The ‘cocaine bear’ ETF keeps on huffing

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

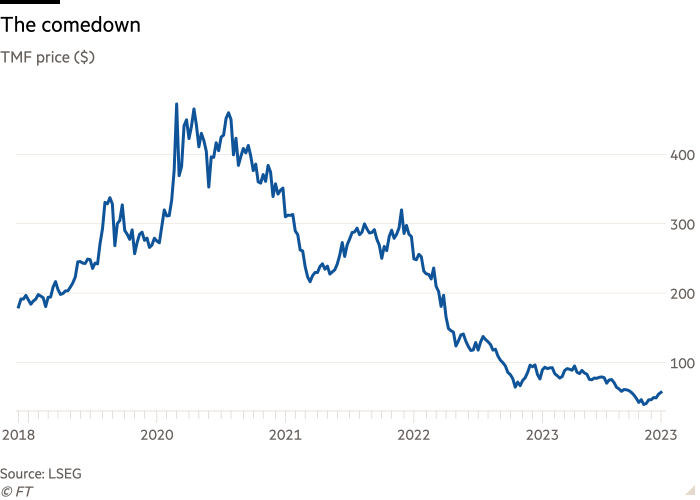

This summer we wrote about the closest thing that the bond market has to a meme stock — Direxion’s triple-leveraged long-maturity Treasury ETF.

The “cocaine bear energy” of TMF has since then cranked up several notches, as people have kept betting that the bond market nadir is in. Just last Friday the $4bn ETF took in a record $205mn!

That means that TMF has seen almost $2.5bn of net inflows and roughly doubled in size since FT Alphaville wrote about it on June 1 — despite what can kindly be described as a bad run.

While it has climbed almost 50 per cent since its October low, the ETF has still done comically badly since going bananas back in the early-2020 Treasury market rally.

Of course, leveraged ETFs like TMF are overwhelmingly just trading tools for Reddit bros. You’d be mad to buy and hold it, given both the ongoing management fees and the cost of the embedded leverage (some people have timed it pretty well though).

However, you can also see the appetite to time the bond market bottom mimicked in its staid, unleveraged big brother, BlackRock’s iShares 20+ Year Treasury Bond ETF, or TLT.

Despite getting brutalised for most of the past two years this bad boy has taken in another $21bn in 2023, lifting its size to $48bn. That means it is now the fourth-biggest bond ETF, and 29th on the overall rankings.

So is this the right time to dive back into duration? Maybe, if the ca 130 bps of rate cuts that markets are now pricing in actually materialise. But as mainFT reported today, central bank officials have been quite aggressive in telling investors that expectations for interest rate trims already in early 2024 are very premature.

Deutsche Bank’s analysts therefore warn that this week’s Fed meeting could shake the bond market rally we’ve seen over the past month.

Rates expectations have changed sharply since then and going into next week’s FOMC meeting the market is already pricing in aggressive and early rate cuts for next year. In our reading this suggests asymmetric risk as the Fed can at best validate market pricing while any push back will raise rates and rates vol.

As our US economists write, they expect the Fed to signal a soft tightening bias and the dot plot to point to 50bps of rate cuts in 2024, which would be a challenge to market expectations. This could be a catalyst for discretionary investors to cut back elevated positioning. Presently, S&P 500 vol priced for next Wednesday’s FOMC day is still muted. Indeed, the market looks to have been more concerned going into today’s payrolls report than it is with the Fed meeting. But as we have seen previously around several calendar event risk days, vol could start to rise as we get closer.

Comments