US bond market is losing its strategic footing

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The writer is president of Queens’ College, Cambridge, and an adviser to Allianz and Gramercy

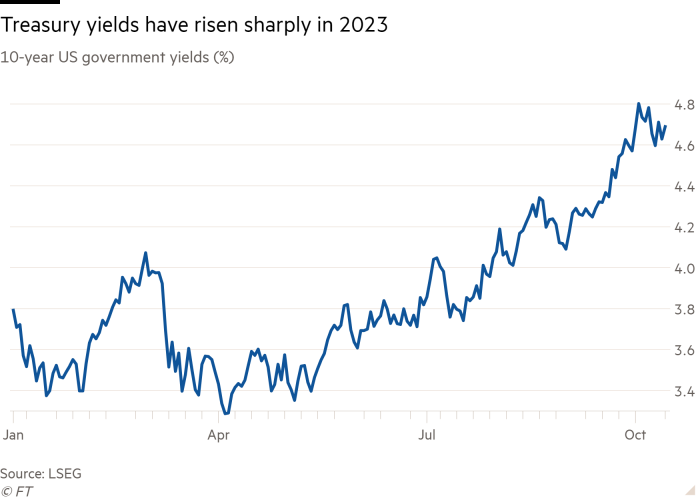

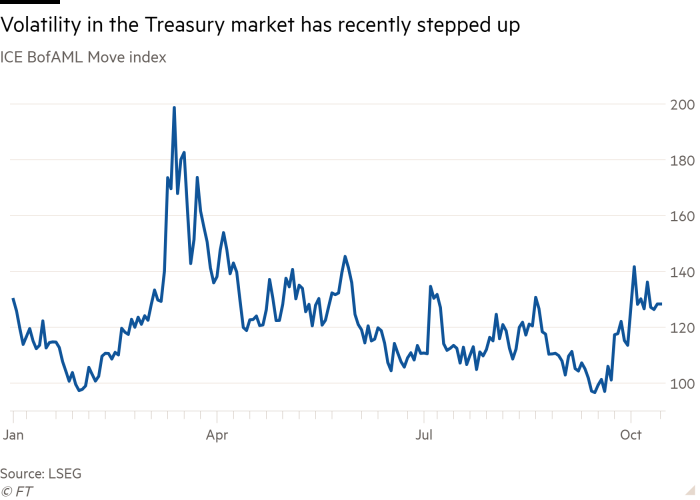

Last week’s unusual turbulence in US Treasuries points to a deeper issue than just the latest reading of the runes on inflation and the interest rate intentions of the Federal Reserve. The US bond market is losing its strategic footing, whether in economics, policy, or technical aspects.

There are readily available short-term explanations for the rollercoaster ride in yields that has garnered significant attention in the US and beyond. Early in the week, dovish statements by several Fed officials influenced market sentiment by indicating the possibility of no further interest rate hikes as the market had been doing the heavy lifting for them. Geopolitical concerns reinforced the yield movements. Bonds rallied sharply with yields falling.

Midweek, the focus shifted to inflation data, including certain measures that came in hotter than expected at both the producer and consumer levels. On Friday, geopolitical worries resurfaced as the market feared an escalation of the tragic conflict in the Middle East. On Thursday alone, the 10-year Treasury yield swung nearly 0.2 percentage points between an intraday high and low.

But my primary concern lies elsewhere: the most influential segment of the world’s financial markets is losing its longer-term strategic anchors and is at risk of losing its short-term stabiliser ones as well.

The recent consensus on economic growth for the world’s largest economy has been erratic, with forecasts fluctuating between a soft and a hard landing with the occasional mention of crash and no landings as well. Expectations about the Fed’s actions have similarly fluctuated, from potential rate cuts in the near term to maintaining higher rates for a longer period.

Federal Reserve policy is further shrouded in uncertainty, with questions over what the equilibrium level of interest rates should be, the delayed effects of a concentrated cycle of rate rises, the impact of a shrinking balance sheet and the absence of an effective framework for monetary policy.

All of this occurs in a context of substantial fiscal deficits that show no signs of significant moderation, for reasons that include Congressional dysfunction and the considerable bills associated with past promises and ongoing transitions in response to critical challenges such as climate change. Consequently, the balance of risks suggests more significant fiscal pressures than originally anticipated.

This uncertainty also extends to longer-term supply and demand dynamics. Despite rising interest rates, there is genuine doubt about who will readily absorb the additional supply of government debt associated with high deficits. The Fed, which was the most reliable buyer for over a decade with a seemingly limitless printing press and little price sensitivity, is now selling bonds, reversing its quantitative easing programmes since the financial crisis with quantitative tightening.

Foreign buyers seem more hesitant, including for geopolitical reasons. A significant portion of the large domestic institutional investor base, such as pension funds and insurance companies, already holds substantial quantities of bonds at large mark-to-market losses. Additionally, concerns about the stability of regional bank deposits persist, possibly leading them to sell bonds if deposits decrease.

Fortunately, the bond market still possesses some short-term stabilisers, which have mitigated even more extreme daily fluctuations. Sudden surges in yields attract buyers seeking greater certainty to lock in higher income for the long term, while sudden drops in yields translate into higher prices, allowing some overexposed investors to lighten up on any holdings where they are sitting on paper losses.

However, it’s important to note that their resilience should not be taken for granted. No matter how you look at it, the world’s most crucial benchmark market is on an unpredictable journey with an uncertain destination.

I recall during the transition I made approximately 25 years ago from the public to the private sector when I was cautioned by a bond trader that there would be moments when technical factors would override fundamentals, resulting in price volatility that could potentially destabilise both the financial markets and the broader economy. He was applying this good old-fashioned “tail wagging the dog” phenomenon to emerging markets. Without a more concerted effort to reestablish key anchors, it seems that this warning needs to be taken more seriously in the most systemic segment of mature markets.

Comments