The four questions financial advisers are most often asked

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

As a rule, the British do not find it easy to talk about money. Yet the office of a trusted financial adviser is the inner sanctum where many feel safe communicating their financial hopes and fears.

Often, clients are seeking to validate how they are managing their finances — and whether their peers are pursuing the same approach.

“Am I doing the right thing?” is one of the top 10 questions that financial advisers say they are most commonly asked by their clients, according to the results of a Financial Times survey. Advisers said their clients frequently want to know how others in a similar position are making the most of their money.

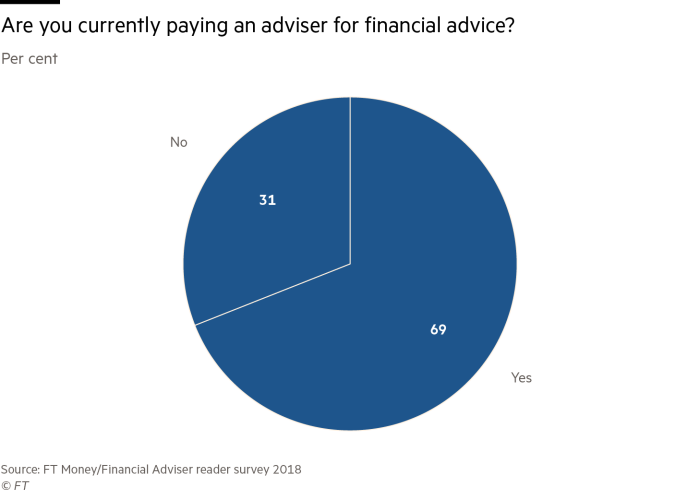

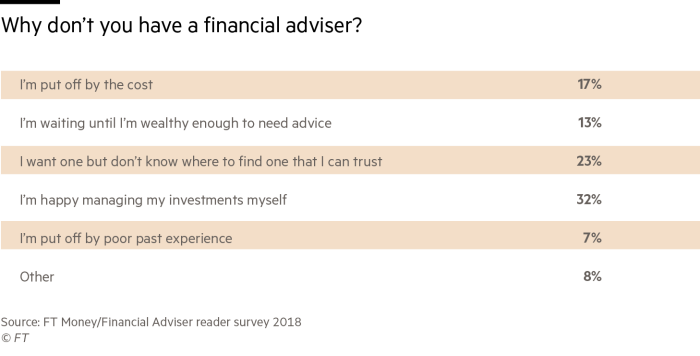

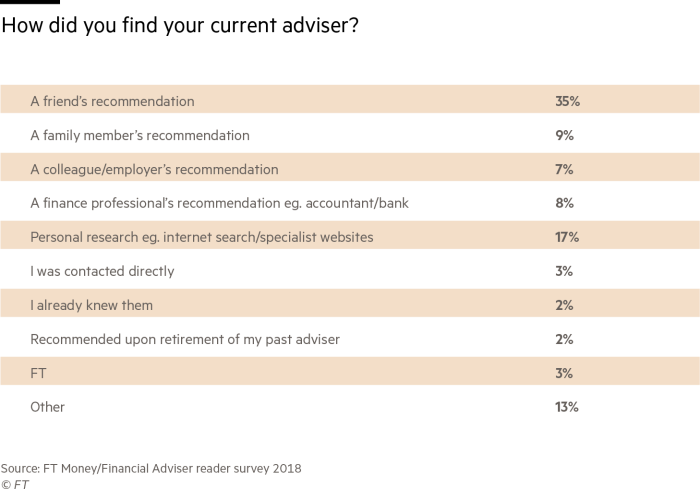

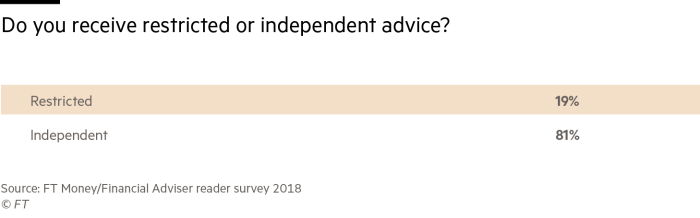

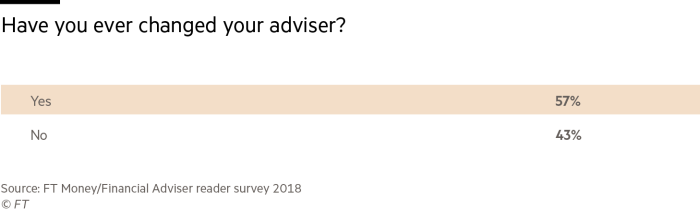

Throughout October, we asked readers to lift the lid on their relationship with their financial adviser — and more than 300 responded to our online survey. We also polled readers of FTAdviser, the specialist publication for financial advisers, to get the picture from the other side of the table.

Here, FT Money reveals clients’ most common dilemmas and the solutions advisers are offering.

Can I afford to retire?

This was the number one question FT readers wanted to discuss with an adviser, with more than 20 per cent of respondents naming retirement and pension planning as their top concern. Over a quarter of advisers we polled also said this was the first question on their clients’ lips.

Pensions are complex — made more intricate by the 2015 pension reforms — which many readers felt uncomfortable tackling alone.

In their more detailed responses, readers cited frequent rule changes to tax allowances as a reason for enlisting an adviser. Some said the best advice they had ever received was to maximise their pension contributions before annual and lifetime allowances were slashed by former chancellor George Osborne.

Two other specific pensions concerns also made the top 10 topics raised by readers with their advisers. One was transfers — allowing savers to be liberated from so-called “final salary” pension schemes — and drawdown products, which have soared in popularity since the introduction of pension freedoms in 2015.

These routes to retirement have proliferated at a time when the state pension age is rising, while occupational pensions offering an inflation-linked income are becoming scarce. So advisers say it is unsurprising that clients worry whether they will have enough money for a comfortable retirement.

Most clients do not fully understand how much their pension will be worth in retirement and frequently have multiple pots from different periods of employment, said Alistair Fullerton, co-founder of Lathe & Co, an advisory firm in the City of London. Assessing and consolidating these can often be a “sensible first step” — a view shared by Fiona Cameron Jones, director of Cameron Jones Financial Management.

In common with many advisers, Ms Cameron Jones encourages clients to look at their current spending, income and outgoings to make a financial plan. Working backwards from current income and expenditure, individuals can calculate how much money they will need for the future, when spending on mortgage payments and commuting is likely to be less — and also assess how much more they might need to save.

“My adviser does cash flow forecasting with me to show my future financial plans,” FT reader John from West Yorkshire told us. “That has been very helpful in planning my future life.”

This kind of financial modelling can also show the impact of different risk appetites on investment choices. Advisers told us that clients often wanted advice on the investment choices they could make on money held in defined contribution company pension pots — many schemes allocate savings to a “default fund” which may not be the best choice — as well as understanding the level of fees and charges they pay.

While advisers consider pensions to be the most tax-efficient way to save for retirement, clients sometimes have other ideas.

In Mr Fullerton’s experience, clients often believe a buy-to-let property offers “a quicker route to retirement” than paying into a pension.

“It is hard to compete against something that is tangible for people, and property has made people a lot of money in recent years,” he said. “Some people simply don’t trust the pension system. Historically, the government has changed the rules and people are wary of them changing the rules again.”

Many readers also raised concerns about breaching the lifetime allowance of what can be saved tax free into a pension — set to increase to £1.05m next April. For the wealthiest, the annual £40,000 tax-free allowance is tapered to £10,000, meaning many readers rely on advisers to suggest alternatives to pension savings.

In such cases, advisers are keen to assess the financial position of the whole family. Even if the main breadwinner is “capped out” of saving into his or her pension, funding a pension for a spouse, children or even grandchildren could be considered.

“I remain astounded by how little intergenerational planning people do,” said one adviser, who wished to remain anonymous. “This applies especially to wealthy people, who don’t need the money and can afford to [set up] child pensions.” This, he said, could also reduce the chances of them becoming “selfish brats” if money was invested for their future instead of being spent on luxuries.

Advisers stressed the same principle applied to Individual Savings Accounts (Isas). Adults have a generous £20,000 annual allowance which can be spread across the growing range of tax-free investments. For under-18s, up to £4,260 can be saved per tax year.

Top 10 issues clients want to discuss with advisers

- Retirement/pension planning

- Tax planning

- Brexit/political uncertainty

- Inheritance tax

- Future financial planning

- Investment returns/dividends

- Portfolio review/diversification

- Global politics/likelihood of market crash

- Pension drawdown

- Pension transfer

How can I pay less tax?

Tax planning was cited by over 17 per cent of readers as a topic they wanted to discuss with a financial adviser.

As one reader put it: “How do I get to keep more of my income?”

The desire to consult an expert about how legitimately to reduce one’s tax bill is set against the wider backdrop of a government clampdown on tax avoidance, and readers were wary of schemes that could land them in hot water.

Advisers say the first crucial step is to maximise all existing tax allowances. David Stone, partner at Mansion House Capital, said a staggering “95 per cent of clients aren’t using all of their tax allowances”.

For most clients, the low-hanging fruit will be exploring how to maximise their contributions into pensions and Isas (see above). Readers frequently cited using up their pensions allowances from previous tax years as something advisers had suggested doing.

Frequently, tax planning with a financial adviser will involve looking at how income will be taken in retirement. For investments held outside a tax-efficient pension or Isa wrapper, advisers will instruct their clients how to make the most of the annual dividend allowance — which was reduced from £5,000 to £2,000 last year. There may also be a small benefit from the new Personal Savings Allowance, which allows basic-rate taxpayers to earn £1,000 of annual interest from savings tax free, falling to £500 for higher-rate taxpayers.

Making the best use of capital gains tax allowances — for both you and your spouse — were also considered key to managing investments in shares and property.

When we asked advisers about the advice their clients were least likely to heed, understanding the changing tax treatment of buy-to-let property was frequently cited.

“People still love buy-to-lets as they’re bricks and mortar investments, despite all the evidence about how new tax legislation is impacting the attractiveness of returns,” said one adviser.

For others, managing “cliff edges” within the tax system was a key concern.

For example, people earning over £100,000 have their £11,850 personal allowance tapered at the rate of £1 for every £2 of income. It is tapered away completely for those earning over £123,700 — although this will rise to £125,000 from next April when the personal allowance is increased.

For individuals who fall within this band, their effective marginal tax rate on this slice of income will be 60 per cent. However, advisers say that this can be mitigated by making higher pensions contributions or taking advantage of salary sacrifice schemes.

Wealthier readers who were “capped out” of a pension said they relied on their adviser to inform them about tax-efficient alternatives, such as Enterprise Investment Schemes and Venture Capital Trusts.

“Specialist financial products are a more complex way of maximising income,” Mr Stone added. Although these products are higher risk, one of the main benefits is the tax-free dividends that successful investments can provide.

Finally, many readers praised their advisers for highlighting the value of company share schemes as a way of buying discounted shares or share options in their employer — which can often be advantageous in tax terms.

How can I reduce the impact of inheritance tax?

In addition to general concerns about tax, inheritance tax (IHT) was a key concern for readers.

Although only 5 per cent of estates nationally pay the tax, many readers nevertheless fear the impact of IHT — and need an adviser’s help to understand the system.

The rising value of property prices in the Southeast has dragged more families into the IHT net, with annual tax receipts hitting £5.2bn in the past tax year.

David Johnson, an FT reader and clinical psychologist from Edinburgh, said he found the system perplexing. “I know nothing of tax or accounting”, he said, explaining that he looks to his adviser for “expert guidance in plain language” on how to manage the IHT liabilities for his four children.

Advisers are keen to minimise the impact by ensuring their clients prepare well in advance, making a will and setting up a Lasting Power of Attorney, as well as organising their tax affairs.

Sometimes, the advice could be to marry your long-term partner, as spouses and civil partners can inherit each other’s estates tax free and transfer the benefit of their inheritance tax allowances when passing wealth to their children. This can be supplemented with the new residential nil-rate band — a useful, albeit complicated, extra allowance that will eventually allow a family home worth up to £1m to be passed down tax free.

For clients with estates that exceed the value of these allowances, one solution is giving money away while you are still alive. To have the confidence to do so, clients will first need to obtain as full picture as possible of their financial needs in retirement.

Laura Cussons, financial adviser at Webster Associates, said that “planning and using your allowances regularly” is a key way to legitimately reduce IHT bills.

For large amounts of money — such as gifting property deposits to your children — the “seven-year rule” will apply, meaning the person who made the gift has to survive for seven years for its value to fall outside the final estate for IHT purposes.

An array of IHT allowances exist for smaller gifts, although many people are unaware of these.

“Giving away small amounts of money for weddings, to family, and making gifts from excess income which isn’t subject to inheritance tax [are all] common methods of managing IHT,” said Rachel Winter, senior investment manager at Killik and Co.

A small number of respondents to the FT survey said they wanted to talk to their adviser about managing IHT by investing in shares listed on the Alternative Investment Market, or setting up a family trust. However, the latter route has lost appeal in recent years due to the changing tax treatment of money held in trust.

How will Brexit impact my finances?

Investors hate uncertainty, so unsurprisingly, the “B” word featured prominently among our readers’ top financial worries. “Brexit, Brexit, Brexit” is how Jim Bisset, an 83-year-old FT reader, expressed what he most wanted to discuss with his adviser.

After retirement and tax planning, discussing the impact of Brexit was ranked third in order of concern by our readers. However, advisers reported that it was the second most asked question — though none could provide their clients with concrete answers.

Hoping for the best, while preparing for the worst broadly sums up the approach most are taking.

The obvious factors to manage are currency exposure — sterling has fluctuated wildly throughout the Brexit negotiations — and the impact this could have on investment income, with domestically-focused stocks and funds being punished more heavily than those with international exposure.

“People come to advisers for answers about Brexit, but the problem is so much is up in the air,” said Mr Fullerton.

“Often, tax and pension queries are mentioned in the same breath as Brexit with clients asking how it could affect their tax planning and retirement plans. A large part of our job as advisers is giving people comfort and assurance — being able to look them in the eye and give an honest opinion goes a long way.”

Weighing short-term reactions against the long-term nature of investing was the approach many advisers took with worried clients, with several saying they stressed it was “time in the markets, rather than timing the markets” that was more important.

“Having a good plan around your finances and sticking to that plan is key,” said Lisa Johnstone, director of VWM Wealth. “Anticipating whether the markets will double or halve is not realistic or healthy.”

Some readers and advisers said their recent conversations had gravitated towards discussing risk appetites, and in some cases, whether to buy specialist financial products such as income protection insurance. However, advisers stressed that an often overlooked form of defence was greater portfolio diversification.

“Too many clients don’t recognise the familiarity bias,” said Barry MacDonald, private wealth director at MacDonald Financial Consultants, noting the tendency to gravitate towards UK listed stocks and funds.

This view was shared by Killik’s Ms Winter. “Most clients accept the principle that diversification is a vital tool for the reduction of risk, but in practice many are reluctant to move away from the FTSE 100,” she said, noting that those who did would have missed the impressive growth of the US market and the technology sector.

Number five on clients’ worry list was market volatility stemming from weakness in the tech giants.

Other ways of reducing risks that readers and advisers said they were discussing included the level of cash held in investment portfolios — not to mention the buying opportunities that could arise if and when markets fall further.

The common theme through all of these discussions is the need for face-to-face validation and assurance that clients are indeed “doing the right thing” with their money. This is the ultimate test of good advice — yet as markets around the world stutter after a decade-long run, conversations between advisers and their clients are likely to take on a new sense of urgency.

Additional reporting by Claer Barrett

Survey methodology

All data are based on two online surveys created by the FT using Qualtrics software in October 2018.

The research questioned attitudes and experiences towards financial advice and commonly discussed issues. One survey was completed by financial advisers and the other by clients.

Both surveys ran from October 25 until November 14 2018. The survey of financial advisers was emailed to the mailing list of FTAdviser.com.

- 304 Financial Times readers completed a detailed survey about financial advice. This comprised 10 questions for readers who had a financial adviser, and six for those who did not.

- 41 financial advisers completed a separate survey of 10 questions.

Both surveys contained qualitative questions, allowing respondents to give detailed and personal insights into the financial advice industry, and quantitative questions, allowing the FT to obtain a broad view of the industry.

Comments