Lessons from a lifetime in investment

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Looking back over my five and a half decades exploring investment and finance, I have to ask the inevitable question: what have I learned from it all?

The period has been marked by a welter of financial innovation, regulatory change, booms and busts, banking crises, geopolitical tension and much else besides. From this protracted drama it is hard to extract a set of simple coherent lessons for investors. Yet I believe that there are some eternal verities in investment and finance. They are often counterintuitive and not always aligned with conventional economic wisdom.

My early education in investment started in the great bull market of the late 1960s, in which a heady pace was set by the so-called Nifty Fifty growth stocks on the New York Stock Exchange. In the brief period I spent in the City of London, becoming a chartered accountant, I had the good fortune to be sent on the audit of the Imperial Tobacco pension fund. This was run by one of the great investment gurus of the postwar period, the actuary George Ross Goobey.

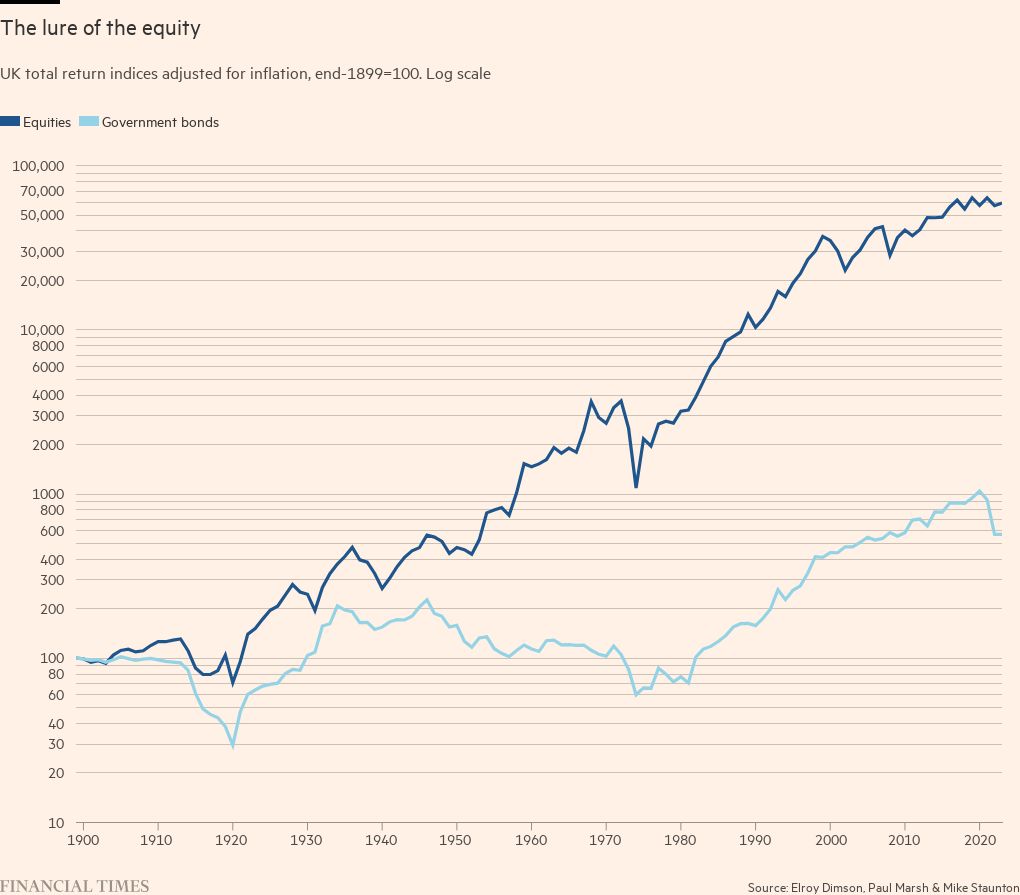

When Ross Goobey went to the Imperial fund in 1947, pension funds were mainly invested in gilt-edged securities, which were regarded as safer than equities. In his view this was a nonsense.

Against the consensus

His thinking, he told me, was not based on sophisticated economics or actuarial legerdemain. He merely thought that the Labour chancellor Hugh Dalton’s 2.5 per cent fixed interest gilts were a swindle when inflation was running at more than 4 per cent. They could not, he thought, deliver the requisite returns to meet Imperial’s pension obligations.

Equities, by contrast, looked to him absurdly cheap. Ross Goobey managed the remarkable feat of persuading the fund’s trustees to let him invest in equities and dump the fund’s gilts.

In the bull market conditions of the late 1960s the Imperial fund’s portfolio struck me as bafflingly cumbersome. It contained nearly 900 holdings in mainly small and medium-sized — far from nifty — quoted UK companies. The fund was stuck with them regardless of their performance because Ross Goobey insisted his managers should never trade, only buy and hold.

Particularly unfathomable to me was his injunction to his managers to buy nothing that yielded less than 6 per cent. In a raging bull market this ensured exposure to some of the shakiest companies on the London Stock Exchange.

A few went bust in the subsequent recession. Yet, thanks to the policy of extreme diversification, the portfolio damage was marginal. In addition the high-yield injunction protected the fund from exposure to the most overvalued (and thus low-yielding) companies in the boom.

Here was an object lesson in the workings of diversification, though not quite as envisaged by economists such as Harry Markowitz, for whom the “free lunch” of diversification came primarily from spreading bets across different asset classes. Ross Goobey instead took a very risky bet on a single asset class while diversifying within it. The risk of capital loss was mitigated by the yield discipline he imposed.

So great were the returns that Imperial enjoyed pension contribution holidays for years. Other institutional investors followed suit by dropping gilts in favour of ordinary shares. Ross Goobey was credited with founding what came to be known as “the cult of the equity”.

Among the enduring lessons: diversification is an invaluable risk management tool. High yield, though often an indicator of dividend cuts to come, can be a good defence in an overheated market; equating risk with volatility, as so many economists do, may be less helpful, especially for private investors, than focusing on avoiding loss of capital. Meanwhile, reducing transaction costs by minimising share trading bolsters investment performance. That logic has turbocharged the rise of passive investing.

A decade of financial turbulence

The 1970s provided me with an induction course, first on the Investors Chronicle and The Times, then as financial editor of The Economist, in the dynamics of booms and busts. The unintended consequences of deregulation — a recurring theme in financial markets — helped shape what proved in economic and financial terms to be an exceptionally violent decade.

Exhibit A in the saga was US President Nixon’s cancellation in 1971 of the convertibility of the dollar into gold. The resulting deregulation of exchange rates unleashed volatile cross-border capital flows that caused wild swings in global asset prices. Exhibit B was the shift in the banking system from being a home for low-risk, highly regulated quasi-utilities — a product of the troubled 1930s — to an adventure playground in which bankers’ insatiable risk appetite was substantially liberated.

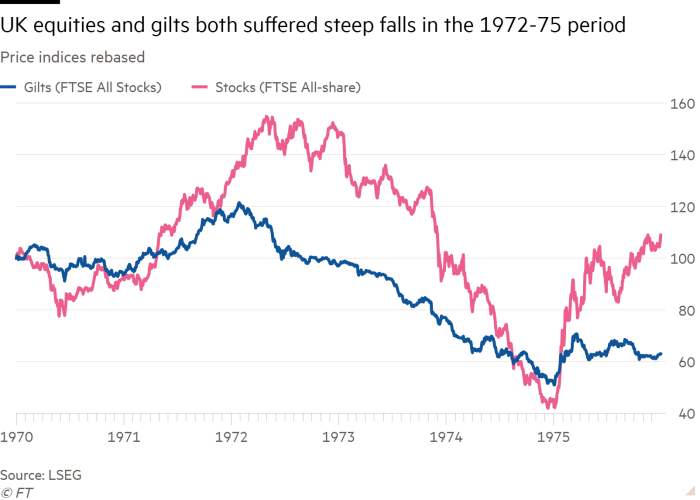

A radical and still instructive deregulatory experiment took place in the UK in 1971. The Bank of England scrapped quantitative ceilings on bank lending in favour of indirect controls, such as balance sheet ratios. This unleashed a wild acceleration of the money supply and credit. Excess liquidity poured into an overheating property market. Then came the 1973 oil crisis, soaring inflation, recession and financial crisis. Property, gilts and equities all plunged.

In equities, the dramatic share price collapse was driven by financial institutions’ selling. Their fear was not ill-founded. In confronting inflation, the Conservative government of prime minister Edward Heath removed key props of the capitalist system by adopting price, dividend and commercial rent controls.

At the same time companies faced not only spiralling wage bills but penal tax liabilities. This was because corporation tax was charged on paper profits from stock appreciation, the difference between the original cost of inventory and the inflated cost of replacing it. Result: British industry was going bust.

When Labour replaced the Tories in early 1974 chancellor Denis Healey intensified the corporate fiscal clamp. Yet by the autumn he had grasped that the corporate sector was being terminally throttled. He introduced tax relief for stock appreciation along with other breaks.

Timing the market

Policy U-turns often signal market turnarounds. Healey’s move to put British capitalism back on its feet should have ended the bear market. Yet in the fourth quarter of 1974, fearful insurance companies, pension funds, investment trusts and unit trusts together sold more shares than they bought for the first and last time during the decade.

Then on January 6 1975, after a peak-to-trough fall on the FTSE All-Share index of 72.9 per cent, the market inexplicably turned and rose vertically. It was impossible for the institutions to get back into the market without causing prices to move spectacularly against themselves.

That is a reminder of the futility, for most investors, of trying to time the market and of the difficulty of contrarianism, the art of investing against the consensus. Note, though, that Ross Goobey, hitherto an equity ideologue, once again defied convention.

When undated gilt yields reached 17 per cent in the mid-1970s the Imperial fund took a big bet on these government IOUs. Ross Goobey’s thinking was that if inflation came down this was an unbelievable bargain. But if the economy was going to hell in a handcart all bets were off anyway.

Of course, all bets are never off in financial markets, not least because when that becomes the common perception, gold comes into its own. There lies the case for the yellow metal as a hedge against catastrophe.

Why should this episode resonate with us today? While economists have explained exhaustively that we are not now reliving the 1970s the similarities remain more striking than the differences. Both periods saw supply side energy and commodity shocks, together with surging money supply. Governments turned on the fiscal tap in response.

Central bankers in both periods initially declared they could do nothing to curb an inflation induced by supply shortages. They were slow to see the demand side of the equation and the risk of second round effects in labour markets. And 21st century central banks’ economic models provided useless forecasts when confronted with supply shocks. So they fell back on a shaky, data-dependent (in other words, backward-looking) monetary policy.

One lesson is that investors, as well as central bankers, ignore money supply signals at their peril. Another is that in such inflationary periods government bonds cease to provide a diversifying hedge against supposedly riskier assets.

Dotcom delirium

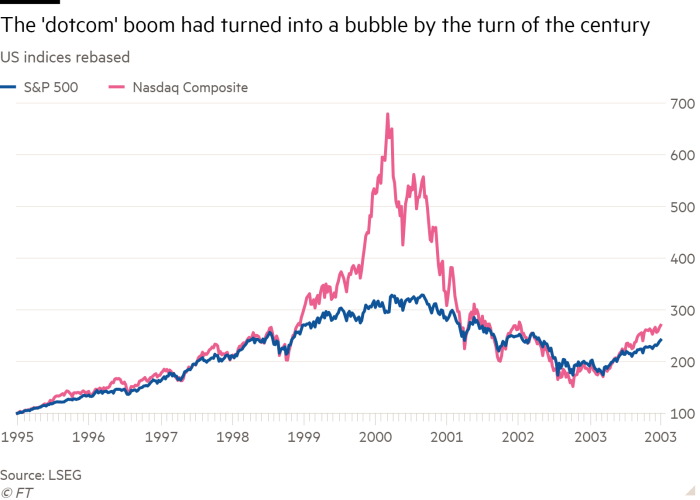

Fast forward, now, to the second half of the 1990s, by which time I had been writing for the FT for a decade and a half. The dotcom boom was turning into a bubble, once again making a nonsense of mainstream economists’ belief that markets are “efficient” or reflect fair market values.

An important psychological factor in the tech euphoria was “Fomo” (fear of missing out) which goes back in history at least as far as the South Sea Bubble of the early 18th century. Fomo adds to investors’ myopia over the risk of capital loss.

For professional investors fear of missing out is more a matter of business and career risk. They are usually benchmarked against an index or peer group. So if they stand against a bubble and underperform the index, clients defect and they may be fired.

This was the fate of Tony Dye, the former chief investment officer of Phillips & Drew Fund Management, during the tech bubble. By shunning overvalued tech and going heavily into cash he seriously underperformed PDFM’s peer group, leading to his ousting just two weeks before the bubble burst. Small wonder fund managers tend to hug their benchmarks.

Central banks responded to the dotcom bust with rapid interest rate cuts. This cemented a view in the markets that policy was asymmetric. That is, the central banks would never lean against a bubble and would reliably extend a safety net when it burst.

The moral hazard implicit in asymmetric policy helped pave the way for the wild credit bubble of the 2000s (see below). Then came the great financial crisis of 2007-09. The central banks’ response was once again to come to the rescue and keep interest rates ultra low for a decade while buying up government bonds and other assets via so-called “quantitative easing”. A further round of propping up followed the pandemic and the war in Ukraine.

Bonus season - are you headed for a payout or a doughnut?

For the third year in a row, the Financial Times is asking readers to confidentially share their 2024 bonus expectations, and whether you intend to invest, save or spend the cash. Tell us via a short survey

By the post-crash 2010s the UK investment scene had reverted to something like the pattern that confronted George Ross Goobey after the second world war. Pension funds had run down their equity holdings to near-zero. Quirky accounting standards and pressure from The Pensions Regulator had pushed them into liability-driven investment. Instead of seeking to maximise the return on their assets, trustees sought to match their liabilities by buying what economists and actuaries described as “safe” government bonds.

Yet nothing in investment is ever safe — witness how the collapse in US Treasuries contributed to the failure of Silicon Valley Bank and other US regional banks last year. And the regulators’ attempts to make individual pension funds risk-free makes the overall market structure more risky: if everyone pursues the same strategy, when the market moves, it moves all one way. That eternal verity re-emerged in the pension fund crisis in the gilt market in 2022.

After a lifetime spent watching the markets, I am struck how, with each new cycle in which central banks act as lenders of last resort, debt mounts inexorably. We continue to muddle through. But a great debt denouement is inevitable because debt cannot rise faster than incomes for ever.

Since debt implosions are inherently deflationary — see Japan in the 1990s — gold, ever resilient against inflation, may not provide insurance against falling prices but government bonds certainly will. To conclude; it is tempting to quote the US economist Herbert Stein who remarked that if something can’t go on forever, then it will stop. But as I have remarked here before, the wise rejoinder by fellow economist Rudi Dornbusch was: yes, but it will go on for a lot longer than you anticipate.

The credit bubble

The chief enablers of the great credit bubble of the 2000s were the easing of monetary policy, a savings glut in Asia that depressed already low global interest rates and, in the UK, light touch regulation.

As in the 1970s, property acted as a residual sink for excess liquidity but with the twist that banks’ property lending was securitised in complex structured products and sold to investors. When boom turned to bust there proved — another eternal verity — to be far more leverage (or borrowing) in the system than regulators and investors had appreciated.

In particular, the banks had shrunk their equity capital to dangerously low levels to boost their return on equity when their return on assets — a more realistic measure of performance — was stagnant or falling.

The credit bubble provided perfect support for the instability hypothesis of the US economist Hyman Minsky. He asserted that extended periods of financial stability breed complacency and excessive risk taking. In 2003 in the FT I relayed Minsky’s thoughts while pointing to the debt spiral. In the same year, I argued in my book Going Off the Rails that asymmetric monetary policy, whereby central banks failed to curb market euphoria but backstopped markets when they plunged, was undermining capitalism’s immune system. Banks’ risk management techniques were also fundamentally flawed. I concluded that the cycle would end with a credit crunch followed by system-wide deleveraging.

But here’s the rub. It is impossible to predict the precise timing of a bubble’s bursting. So I and most others who predicted the crash won no plaudits. An echo in modern journalism of Cassandra’s plight in antiquity.

Comments