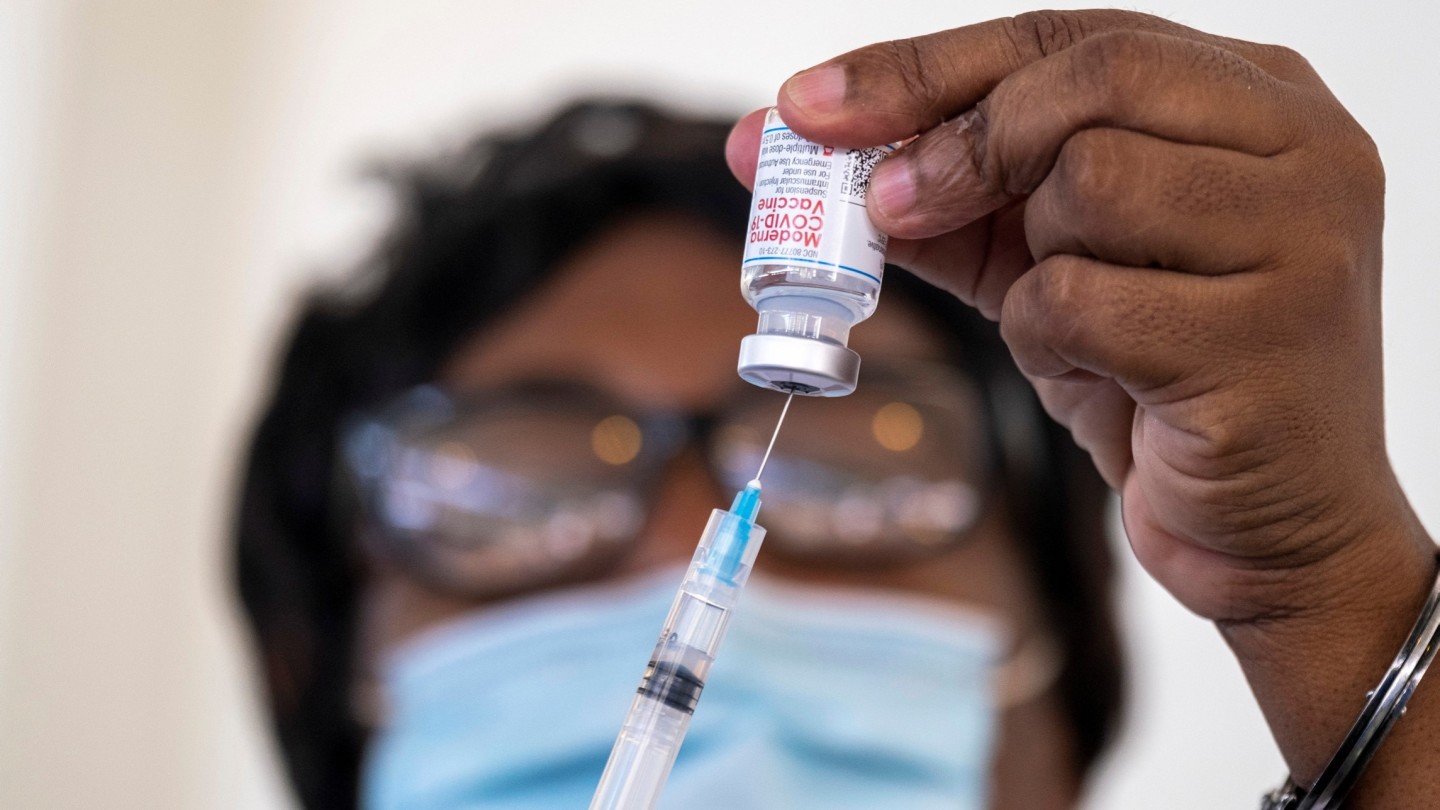

Moderna tries to show it’s not a ‘one trick pony’

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Moderna’s Covid-19 vaccine saved millions of lives and made the biotech group one of America’s fastest-growing companies. But a plunge in sales of the jab due to the easing of the pandemic could push Moderna back into the red this year, as it races to prove it is not a “one-trick pony” with a single product.

The US drugmaker is funding an ambitious expansion with the windfall profits generated by its successful Spikevax Covid jab, which is, at present, its only approved product.

It is recruiting 2,000 employees, building a manufacturing plant in Africa, and preparing six new product launches, among a host of other ambitious projects designed to drive future growth.

“Our base plan is to, hopefully, not lose money but there is a chance we could,” explains Jamey Mock, Moderna’s chief financial officer. “It’s a delicate balance of how much you can lose. But we have the luxury, right now, of sitting on $18bn in capital to make those investments for long-term value creation — for patients and for all stakeholders. And we think that’s the right thing to do.”

Moderna is betting its messenger RNA technology platform will give it an edge over rival pharmaceutical companies in developing medicines that prevent or treat a wide range of diseases, from influenza to cancer. Using mRNA — a genetic material that instructs cells how to make proteins that can fight disease — is a faster and more efficient way to develop and launch medicines, according to the company.

“We don’t believe that Moderna or the mRNA platform we are building is a one-trick pony,” says Mock. “It’s not just a respiratory vaccine business. It’s a latent vaccine business. It’s a personalised cancer vaccine business. It’s a rare disease business.”

Moderna was founded over a decade ago in Cambridge, Massachusetts, and launched its first product — Spikevax — in January 2021, following authorisation by the US Food and Drug Administration. It now has almost 50 drugs in development, of which 36 are in clinical trials. It plans to spend $4.5bn on research and development in 2023 — just below the $5bn in sales from Spikevax so far this year. Last year, Moderna sold $18.4bn in Covid vaccines.

Several of its advanced drug programmes were showcased at an annual vaccines day earlier this month, including jabs targeting respiratory illnesses including RSV (respiratory syncytial virus), influenza and Covid. The company aims to gain regulatory approval and launch these vaccines next year. It forecasts that its respiratory jabs will generate $8bn-$15bn in revenues in 2027.

But some investors remain cautious about this 2027 sales forecast due to a sharp fall in demand for Covid jabs, globally. The company also faces competitive, regulatory and logistical challenges as it seeks to win approval and launch its RSV and flu jabs, they say.

“Moderna’s RSV vaccine will be third to market,” says Mani Foroohar, analyst at SVB Securities, a broker with a sell rating on Moderna’s shares. “The influenza market is also relatively crowded so it remains to be seen if Moderna’s lead asset is commercially viable.”

He says Moderna faces logistical challenges in ramping up commercial operations to compete against more established companies. And there is no guarantee of a rebound in the Covid vaccine market in 2024, as predicted by Moderna and Pfizer, which have both announced plans for price increases, notes Foroohar.

Moderna’s market capitalisation of about $50bn has already fallen well below its pandemic-era high of more than $200bn in September 2021, reflecting the decline in Covid jab sales and a wider downturn across the biotech sector. Its shares have traded flat over the past 12 months as investors assess whether it can successfully commercialise its pipeline of drug candidates.

That wait is almost over, says Stephen Hoge, Moderna’s president. The company is planning to apply for approval of its RSV vaccine within the next month or two and is also sticking with its plan to launch a flu jab in 2024, despite failing to prove the efficacy of the shot in an interim analysis released earlier this month. Further studies are planned, adds Hoge.

He says Moderna would be able to differentiate its respiratory vaccines from competitors such as Pfizer, GSK, and Sanofi by offering a combined jab targeting RSV/flu and Covid. “The convenience of a single injection that covers all three of those is where we think that the world needs to go. And we are already developing that kind of combination work,” he says.

Some long-term investors in Moderna say they are not concerned by the short-term decline in earnings forecast for 2023 as they focus on the longer-term opportunity provided by its mRNA platform.

“When you’re investing on a 10-to-15-year time horizon, it doesn’t matter what a company’s quarterly earnings are . . . We’re much more interested in what management is doing to invest in the future of the business,” argues Julia Angeles, an investment manager at Baillie Gifford.

The Edinburgh-based fund manager is the largest institutional investor in Moderna, holding an 11 per cent stake.

Angeles says mRNA would be “transformational for modern medicine” and has the potential to completely replace vast swaths of therapies and address disease areas where there are, at present, no treatments available.

One of the most exciting and potentially lucrative areas targeted by Moderna is in the field of oncology. The company is trialling a mRNA personalised cancer vaccine in combination with Merck’s immunotherapy drug Keytruda that treats melanoma in high risk patients.

Mid-stage trial results for the therapy, which uses mRNA to deliver a vaccine that teaches the body’s immune system to target cancer tumours, has shown promise.

In a trial of 157 people who had surgery to treat melanoma, 79 per cent of people receiving both treatments were cancer-free 18 months later, compared with 62 per cent of those who got only Keytruda.

“This could be a revolution in cancer therapy — that is, as dramatic as what was achieved with the immuno-oncology space over the last decade,” claims Hoge. He says Moderna will start a phase 3 study this year.

Analysts are positive about the potential for Moderna’s cancer vaccines, which have received breakthrough therapy designation from the FDA — a process that seeks to speed up the development and approval process for a drug. But most agree it will take several years to prove these results can be replicated in a late stage trial and gain regulatory approval for such a novel therapy.

Tim Anderson, analyst at Wolfe Research, says expectations were high when the data was presented this month at a major cancer conference in Florida but notes there has been a long history of failure of cancer vaccines in the past. “Accordingly, many stakeholders remain ‘cautiously optimistic,’ at best, about the opportunity set here, whether in [melanoma] or other tumour types.”

Comments