Thematic fund investors miss two-thirds of potential returns, research shows

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

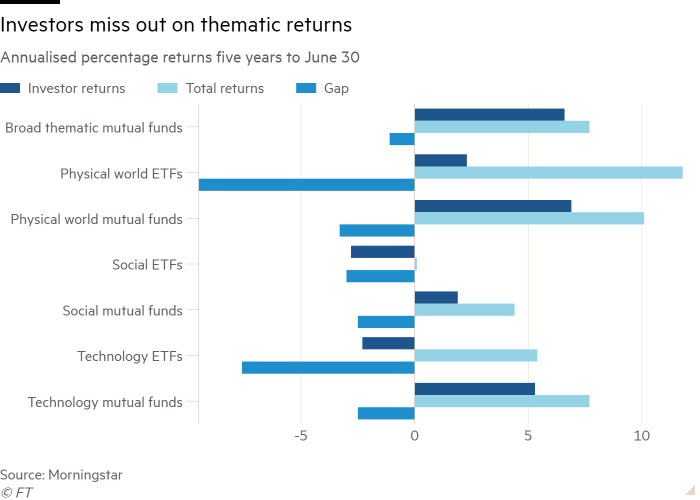

Investors in funds that follow a narrow theme have lost out on more than two-thirds of their potential total returns over the past five years due to buying high and selling low, research from Morningstar reveals.

Thematic funds that existed for the entire five-year period ending June 30 enjoyed annualised returns of 7.3 per cent, but the typical investor received only 2.4 per cent a year as many bought in after the bulk of returns had been made.

The return gaps were far wider in exchange traded funds than in thematic mutual funds, the researchers found.

Matias Mottola, head of manager research at Morningstar, said the disappointing returns achieved by investors were a feature of the funds’ volatility and the fact that they were vulnerable to rapid changes in fashions.

“Many of these funds have very strong returns as they rise from obscurity to being in the headlines and then investments start coming in,” said Mottola. “But partly because of the nature of these products, after they boom in popularity, the money goes elsewhere,” he said.

The Morningstar research found the returns gap was widest for “energy transition” funds, with an “eye-watering” 11.9 percentage point gulf between the funds’ annualised returns over the five-year period (14 per cent) and what the average dollar invested in the funds gained over the same period (2.1 per cent a year).

This was followed closely by future mobility funds and vehicles targeting multiple technologies — a Morningstar grouping that includes the Ark Innovation ETF (ARKK).

Laith Khalaf, head of investment analysis at AJ Bell, a UK retail brokerage platform, said investors should always be wary of trying to time the market.

“It’s incredibly easy to get carried away with sentiment and simply end up buying high and selling low,” Khalaf said.

“This applies to all areas of the market but thematic funds are probably at particular risk of encouraging this behaviour because they often operate in areas which are fashionable or newsworthy, such as ESG or technology.”

He recommended that investors interested in thematics try to adopt a long-term approach, “rather than buying and selling on herd instinct”.

Latest news on ETFs

Visit the ETF Hub to find out more and to explore our in-depth data and comparison tools helping you to understand everything from performance to ESG ratings

Dzmitry Lipski, head of funds research at Interactive Investor, another brokerage platform, agreed that patience had delivered strong returns in recent years, but added that investors should try to broaden their thematic exposure.

“Longer term investors who are prepared to be patient and tolerate higher volatility would be better off having exposure to not just one but to a few themes in their portfolio,” Lipski said.

He added that investors might want to compare performance of thematic funds to simple index tracking alternatives. If it looked as though the thematics were struggling to outperform it might be worth considering whether simpler funds could achieve an investor’s objective, he said.

Khalaf pointed to another factor that investors should bear in mind when considering funds that operate in particularly narrow themes.

“If the thematic funds in question are operating in a particularly niche area, fund flows can have a significant impact on the market price of the underlying assets, driving up prices and boosting performance until flows dry up or go into reverse, with the inevitable hangover to follow,” he said.

Mottola said wider data did not suggest that ETFs’ increased tradeability had led to the existence of their wider returns gap compared with mutual funds, rather it was their more concentrated bets.

Comments