Oil market caught by surprise as US output surges

Simply sign up to the Oil & Gas industry myFT Digest -- delivered directly to your inbox.

A heavy weight is leaning on global oil markets as prices slide to five-month lows: record US supply.

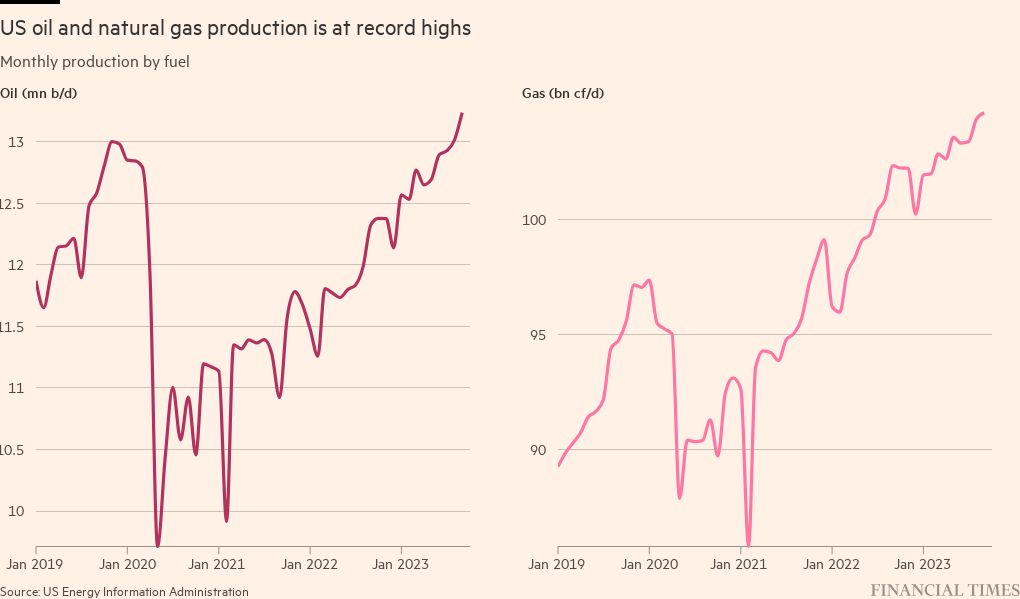

American crude oil production reached a fresh all-time high of 13.2mn barrels a day in September, according to figures released last week, more than any other country and accounting for about one in eight barrels of global output.

The added volumes have outpaced official forecasts and called into question claims of a US oil industry constricted by Wall Street or environmental regulations. They are causing difficulties for the Opec+ oil cartel, which last week agreed to deepen cuts to its members’ own volumes in a bid to prop up faltering prices.

The new supplies are also creating discomfort for the Biden administration, as US officials join a push to phase out fossil fuels at the UN climate talks in Dubai.

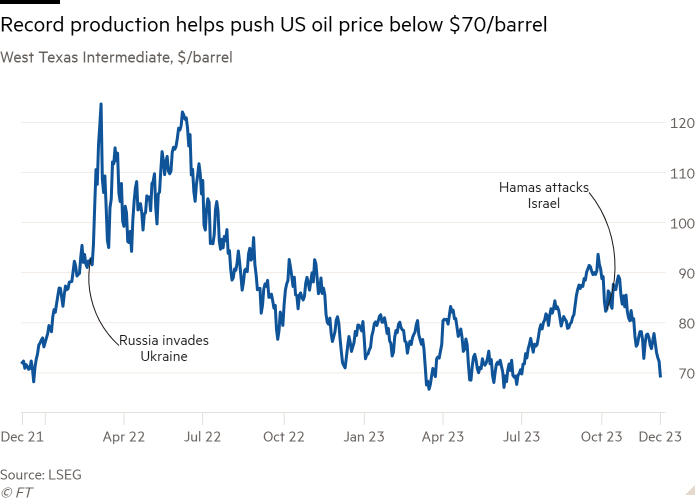

West Texas Intermediate crude on Wednesday fell below $70 a barrel for the first time since July, a move analysts said was driven in part by higher-than-expected production from US shale fields.

“US supply was probably the biggest surprise of the surprises,” said Bob McNally, president of Rapidan Energy Group, calling it the “main reason” why markets had not tightened as many expected.

It is a stark contrast with three years ago, when the Covid-19 pandemic caused oil prices to plunge and drilling companies idled rigs and laid off workers. In the aftermath, Wall Street’s insistence on financial returns over growth, fears about the availability of prime acreage worth drilling and President Joe Biden’s combative stance towards the sector stoked fears that the industry’s best days were behind it.

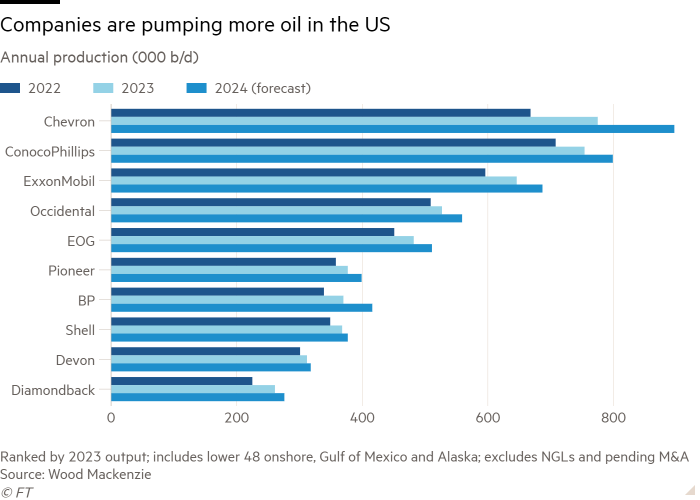

The US accounts for 80 per cent of the expansion in global oil supply this year, according to the International Energy Agency. Its production is set to grow by 850,000 b/d, the US Energy Information Administration estimates, well below the pace reached earlier in the shale revolution but much faster than analysts had anticipated.

Growth has been strongest in the Permian Basin of Texas and New Mexico, the most prolific oilfield in North America and the scene of a flurry of corporate dealmaking that points to further production gains.

At new wells in the Permian, average oil production per drilling rig has increased to 1,319 b/d. A decade ago the figure was about 183 b/d. Big producers including Devon Energy, EOG Resources and ExxonMobil all reported Permian output growth in the third quarter compared with a year ago.

Scott Sheffield, chief executive of Pioneer Natural Resources, the Permian’s biggest producer, said he was “very surprised” by the growth, which was almost double what he had estimated a year ago. “Because of that there’s a good chance we may reach 15mn barrels a day within five years,” he said, referring to total US volumes.

New technology and increased efficiencies are enabling drillers to continue to squeeze more out of the ground, building on breakthroughs such as horizontal drilling and hydraulic fracturing that unleashed the shale revolution in the mid-2000s. The advances mean drillers can now bore horizontally — or laterally — for more than three miles through rock.

Shale remains “relatively early in its life” in terms of the technological advances that could drive higher productivity, said Eimear Bonner, chief technology officer at Chevron.

“What we’ve seen is we can drill longer laterals, we have improved drilling efficiency, we are contacting more reservoir, we are getting more data that’s helping us with improved decisions — and our early technology pilots are showing us that there’s more there,” she said. “My perspective is there is more to come — and that’s what we are working on.”

US oil supermajors are boosting investment after austerity that followed the 2020 oil price crash. Exxon has agreed to buy Pioneer for $60bn and Chevron is spending $53bn on Hess as they bet on strong future fossil fuel demand.

Since the Covid-induced downturn, higher prices triggered by Russia’s invasion of Ukraine have spurred producers to drill. Natural gas production is also at a record in the US, topping 125bn cubic feet a day in September.

The rebound in oil and gas production has led to accusations of hypocrisy as the Biden administration urges countries to shift away from fossil fuels at the COP28 climate summit in Dubai. Biden, who entered the White House on a promise to “transition from oil”, has since urged greater levels of drilling to keep fuel prices under control.

Biden initially sought to freeze new drilling on public lands and has restricted lease sales in the Gulf of Mexico. Despite this, oil production on federal lands and waters has also risen to record levels during his presidency.

“The US presenting itself as a climate champion at COP is largely a facade, considering it is the biggest oil and gas producer in the world,” said Raena Garcia, senior fossil fuels campaigner at Friends of the Earth.

Industry executives lauded a change in tone from the administration, which they say became more pragmatic since the war in Ukraine pushed energy security to the fore.

“I think what we see in the US is the recognition that a balance has to be struck here,” said Darren Woods, Exxon chief executive, who this week attended the UN climate summit for the first time.

“I think the Biden administration in the US is committed to reducing emissions . . . but they also recognise in order to meet people’s needs today — to warm their homes and to cool them and to provide affordable transportation — we’ve got to have our existing system working,” Woods said.

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here

John Kerry, America’s top climate diplomat, said the administration had signed up to the “phaseout of unabated fossil fuels” and voted in favour of a G7 measure targeting net zero energy systems by 2050.

“The increased production is a reflection of Ukraine, the effort to come back from Covid and the reflection of what happened with Russia cutting off all the gas to Europe . . . we’re sending a lot over there and other places to try to help them out,” he said.

A steeper decline in oil prices could cause US producers to pull back as they have done in earlier slumps, eventually forcing output lower.

“We’ll just have to see how it plays out,” said Harold Hamm, chair of Continental Resources, the biggest private oil producer in the US. “But so far, they have determination and commitment to continue what they’re doing.”

Additional reporting by Amanda Chu in New York and Aime Williams in Dubai

Comments