Energy quarrels overshadow Poland at EU summit

Simply sign up to the Energy crisis myFT Digest -- delivered directly to your inbox.

Good morning and welcome to Europe Express.

The summit wrapped up just before midnight, with EU leaders having to rush through their dinner after being locked in hours-long quarrels, mainly over energy and to some extent over Poland. We’ll give you the rundown of how discussions went and why the outgoing Czech prime minister, Andrej Babis, was the most difficult to convince in signing up to the summit’s conclusions on energy.

Meanwhile, on the other side of town at Nato, defence ministers stuck to a more reasonable timetable and will resume their session today with some EU guests. We’ll explore what their overlapping diaries spell for future co-operation.

And with digital policy on the agenda of today’s EU summit (along with migration), we look at an upcoming review of competition rules that will also impact tech companies.

This article is an onsite version of our Europe Express newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday morning

Winter is coming

The EU leaders’ summit showdown with Poland was overshadowed in the end by the divisive issue of energy prices, writes Mehreen Khan in Brussels.

Before the flare-up between Brussels and Warsaw over the primacy of EU law, this week’s summit was scheduled as the moment for leaders to debate the bloc’s common response to surging electricity prices. It lived up to the billing.

More than four hours were devoted to the energy crisis, with the Czech Republic’s Andrej Babis taking centre stage in a debate that pit a group of free market countries against others demanding protectionism and energy price stability.

Babis held up proceedings by initially blocking a summit communiqué over his claims that the bloc’s carbon market, known as the Emissions Trading Scheme (ETS), was responsible for driving up household energy bills and was rife with market manipulation.

Twice weekly newsletter

Energy is the world’s indispensable business and Energy Source is its newsletter. Every Tuesday and Thursday, direct to your inbox, Energy Source brings you essential news, forward-thinking analysis and insider intelligence. Sign up here.

Other governments have also made similar claims about speculators forcing up the cost of carbon credits to records in recent months. The European Commission has repeatedly said they have no evidence of skulduggery and point out that the ETS price only contributes to about 15 per cent of the EU’s wholesale electricity costs.

The impassioned debate was a foreshadowing of deepening divisions over the merits of Brussels’ climate proposals to come this winter, when the squeeze on gas supplies and ensuing price increases are set to worsen. The crisis has strengthened calls from the likes of France, Spain, Poland and Greece for an overhaul of the EU’s energy market rules, to help lock in long-term prices and damp volatility.

Standing against those demands are the likes of Germany, Ireland, the Nordics, and Baltics who don’t want heavy-handed interference in an energy market that has moved towards greater liberalisation in the last decade. “I am a firm believer in markets,” said Estonia’s Kaja Kallas on arriving at the summit.

The commission is caught between these competing demands for radical action on the one hand, and a wait-and-see stance on the other. Brussels has promised to come up with proposals for joint EU procurement and storage for natural gas in December. But Ursula von der Leyen, commission president, told leaders last night that any common procurement would be done on a voluntary basis, allowing only countries who want to pool their resources to do so.

Leaders also heaped pressure on what is arguably Brussels’ most important climate proposal due in the coming months: the EU’s green labelling system, known as the taxonomy.

Leaders including Babis and France’s Emmanuel Macron called for an explicit inclusion of natural gas and nuclear power in the forthcoming taxonomy draft. Germany, Austria and Luxembourg are among those resolutely opposed to nuclear being awarded a green label, on the grounds that it produces thousands of years of toxic waste.

With last night’s debates largely unresolved, leaders are gearing up to do it all again in December. Spain has been at the vanguard of calls for more crisis talks at the end of the year, banking on the fact that a worsening winter crisis might help concentrate minds and push the cause of sweeping energy price reform.

Should the EU freeze Poland’s funding? Tell us what you think and click here to take the poll.

Nato-EU overlap

For those demanding greater co-ordination between the EU and Nato, this week’s parallel summits of EU leaders and Nato defence ministers was proof that the two Brussels-headquartered organisations could perhaps compare their diaries a little more in the future, writes Henry Foy in Brussels.

Building on the overlapping calendars, Nato defence ministers today will strive to also draw up overlapping (but not duplicating) strategic objectives. Finland, Sweden and the EU’s foreign policy and defence chief Josep Borrell will join Nato member states to “discuss how we can further strengthen the partnership . . . with our closest partners,” said Nato secretary-general Jens Stoltenberg yesterday.

There is unanimity on the rhetoric, and the need to align approaches. But defining the details may need some work, amid tussles inside the EU regarding the “autonomy” in “open strategic autonomy”, and broader discussions within Nato as to its future after the Afghanistan withdrawal and the US pivot to China.

In conversations with Europe Express, ministers involved in today’s talks stressed the need for the two organisations to complement each other and bring their individual capabilities to the table, rather than seeking to duplicate abilities or compete for resources.

Ben Wallace, the UK defence secretary, dismissed a recent surge in chatter around the constantly re-emerging notion of an EU army as “a red herring”, instead explaining that the EU’s strength is in its ability to raise resilience among societies to new hybrid and cyber threats.

“I do actually think that the best place for the EU to complement Nato is in the pre-conflict space, hardening the resilience of Europe, challenging hybrid efforts to disrupt our societies,” he said. “That’s actually where the EU can help corral its members and plug perfectly into Nato’s predominant role in conflict in war.”

The UK is of course inside Nato but outside the EU. And in Sweden, a country inside the EU but outside Nato, the view is similar.

The EU “must develop the capabilities” to counter hybrid threats, Sweden’s defence minister Peter Hultqvist said. “It is very important to have a situation where the EU and Nato are complementary to each other and not competitors.”

Striking that balance will take more than just one day of meetings, but a new Nato-EU declaration in the offing before the end of the year should set the broad framework. Assuming that goes to plan, expect large overlap in the EU’s Strategic Compass (due in the spring) and Nato’s Strategic Concept (due in the summer).

Borrell, who will have uniquely attended both summits this week, said yesterday that “intense discussions” had taken place on the Strategic Compass “in order for the European Union to act more and better as a security provider. To use all our forces, to spend better on defence and being a stronger partner.” Nato certainly hopes so.

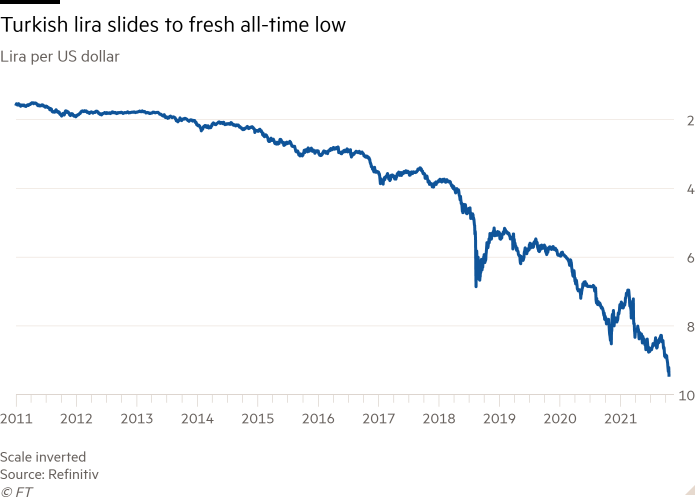

Chart du jour: Turkish free fall

Turkey’s central bank has defied warnings from the business world and opposition parties by slashing its main interest rate despite rising inflation and an ailing currency. The lira, which had already lost about 20 per cent of its value against the dollar this year prior to the announcement, fell a further 2 per cent on the news. (More here)

Competition update

EU leaders today are set to discuss the bloc’s digital agenda, just weeks ahead of a proposed update to the competition rules that will also have an impact on tech companies, writes Javier Espinoza in Brussels.

The point of today’s discussion, according to a senior official familiar with the meeting, is to give a nudge to the stalled regulation, bogged down in internal quarrels within the European parliament and among member states.

According to the summit’s draft conclusions, leaders will call on all parties “to continue work on the Digital Services Act and the Digital Markets Act proposals with a view to reaching an ambitious agreement as soon as possible”.

While member states want to be seen to be tough on pushing for new tech regulation, the EU’s chief competition chief, Margrethe Vestager, is quietly ploughing ahead with an update to the bloc’s competition rule book that will also have an impact on the digital economy.

Updates to the competition rules are expected on November 17 in three main areas:

Foreign subsidies: The EU has been working for a while on new rules to curb foreign public subsidies, in what would be a challenge to China. The idea is to properly scrutinise investments and whether they are heavily subsidised and therefore distort competition. Some have complained that this may reduce the willingness from companies — even if not subsidised — to invest in the bloc.

Killer acquisitions: Brussels is also exploring for the first time its ability to review deals even if the companies seeking to merge have no revenues in Europe or do not meet the current thresholds. The EU is looking at Illumina’s $8bn acquisition of Grail as the first test case of a transaction that may be bad for consumers. Opponents claim this will introduce more uncertainty for future deals.

State aid revamped: Vestager also told the Financial Times earlier this week that the EU will look to extend the relaxation of state-aid rules because of the pandemic just one more time. In the future there will be special exemptions for those sectors, such as travel and hospitality, that were particularly hit hard by the health crisis.

Vestager told Europe Express that it’s more about tweaks than a complete overhaul. She said Brussels was looking at gaps in their regulation and how to address them: “We figure out how to stay relevant, which is a much more evolutionary approach than a revolutionary approach.”

What to watch today

Second day of EU summit, focused on migration and digital policy

EU officials and non-Nato members join the second day of the Nato defence ministers’ meeting to discuss EU-Nato co-operation

Smart reads

German corporate lenders: The pandemic has increased the net lending position of the country’s corporate sector — a trend that is set to continue in 2022, hinting that the unusual situation of net lending by companies could be the new norm in the German economy, writes Bruegel.

Climate change impact: Chatham House has mapped 10 major impacts of climate change by 2030, including on food security and migration. Most at risk are communities that are already quite vulnerable, with adaptation measures urgently needed to avert a domino effect across the globe.

Cohesion funding, unpacked: A report from EU’s Court of Auditors found “no clear link between financing and programme performance in the area of cohesion” for the bloc’s last seven-year budget. The court recommends stricter conditionality linked to the 2021-2027 budget.

Recommended newsletters for you

The Road to Recovery — Our must-read briefing on business and the economy, post-pandemic. Delivered three times a week, it contains expert analysis on the changes to our workplaces — and our lives. Sign up here.

Britain after Brexit — Keep up to date with the latest developments as the UK economy adjusts to life outside the EU. Sign up here

Are you enjoying Europe Express? Sign up here to have it delivered straight to your inbox every workday at 7am CET. Do tell us what you think, we love to hear from you: europe.express@ft.com.

Today’s Europe Express team: mehreen.khan@ft.com, sam.fleming@ft.com, henry.foy@ft.com, javier.espinoza@ft.com, valentina.pop@ft.com. Follow us on Twitter: @MehreenKhn, @Sam1Fleming, @henryjfoy, @javierespFT, @valentinapop.

Comments