Chinese investors drive rally in local government dollar bonds

Simply sign up to the Chinese business & finance myFT Digest -- delivered directly to your inbox.

Chinese investors are buying up the high-yielding dollar bonds of the country’s cash-strapped local governments, spurred on by a renewed belief in Beijing’s implicit guarantee of the debt and a hunt for returns.

The gains for bonds issued in international markets by local government financing vehicles — investment entities that raise debt to fund spending on infrastructure and other projects — reflect Chinese financial institutions’ demand for higher yields. These investors have faced a lack of attractive options in the country’s flagging onshore stock and property markets this year.

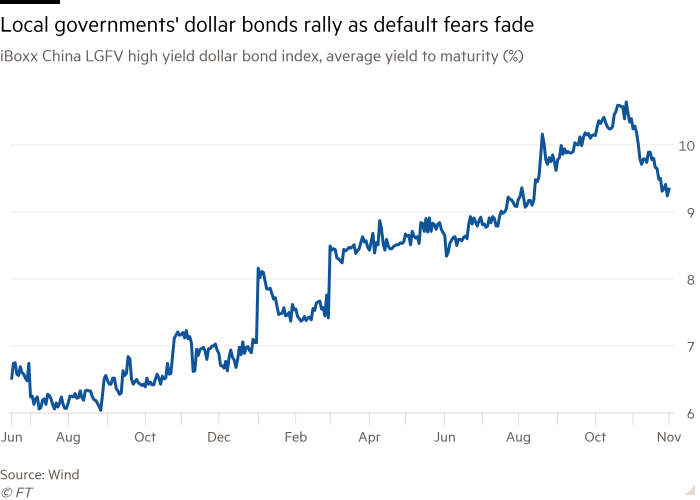

Despite selling pressure from international investors worried about defaults, demand from Chinese buyers has pushed the average yield on debt in the iBoxx China LGFV high-yield dollar bond index down about 1.5 percentage points over the past month to 9.3 per cent. Yields fall as bond prices rise.

Analysts said recent refinancing support from the central government had mitigated the perceived danger of holding LGFVs’ dollar bonds compared with the same entities’ onshore debt, which is widely seen by investors as being safer in the event of default.

“At the beginning of the year people were very scared about the property spillover, but they’ve realised that the central government doesn’t want the property sector and local governments’ fiscal health to deteriorate at the same time,” said George Sun, head of global markets for greater China at BNP Paribas.

“Last year investors weren’t focused on dollar LGFV bonds, but now we’re seeing more coming back to the market, including some regional investors based in Singapore,” he added.

Enormous debts accumulated by China’s provinces and cities have become a pressing problem for policymakers this year, with many bonds issued by indebted provinces such as Guizhou coming close to default. China LGFVs have outstanding onshore bonds of more than Rmb15tn ($2.1tn) as of the end of November, while its outstanding offshore bond size is around $95bn, according to information provider Wind.

That has alarmed global credit investors with large holdings of onshore and offshore LGFV bonds. Although no LGFV bonds on public markets have ever defaulted, foreign investors showed little appetite for their debt in the first half of this year, with yields rising sharply.

However, since July, Beijing has dispatched financial experts to scrutinise the books of local governments and find ways to cut their debts, including arranging more debt swaps and credit support from state banks.

The repayment pressure faced by local governments has also been eased by Beijing’s moves to allow them to sell an additional Rmb1.4tn of so-called special purpose bonds so far this year to help with refinancing, according to Sun. That is in addition to issuance of Rmb1tn in sovereign debt from the central government, which was raised with the stated purpose of helping local economies recover from natural disasters.

“Even though this [central government] bond issuance is purportedly targeted at natural disaster recovery, people understand this is being done to help local governments deal with repayment pressure,” he added.

In recent months refinancing support has helped lower the difference in yield between LGFVs’ onshore renminbi bonds and central government bonds. Since the start of this year, the average so-called spread of three-year LGFV bonds over same-maturity Chinese Treasuries has fallen by more than half to just 0.7 percentage points.

But offshore spreads remain far wider, encouraging Chinese investors to hunt for bargains on higher-yielding dollar bonds from issuers they know and whose credit profiles they are comfortable with.

“Some foreign investors are dumping LGFV bonds offshore at a relatively attractive price, [bonds] which in our view would definitely be paid in full,” said one Hong Kong-based fixed-income trader at a state bank.

“Besides, if the same local government vehicle is offering higher yield on its offshore bonds than onshore, why pass up such a good chance to buy more?”

The confidence among Chinese investors is based on a strong and widespread belief in Beijing’s implicit guarantee of local governments’ debt and expectations that the offshore market will remain key to fundraising and refinancing for many LGFVs.

In contrast with Chinese developers, who are now completely frozen out of international bond markets, LGFVs have issued more than $4.6bn of dollar bonds this year, about $720mn of which was sold in the past month, according to data from Dealogic.

“Our baseline scenario is that there will be no LGFV default, because the government will provide a strong implicit guarantee,” said Zhu Haibin, chief China economist with JPMorgan. “But that doesn’t mean the local governments will no longer be issuing debt. That will continue, because they need to keep on rolling it over until a fundamental resolution for these debt problems is reached.”

But BNP Paribas’s Sun warned that the scale of repayment obligations remained daunting, with outstanding LGFV bonds totalling about Rmb60tn.

“Yes, there’s been a few trillion renminbi refinanced, but there’s a lot more to go,” Sun said. “The real question is whether there will be enough additional fiscal stimulus or special bonds or loans issued to refinance the remainder.”

Letter in response to this report:

Chinese investors’ faith in the state is misplaced / From Albion M Urdank, Emeritus Professor, University of California, Los Angeles, US

Comments