Short-term investors in SPY and QQQ warned of options risks

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

The surge in options trading linked to the US stock market in recent years is driving more volatile pricing activity and creating potential risks for short-term investors in some of the world’s largest ETFs, analysts warn.

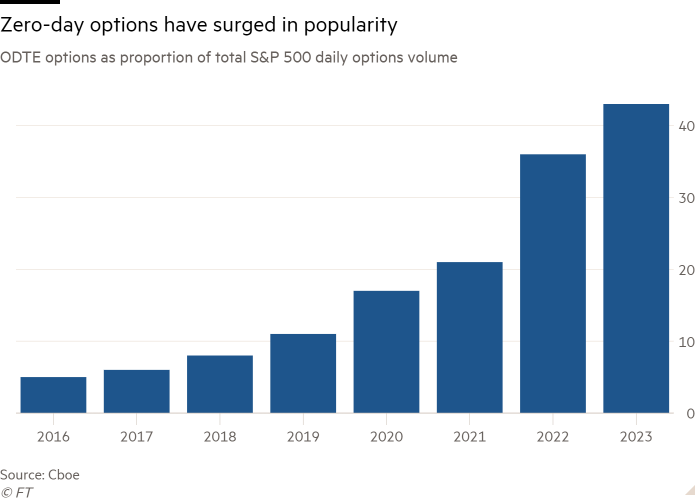

A rapid increase in the use of very short-term options, known as “zero-day-to-expiry” (0DTE) contracts, linked to the S&P 500 index and the world’s largest tracker fund, the $402bn SPDR S&P 500 ETF (SPY), is driving price movements in ways that have raised concerns among academics and even highly experienced market participants.

At least two more of the most popular US ETFs — Invesco’s QQQ which follows the tech-heavy Nasdaq 100, and BlackRock’s iShares Russell 2000 ETF (IWM), which tracks small-cap US equities — have also seen a huge increase in 0DTE trading activity, which is suspected of creating a disconnect between the volatility of the indices and that of their underlying securities.

“What that means is the fundamentals of the underlying stocks are mattering less to the movement of the index than one might have seen 10, 15, 20-years ago,” said Dave Nadig, financial futurist at VettaFi, a consultancy.

“The idea that the short-term [retail] punter has a shot of trading in this market is insane,” Nadig added, explaining that such investors could not compete with professional traders who have access to much more market information.

The post-pandemic stock market is now a very different place to what it was pre-pandemic, Nadig said. “I think zero-day-to-expiry options are a significant chunk of that. I would say options in general are a significant chunk of that.”

Nadig’s observations are supported by academic research. A paper published in April this year concluded that the massive growth in 0DTE options trading between 2011 and 2022 had led to an increase in the volatility of the S&P 500.

“A better understanding of 0DTE option trading and its impact on market dynamics is critical for market participants to ensure financial stability and prevent potential market crashes,” the authors from the Eccles School of Business at the University of Utah, wrote.

Steve Sosnick, chief strategist with Interactive Brokers, explained that the mechanism driving short term price moves revolves around a so-called “gamma squeeze”.

Such a squeeze can create feedback loops that reinforce an initial movement in an index or security, potentially exerting a gravitational pull on the entire market.

A build-up of options, particularly those nearing expiry as 0DTE options always are, increases the risk of a gamma squeeze, some analysts fear.

For example, if a hedger has sold a call option and the underlying stock goes up towards and through the option’s strike price, the gamma effect — gamma can be defined as a dynamic measure of the probability that the owner of an option will be entitled to a payout — will require the hedger to buy more shares to remain hedged.

This will push the price higher still, forcing those who have sold call options at slightly higher strike prices to also buy in order to hedge their exposure.

“It’s a potentially nasty feedback loop for options sellers who want to remain hedged. Options math requires hedgers who are short options to buy high and sell low if they want to maintain a hedged position,” said Sosnick.

“So, if enough speculators join one side of a rising market, they can actually force the market higher. When many speculators are present — and this market is rife with speculation — rising markets attract more buying,” he added.

“What it means is that the stocks can be dragged to the index’s performance,” said Nadig.

Latest news on ETFs

Visit the ETF Hub to find out more and to explore our in-depth data and comparison tools helping you to understand everything from performance to ESG ratings

The question for retail investors and market regulators is whether the possible risks warrant much more caution or even new rules. In a research note published in June, analysts at Bank of America said the influence of 0DTE options had been “overstated” in comparison to other factors, such as trading by hedge funds. They could find no evidence so far of the 0DTE tail wagging the markets dog.

But they went on to say: “Although we find little evidence that 0DTEs are distorting underlying markets, we can’t rule out the risk of a 0DTE-related accident if the stars align.” The authors pointed out that the current large use of 0DTEs had not been stress tested during a big market shock such as at the start of the Covid pandemic.

Nadig also said he could not say if the elevated levels of 0DTE trading was “good or bad”, but he added: “The difference between being a short-term trader and a long-term investor is probably bigger than it has ever been.”

The risks, he said, arose for retail investors who take short-term decisions based on the daily price movements of ETFs even though they do not have access to the same sophisticated data as professional traders.

“Who gets hurt? It’s the average investor who doesn’t understand any of this stuff is going on, who thinks they can be clever and who believes that pricing is representing fundamental value all the time, which it hasn’t in decades,” said Nadig.

Additional reporting by Chris Flood.

Comments