How do ETFs work?

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Interested in ETFs?

Visit our ETF Hub for investor news and education, market updates and analysis and easy-to-use tools to help you select the right ETFs.

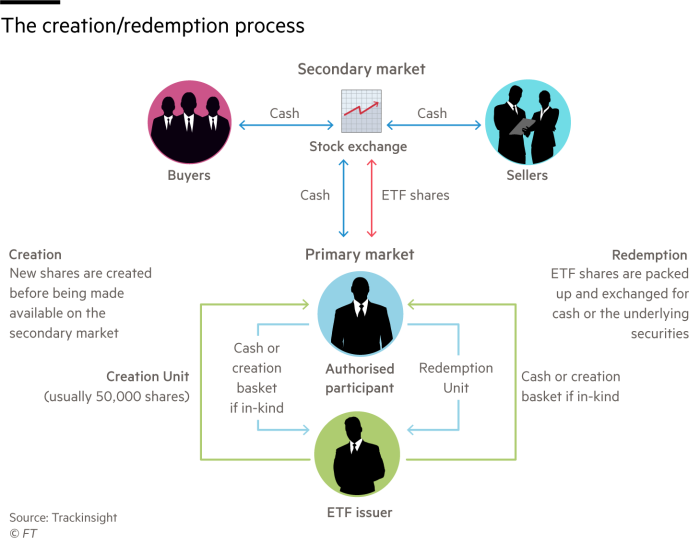

An exchange traded fund provider relies on other entities called authorised participants, which are usually investment banks, to create and redeem the ETF shares that are available in what is known as the secondary market for ordinary investors to buy and sell.

Authorised participants are appointed by the ETF provider but are not required to trade and nor do they receive fees for their services. Instead they are motivated to participate because they can take advantage of the differences between the net asset value and the trading price of ETF shares to make money. They do this through the so-called creation-redemption mechanism.

The authorised participant delivers a basket of securities to the ETF provider and receives an ETF creation unit, which is a large batch of shares, in exchange. The authorised participant then sells those shares on the stock exchange.

The redemption mechanism works in the same way but in reverse. The AP buys shares on the stock exchange until it has enough for a creation unit (typically 50,000 shares) and redeems them for the equivalent value in securities.

The creation-redemption arbitrage

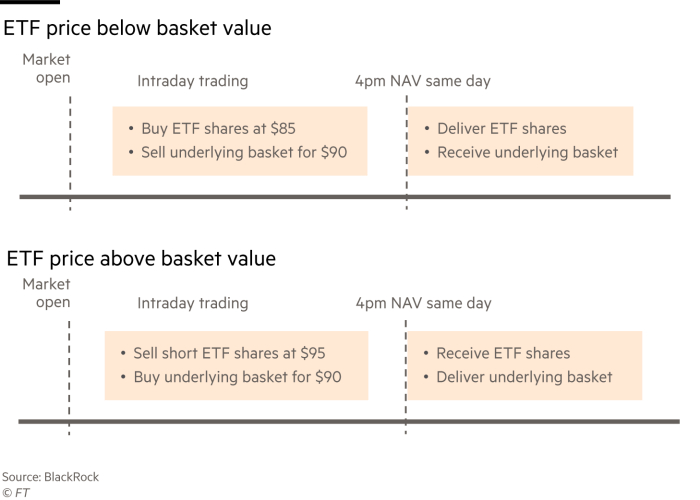

The process works because authorised participants can make money out of it. If the NAV of an ETF becomes cheaper than its underlying securities the authorised participant can buy shares on the secondary market and return them to the issuer, who then hands over the basket of securities, which the AP can sell at a profit on the stock market.

If the ETF’s NAV becomes more expensive than the underlying securities, the authorised participant buys the cheap securities and exchanges them for ETF shares with the provider. The authorised participant can then sell the more valuable ETF shares making arbitrage profits.

In a traditional ETF tracking an equities index, that basket of securities would usually be made up of shares of listed companies in the underlying index.

The process is slightly different for synthetic ETFs that do not actually own the underlying securities of an index and instead invest in derivatives to replicate the movement of that index. In synthetic ETFs, APs usually pay for a creation unit with cash that the ETF provider uses to invest in collateral. The interest earned on the collateral typically covers the cost of the swap the provider enters into with a counterparty to deliver the returns of the index.

To satisfy share redemptions, the ETF provider sells the collateral and uses the money to buy the returned ETF shares. The swap counterparty plays no role in the creation-redemption process.

Advantages of the creation-redemption mechanism

The creation-redemption mechanism controls supply and demand and ensures that the ETF’s NAV does not veer too far away from the underlying value of its securities.

The mechanism also helps to keep ETFs cheap and tax efficient in some jurisdictions such as the US because APs do all of the buying and selling of securities on the ETF’s behalf and bear the costs of trading. In contrast, when mutual fund investors redeem shares from a fund all shareholders in the fund are affected by the tax burden. In the UK, however, ETFs and traditional funds are treated the same for tax purposes.

For most ETFs that operate on a transparent basis, the creation-redemption mechanism helps to ensure that transparency. At the start of the trading day an ETF declares current fund holdings and the basket of securities that the ETF will accept for creations or deliver for redemptions on that day.

Click here to visit the ETF Hub

Comments