Inflation eats away at wealth

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

A million dollars ain’t what it used to be. With inflation biting into the pockets — and trust funds — of even the very rich, few people can ignore the effects of rising prices.

Of course, the pain is very unevenly shared, with poorer people bearing the brunt. But, even at the top of the wealth pile, the impact is clear.

The real value of fortunes has been eroding in the past two years at its fastest rate in more than 40 years, with inflation at its highest since the early 1980s in the US, the UK and the EU.

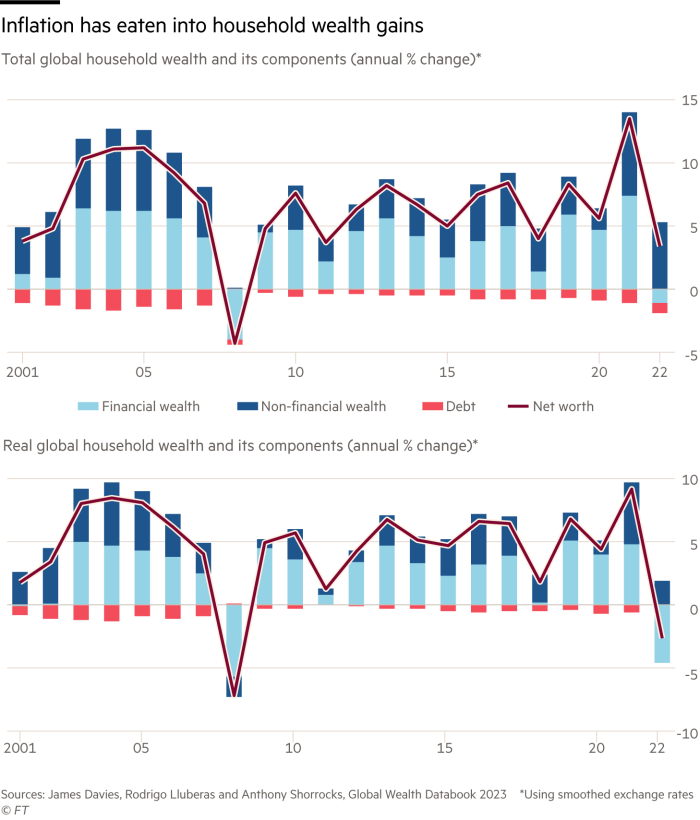

In dollar terms, inflation reduced wealth growth by 6 percentage points last year, turning a nominal wealth gain of 3.4 per cent into a real wealth loss of 2.6 per cent. That’s according to the Annual Wealth Report, a guide to household wealth, produced by Credit Suisse/UBS.

It’s hardly a surprise, given the upsurge in inflation, which hit 8.3 per cent in the US. What’s more striking is that, even in the previous two decades, when inflation was low, rising prices still managed to eat away at asset values.

As the data shows, there have been five years since the turn of the century when nominal investment returns exceeded 10 per cent, but none at all when real returns reached this level.

To put it another way, in figures prepared for FT Wealth, the Credit Suisse authors calculate that only 34mn of the 59mn people in the world with assets of $1mn and more last year would have qualified as real-terms asset millionaires after adjusting for inflation since 2000.

For those with $50mn and more to their name, it was only 112,000 out of 243,000. As the report says: “Inflation has eroded the real value of wealth this century (and made it easier for adults to become dollar millionaires).” And this has happened in a two-decade period when US inflation rates averaged just 2.5 per cent.

Currently, rates are falling from their recent highs, in the US and western Europe. However, few economists expect a return to the low-rate average of 2000-2020. This decade is, in so many ways, turning out to be quite different, with massive disruptions in global stability, trade and finance.

The range of inflationary risks from geopolitics is particularly wide, including everything from Russia’s invasion of Ukraine (which has raised agricultural prices), economic sanctions on Russia (which feed into the oil market) and concerns about stability in the Middle East (oil again) and around Taiwan (electronics supplies).

On top of this, there is the monetary overhang from years of cheap money and pressure from workers to increase pay after decades of decline or stagnation in real wages.

How should investors respond? One lesson from the price-adjusted numbers is the central importance of inflation in assessing how much money you need to live on if you are not working and earning an income. In your pension pot, for example. Or family trust fund. What ultimately matters is not the size of your asset pile today but the future value of the income you’ll draw down — adjusted for inflation.

Canny wealth managers often urge clients not to focus too much on whether their nominal returns are beating portfolio benchmarks (such as stock and bond indices) but to concentrate instead on the real returns. Such advice can often sound like an excuse from a poorly-performing manager worried about losing a client to a benchmark-beating rival.

But it’s a useful reminder that there is a world beyond the financial markets where you will actually be spending the money you draw from the portfolio — in real, inflation-adjusted, dollars, euros and pounds.

It’s advice that is particularly relevant now that markets — and benchmarks — are volatile and inflation, while falling in most developed countries, looks like it might persist.

Stefan Wagstyl is the editor of FT Wealth and FT Money. Follow Stefan on X @stefanwagstyl

This article is part of FT Wealth, a section providing in-depth coverage of philanthropy, entrepreneurs, family offices, as well as alternative and impact investment

Comments