Investors miss out on sugar rush as they flee commodities ETFs

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

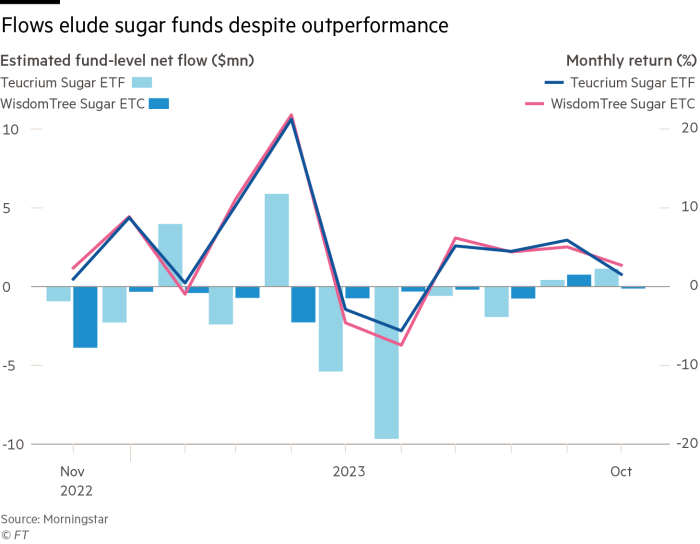

Investors have missed out on the latest rally in sugar as exchange traded funds devoted to the sweet stuff have suffered outflows despite soaring prices for the commodity.

Poor crops in India and Thailand due to the re-emergence of the El Niño weather system and export restrictions in India have pushed sugar prices to levels not seen in more than a decade.

Some investors cashed out after a jump in sugar prices earlier in the year and did not return to the market, meaning they did not enjoy the bump in the second half of 2023, according to investment flow data from Morningstar.

There was a combined $25mn in net outflows from the Teucrium Sugar exchange traded fund (CANE) in the US and the WisdomTree Sugar exchange traded commodity (SUGA) in the UK over the year to October. Even so, the two sugar investment vehicles overcame plummeting prices in late June to generate returns of about 70 per cent, according to Morningstar.

“Investors sold out after the spring rush and they have not come back,” said Jake Hanley, senior portfolio strategist at Teucrium.

Assets in US commodities ETFs on the whole have fallen from about $141.8bn in January 2022 to about $124.4bn as of September 2023, even as US ETF assets overall have steadily grown, according to Morningstar.

While prices of soft commodities such as sugar and cocoa have soared to multiyear highs in recent months, costs of other critical agricultural commodities such as wheat and corn have plummeted on the back of bumper crops in big producing countries.

Energy ETFs have been a recent bright spot while funds for precious metals like gold have suffered outflows, according to data provided by Invesco. When it comes to sugar-specific investment vehicles, investors do not appear to have chased performance over the second half of the year, despite prices that rose beyond spring’s highs.

Investors in single-commodity funds like CANE and others that Teucrium specialises in were predominantly hedge fund traders and commodity trading advisers, Hanley said.

“A big part of my job is to educate folks on why they might consider exposure to sugar specifically and agriculture in general,” Hanley said.

WisdomTree’s director of macroeconomic research, Aneeka Gupta, acknowledged that investors seemed to have lost out on the rise in the price of sugar and may not buy back in.

She added that she thought logistical problems affecting exports from Brazil — which has been picking up the slack left from shortfalls in India and Thailand — might mean that the sugar price could climb higher.

“There is a bit of room to catch up in upside performance,” Gupta said.

Additional reporting by Susannah Savage in London

Comments