Asset management: an activist’s playground

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Don’t miss it: Next Tuesday we are hosting the inaugural FT Dealmakers Summit. This event on November 10 is the flagship conference of the Due Diligence team, a full-day virtual conference put on with our colleagues in FT Live.

We’ve updated the event agenda, where you will see sessions that feature speakers from top banks, law firms, corporations, hedge funds and private equity groups. Do join us if you can. Use this link to register.

Welcome to the Due Diligence briefing from the Financial Times. Not a subscriber? Sign up here. Drop us a line and join the conversation: Due.Diligence@ft.com.

Nelson Peltz plays matchmaker

Activist investor Nelson Peltz is no stranger to the asset management industry. And that isn’t just because he owns a hedge fund.

After Trian Partners made a solid return on its investment in Legg Mason following its $6.5bn acquisition by Franklin Templeton, Peltz’s group has now set its sights on Invesco and Britain’s Janus Henderson.

The New York-based firm has a near 10 per cent stake in both asset managers and speculation is rife that Trian is trying to play matchmaker between the two, though not everyone is convinced that would be a great idea.

Regardless of whether the two companies do link up, there is little doubt that Trian wants to see more consolidation in the asset management industry — in fact, it has a fund that is specifically built for this purpose.

And Trian is essentially using the same playbook it did for Legg Mason, where Peltz played a key role in its deal with Franklin Templeton.

On Thursday Invesco said it had granted Trian three board seats — adding Peltz and Ed Garden, the group’s chief investment officer, as well as Tom Finke, chief executive of the $354bn fund group Barings.

As with Legg Mason, the appointments involve Invesco expanding its board to 12 directors, which helps to avoid a proxy battle. Peltz and Garden’s nominations to the board were obvious. More interesting is the appointment of Finke.

Barings is a subsidiary of MassMutual, the US insurance company that happens to be Invesco’s largest shareholder. Nominating a board member who will be familiar with the group’s largest shareholder isn’t a bad idea. Plus Finke, who is leaving Barings, has overseen several M&A deals in the industry during his career.

Invesco’s concession to Trian doesn’t come as a surprise, either. The manager’s longtime chief executive Martin Flanagan is well aware that companies in his industry will struggle to survive if they don’t band together. He told the FT last year that one in three asset managers would disappear as mounting fee pressures and rising costs took their toll.

While Invesco, which last year earned the not so coveted title of the worst-selling fund manager globally, and Trian seem to be getting on famously, little has been said about the hedge fund’s plans for Janus.

The London-based company said it was only aware of Trian’s stake the day before it was officially disclosed and had not given any indication that it was in discussions with the hedge fund. If Trian wants a deal between the two, it’ll probably have to get both companies to play ball.

Ant Group: stuck in the mud

It was meant to be the best week yet for Ant Group.

But Chinese regulators halted the country’s biggest fintech group in its tracks to achieve the largest initial public offering in history. (Catch up on DD’s coverage of the debacle here.)

Now lawyers involved in the deal and investors say it could be delayed by at least six months and its valuation slashed sharply thanks to new regulations, writes the FT’s Hudson Lockett and Primrose Riordan from Hong Kong.

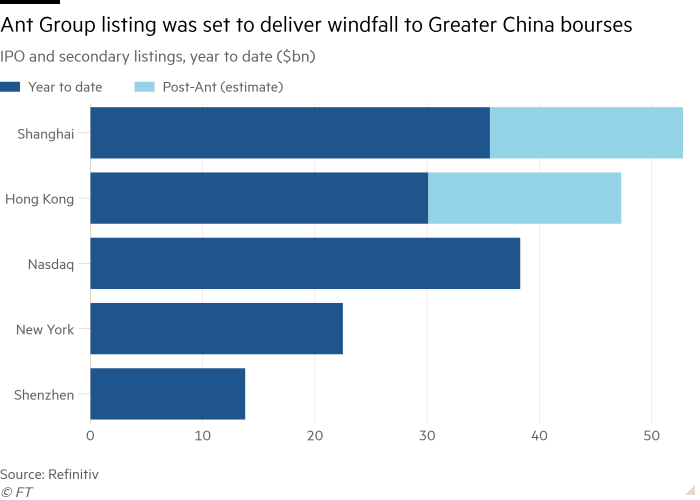

Shares in the group, which was set to raise $37bn, were due to begin trading in Shanghai and Hong Kong on Thursday. Shanghai’s bourse suspended the listing on Tuesday night, a day after Beijing announced draft rules that could weigh heavily on Ant’s vital lending business.

While Ant currently acts mainly as a high-tech liaison between consumers and financial companies, the new regulations would require the payments platform controlled by Alibaba’s billionaire founder Jack Ma to provide at least 30 per cent of funding for loans.

That could ultimately make its business model more akin to a (highly regulated) bank, and leave Ant’s balance sheet more exposed in the event of loans turning sour.

“If [the new rules] get strictly carried out, Ant would be worth less than half of what it is now,” said a Shanghai-based fund manager who subscribed to Ant’s IPO. And if the Past four days are any indication, the situation could change even more drastically over the next six months.

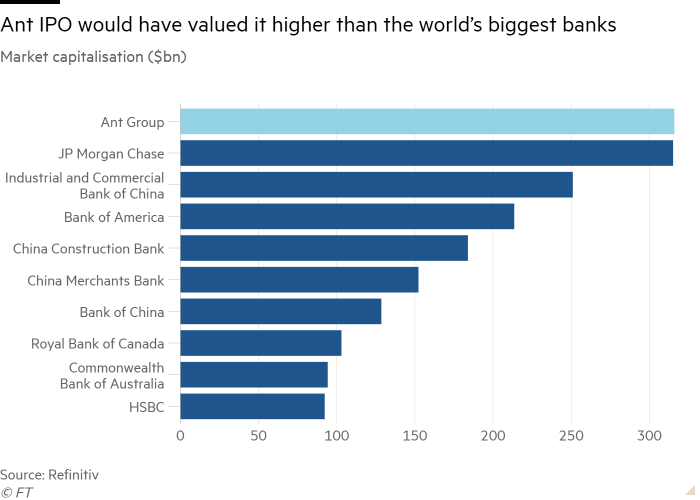

Ant’s last implied valuation of $316bn — almost a fifth larger than China’s ICBC banking behemoth — isn’t the only thing that risks shrinking as regulators keep the listing at bay, Lex points out. Banks giddily awaiting a payday estimated at $400m will probably see that sum deflate.

It was also a rude awakening for Alibaba investors, who saw shares in the group fall sharply on Wednesday before recovering some of those losses on Thursday.

The highly-anticipated dual listing was thought to illustrate the dynamism of China’s financial system, no matter the political conflicts unfolding in the region. Its suspension may change all that.

H2O Asset Management: cut adrift

Regular DD readers will have closely followed the saga of the ironically named H2O Asset Management and its troublesome illiquid investments.

It has been almost 18 months since DD’s Rob Smith and the FT investigations team’s Cynthia O’Murchu first revealed a startling fact: that H2O, one of Europe’s best-performing fund managers, had loaded up on more than €1bn of hard-to-sell bonds linked to Lars Windhorst, a controversial German financier.

The €20bn investment group’s parent company, the French bank Natixis, initially dismissed the story. The lender’s fund management chief Jean Raby reassured investors shortly after the FT’s exposé that these bonds were in fact “quite diversified”.

And while the Paris-based bank launched an audit into its lucrative fund management subsidiary, Natixis repeatedly refused to disclose the findings.

“This is not something we make public,” Raby told a reporter on the slopes of Davos in January. “This is something that is really for internal purposes.”

But since that interview, H2O has suffered a bruising year of drastic losses and an unprecedented intervention from French regulators over its illiquid assets.

And now it appears enough is enough for Natixis: the French bank is now looking to sever all ties with its controversial subsidiary by offloading its majority stake. Get the full story here.

Job moves

Finsbury has hired Ginny Wilmerding as a partner in its Hong Kong office. She joins from Brunswick, where she was a partner and led the TMT sector in Asia, advising on deals for clients including Alibaba and Ant Group.

Blackstone has appointed Eric Duchon to the newly created role of global head of real estate ESG. He was previously global head of sustainability at LaSalle Investment Management.

Smart reads

Popping pills Hims amassed a $1.6bn empire by delivering Viagra, Rogaine and other remedies in sleek, colourful packaging that spared consumers from blushing at the pharmacy counter. But the telemedicine start-up may be a little too generous when doling out prescriptions, potentially crossing legal boundaries in the process. (Bloomberg)

Buyer beware The risky US market for collateralised loan obligations has long been supported by Norinchukin Bank, a Japanese institution investing overseas on behalf of the country’s yield-starved farmers and fishermen. The pandemic infected that route, exposing vulnerable investors to staggering losses by US companies during the height of the crisis. (Wall Street Journal)

It’s a landslide As the US languishes in uncertainty throughout a multi-day election, Silicon Valley executives have already uncorked the victory champagne. The pandemic has concentrated almost every industry into the hands of big tech — the true recipients of power in 2020. (FT)

News round-up

UK insurer RSA in talks to be acquired for £7.1bn (FT)

US justice department sues to block Visa’s $5.3bn Plaid takeover (FT)

Intesa Sanpaolo chief calls for cross-border European banking deals (FT)

More than £1.1bn in fraud exposed in UK bounce back loan scheme (FT)

Justice Department files antitrust lawsuit challenging Visa’s acquisition of Plaid (WSJ)

Saudi Arabia media group to make play for elite global sports events (FT)

TikTok parent ByteDance seeks to raise cash at $180bn valuation (BBG)

Commerzbank warns of impact of government Covid support running out (FT)

SocGen swings back to profit as equity trading rebounds (FT)

Iberdrola pledges €75bn to capitalise on energy transition (FT)

Sainsbury’s to close most Argos stores (FT + Lex)

Due Diligence is written by Arash Massoudi, Kaye Wiggins and Robert Smith in London, Javier Espinoza in Brussels, James Fontanella-Khan, Ortenca Aliaj, Sujeet Indap, Eric Platt, Mark Vandevelde and Francesca Friday in New York and Miles Kruppa in San Francisco. Please send feedback to due.diligence@ft.com

Comments