US junk loan market hit with flurry of credit rating downgrades

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

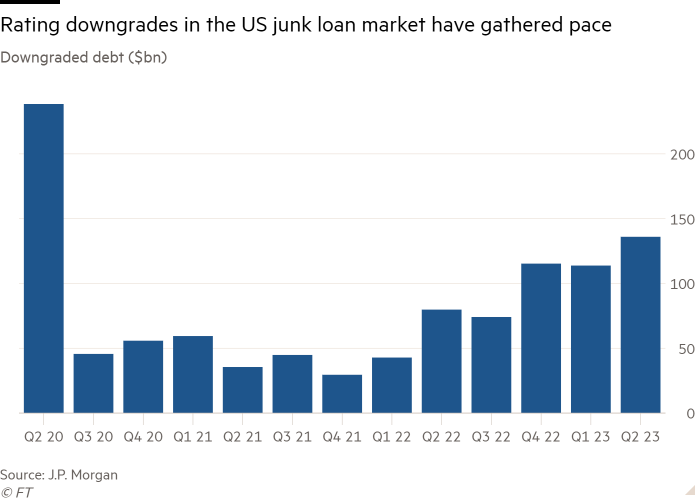

America’s $1.4tn risky corporate loan market has been hit by the biggest slew of downgrades since the depths of the Covid crisis in 2020, as rising borrowing costs strain businesses piled high with floating-rate debt.

US junk loan downgrades numbered 120 in the quarter to June, according to an analysis by JPMorgan, amounting to $136bn — the highest total in three years.

Leveraged loans are issued by heavily-indebted companies with non-investment-grade credit ratings, and typically have floating coupons that move with prevailing interest rates. Some of the US companies that have been downgraded in recent weeks include Aspen Dental Management, MedData and investment software company Confluence Technologies.

The diminishing credit quality of junk loans follows the market’s explosive growth in recent years. Companies and private-equity backers loaded up on this type of debt when borrowing costs were ultra-low during the pandemic.

The asset class swelled beyond the size of the longer-established high-yield bond market and became a critical mainstay for risky borrowers.

But the companies now face the daunting task of repaying lenders in an environment of much higher interest rates since the Federal Reserve began raising rates in March 2022.

“There’s an immediate impact on their entire capital structure, their entire debt liability stack, as soon as rates move”, said Steve Purdy, head of credit research at asset manager TCW.

Downgrades mean that companies have to pay more to issue new debt, with lenders demanding a bigger premium to compensate for a higher risk of default. They could also force the market’s biggest buyers — vehicles called collateralised loan obligations — to shun some of the riskiest loans.

CLOs scoop up loans, sort them into risk categories and sell them on to investors in tranches. The top rung is labelled “triple-A” and the bottom rung is known as “equity”.

If too many companies slide down the ratings scale to triple-C, they could trip a protective switch within the CLO structure that potentially cuts off cash flows to the lowest “equity” rung of investors, diverting money higher up the pecking order.

CLOs have built-in defence mechanisms to manage risk in their portfolios, including a typical cap of 7.5 per cent for how much triple-C debt they can hold.

Worries about overflowing triple-C buckets could limit crucial financing for riskier companies, possibly sending them towards higher-cost funding or spiralling towards default anyway.

CLO investors are carefully monitoring their exposure to loans rated just above triple-C in case they are downgraded, according to Kevin Wolfson, a leveraged loan manager at PineBridge Investments. “I definitely think that has an impact on the demand for those credits,” he said.

Many CLOs are also exiting their so-called “reinvestment periods”, the timeframe in which they are able to invest in new debt — potentially reducing demand for loans more broadly.

The growing pressures on the loan market contrasts with relative calm in high-yield bonds, where fixed coupons give companies longer to adjust to the rising rate environment. Analysts also said the shrinking size of the junk bond market, owing to relatively low new issuance and more issuers rising up the ranks to investment-grade, was helping to prop up prices.

The divergence between loans’ and bonds’ credit quality is also showing up in their default rates.

The loan default rate stood at 4 per cent as of June 30, rating agency Moody’s said this week — up from 3.7 per cent in May and 1.4 per cent a year earlier. By comparison, the junk bond default rate stood at just 1.7 per cent in June, up from 1.4 per cent in May.

Six US loan borrowers defaulted in June including kitchenware group Instant Brands and telco US TelePacific, which does business as TPx Communications.

“Healthcare and software are the two sectors that we think could see elevated default activity”, said Wolfson, noting that “the two account for the largest percentage of the market trading at distressed levels.”

The potential for further downgrades and defaults depends partly on the path of the wider economy and the Federal Reserve’s policy response.

Some analysts and investors have cooled their predictions of a looming slowdown, following encouraging signs of easing inflation and softer hiring data. Goldman Sachs this week reduced its forecasted probability of a recession in the next 12 months from 25 per cent to just 20 per cent.

“Unless you have a real, hard recession, I don’t expect a spike in defaults,” Peters said. Still, he added: “What’s somewhat perverse in here is that if you have a soft landing, and front-end rates remain high, a lot of these companies are going to struggle regardless — given the increase in interest costs.”

Comments