JPMorgan and Citi expect euro to fall to parity with US dollar

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Wall Street’s biggest banks are expecting the euro to fall to parity with the US dollar, as the war in the Middle East threatens to push up the price of Europe’s imported energy and higher borrowing costs weigh down on eurozone growth.

JPMorgan has downgraded its forecast for the euro to $1 by the end of the year. Citibank said it is targeting a move to parity “within six months” given its “ongoing view of European recession well ahead of the US”.

The calls put the US banking giants at the forefront of a growing group of lenders forecasting that the common currency’s steady decline since the summer has further to run.

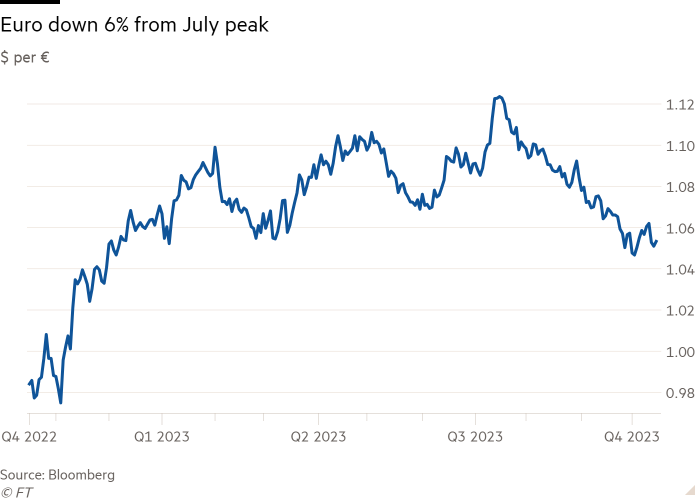

The euro, which is at present trading at $1.0530, has already fallen about 6 per cent against the greenback since its peak in mid-July, as the unexpected strength of the US economy has pushed the dollar higher while the eurozone braces itself for a downturn.

Despite recent weakness, the euro is “still not incorporating a discount for the myriad of uncertainties the currency faces”, said Meera Chandan, co-head of the global FX strategy research team at JPMorgan, citing “tighter financial conditions and potential geopolitical spillover risks, all of which come amid stagnant growth”.

“We now expect EUR/USD to test parity, down from our previous target of 1.05,” she added.

The US’s surprisingly resilient economy in recent months has helped push the dollar higher, while mounting recession fears in Germany, the eurozone’s traditional growth engine, have pulled the euro lower.

“We think the US dollar can go further on US exceptionalism,” said Yasmin Younes, a strategist at Citi, adding that the Federal Reserve still has more rate cuts priced in for next year than any other G10 central bank, “which we find incongruous with a tightening labour market”.

The German government last week slashed its own forecast for economic growth, warning that its economy would shrink 0.4 per cent this year, while the IMF expected it would be the worst-performing major advanced economy this year.

A fall to parity would bring the euro back to levels not seen since the second half of last year, when the single currency fell below $1 for the first time since 2002 after the war in Ukraine cut off much of Europe’s gas supply.

A recent resurgence in energy prices sparked by the Israel-Hamas war has added to the pressure on an already slowing economy. The price of benchmark European gas futures has risen 26 per cent since Hamas’s attack on Israel on October 7.

Prices were trading at about €50 per megawatt hour on Monday, still far below a peak of more than €300/MWh hit in August 2022. Europe has largely filled its gas stocks in preparation for winter, cushioning it from further disruption.

In a research note on Friday, analysts at Goldman Sachs said the bearish case for the euro has been growing, exacerbated by bond investors’ concerns over Italy’s bigger than expected budget deficit.

“First, activity data disappointed expectations over the summer. Second . . . fiscal concerns have re-emerged in Italy that will likely drive upward pressure on BTP [Italian government bond] yields . . . Third, the risks to oil and natural gas prices look skewed to the upside,” said Goldman Sachs.

The spread — or gap — between yields on benchmark Italian debt and that of Germany was 2.01 percentage points on Monday, breaching the key level of 2 percentage points. Bond market strains could increase pressure on the European Central Bank to stop increasing, or begin cutting, interest rates. The governor of Spain’s central bank said on Monday that the rout in global debt markets meant the ECB had probably done enough to get inflation under control.

Currency speculators have also been removing bullish wagers on the euro in recent weeks. Although they remain net long — betting on a rising price — analysts said the currency could move lower as positions continue to be unwound.

Net long positions were about 75,000 contracts among leveraged funds for the week to October 10, according to data from the US Commodity Futures Trading Commission, down from more than 170,000 in August.

“Normally to prevent the euro from falling lower you like to see the market extremely short already but it’s still long,” said Chris Turner, global head of research at ING, who said that euro-dollar parity was “possible”. Shorting means betting on a falling price.

While some banks still expect the euro to strengthen by the end of the year, a number including Rabobank, Nomura and RBC Capital Markets have lowered their forecasts in recent weeks, expecting the euro to fall to $1.02 by the end of the year or early in 2024.

“On many fronts Europe is faced with a lot of hurdles and this is totally independent of the higher for longer and safe haven narratives which are promoting the dollar right now,” said Jane Foley, head of FX strategy at Rabobank, who expects the euro to fall to $1.02 by the end of the year.

“Parity is certainly something that we see as possible and we think it will be talked about increasingly in the months ahead,” she added.

Comments