Falling corn prices heap pressure on farmers

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

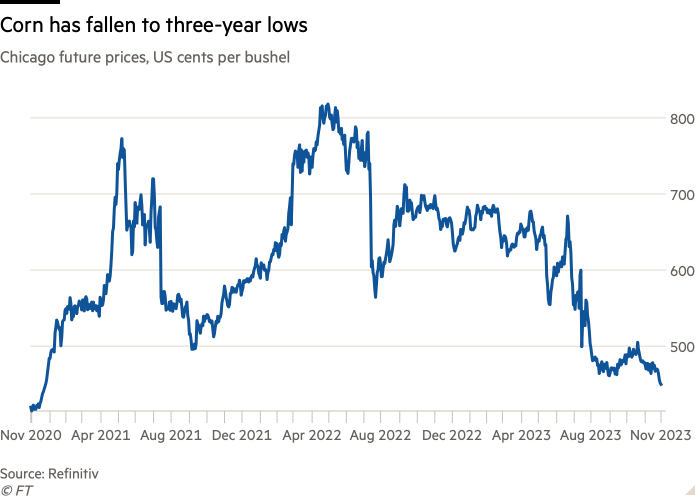

The price of corn has tumbled to a three-year low as supplies from the US and Brazil surge while demand stagnates, helping to cool food price inflation but heaping pressure on farmers who had been expecting high prices to last.

Corn, which is used predominantly for animal feed and to produce ethanol, has been trading below $4.50 a bushel in Chicago in recent days, its lowest level since December 2020. It had been trading above $8 a bushel in May last year.

The fall in prices, which has come after US farmers expanded their crop acreage last year in response to high prices, just as demand was dropping off, is proving a boon for hedge funds, who have been raising their bets on price falls.

“Supplies have risen dramatically as a result of that higher acreage but demand has stayed sluggish,” said Michael Magdovitz, senior commodity analyst at Rabobank. This had thrown a “wet blanket” on corn, he added.

The price fall comes as other key agricultural commodities such as wheat drop from last year’s highs, in a reversal of price trends that had sharply pushed up food costs for consumers. Cheaper animal feed tends to lead to lower costs for meat and dairy producers and cheaper products for consumers.

Russia’s invasion of Ukraine, one of the world’s largest grain exporters, sent prices of corn and other cereals soaring last year. Drought in parts of South America as a result of the La Niña weather phenomenon also hampered grain harvests, supporting the market.

In response to rising prices, demand for corn fell last year for the first time in a decade — contracting nearly 3 per cent between 2022 and 2023.

At the same time, farmers were trying to cash in on the high market price by planting more corn. Earlier this month a US government forecast on agricultural commodities output showed an extra 6mn acres had been planted in the Midwest’s corn belt — which includes states such as Missouri and Kentucky — while yields were higher than anticipated.

The resulting surge in supply and the fall in demand have pushed prices down this year and left many farmers facing losses.

“The average farmer in America is under water if he sells corn today,” said Magdovitz, adding that prices are below input costs.

Supplies have also increased as Ukraine has resumed exports of grain through its Black Sea ports, which were stymied after Russia pulled out of a UN-brokered deal in July. This has given big importers, especially China, an alternative source of the grain, according to Argus AgriMarkets, a price reporting and analysis service.

Ample supplies have been met with flat demand. Producers of animal feed, who buy much of the world’s corn, have seen their market curtailed as cattle ranchers in the US have had to cut their herds after years of drought. China could also be forced to trim its hog herd amid sluggish economic growth, according to analysts.

Producers of compound animal feed — made from a blend of ingredients — also have more options due to the falling wheat price. While the variety of corn used for animal feed is not typically eaten by humans, wheat is used for both but primarily for humans, meaning it trades at a premium. Prices of the grain have fallen recently, bringing it down nearer the price of corn. That makes it more appealing for feed producers in Asia and Europe, where it is popular among farmers.

Hedge funds have been increasing their short positions — bets on falling prices — and trimming their long positions as prices have fallen. Their net short position has now risen to the highest level since June 2020, according to the latest figures from CME, the world’s largest futures exchange.

The number of speculative traders buying options on corn has also increased, according to Tristan Fletcher, chief executive of ChAI, a commodity price forecaster that uses artificial intelligence. This is “a strong bearish signal” in the short term, he said.

La Niña has given way to El Niño and drought and intense heat have delayed soyabean planting in the central-west part of Brazil. This will have a knock-on effect on the winter corn crop as farmers cannot sow all their corn until the soy harvest is finished, according to Argus.

Farmers facing losses could also crimp future supplies. Corn producers in Brazil were refusing to sell at current prices, said Argus.

Their US counterparts meanwhile were set to ditch corn in favour of more profitable crops, such as soy, said Magdovitz. “Farmers planted with abandon and now they are abandoning corn.”

Comments